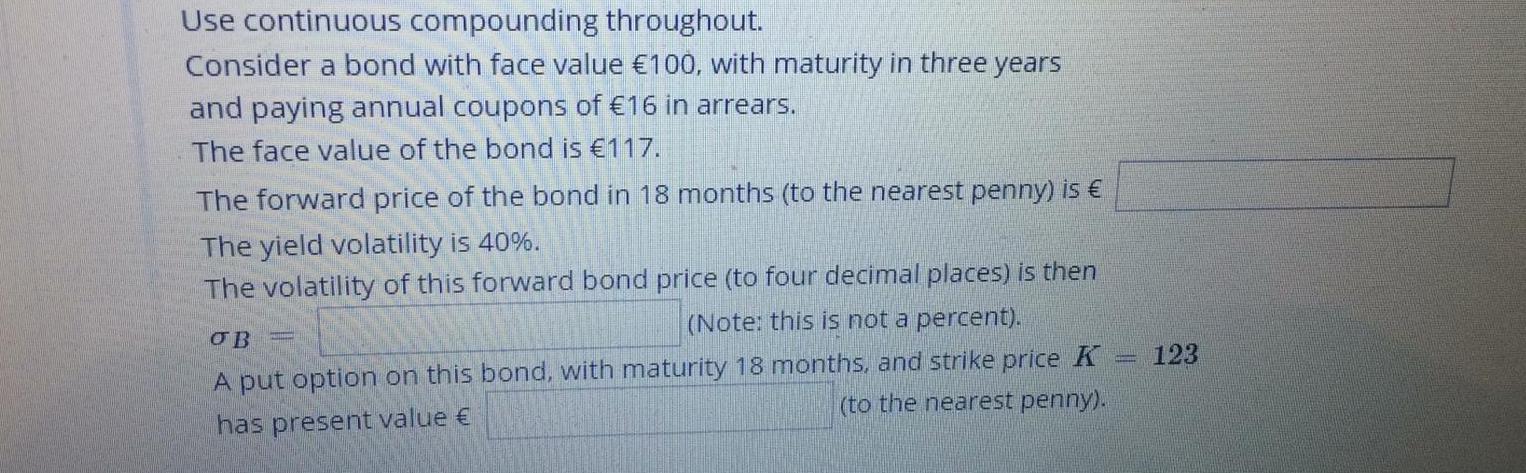

Question: Use continuous compounding throughout. Consider a bond with face value 100, with maturity in three years and paying annual coupons of 16 in arrears. The

Use continuous compounding throughout. Consider a bond with face value 100, with maturity in three years and paying annual coupons of 16 in arrears. The face value of the bond is 117. The forward price of the bond in 18 months (to the nearest penny) is The yield volatility is 40%. The volatility of this forward bond price (to four decimal places) is then (Note: this is not a percent). A put option on this bond, with maturity 18 months, and strike price K (to the nearest penny). has present value OB 123 Use continuous compounding throughout. Consider a bond with face value 100, with maturity in three years and paying annual coupons of 16 in arrears. The face value of the bond is 117. The forward price of the bond in 18 months (to the nearest penny) is The yield volatility is 40%. The volatility of this forward bond price (to four decimal places) is then (Note: this is not a percent). A put option on this bond, with maturity 18 months, and strike price K (to the nearest penny). has present value OB 123

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts