Question: use current CCH rules also please site where you got your info from! i know this question has already been answered on chegg but i

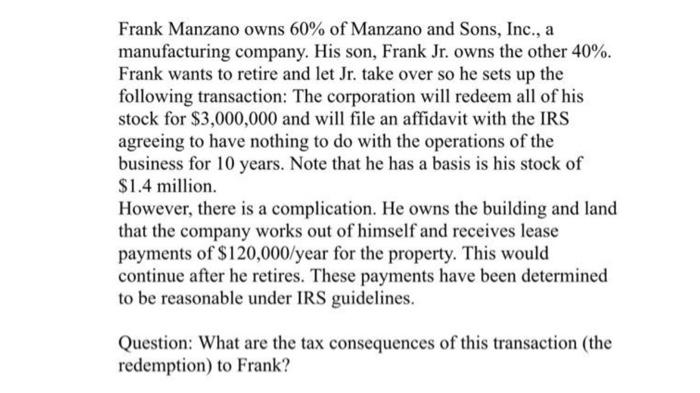

Frank Manzano owns 60% of Manzano and Sons, Inc., a manufacturing company. His son, Frank Jr. owns the other 40%. Frank wants to retire and let Jr. take over so he sets up the following transaction: The corporation will redeem all of his stock for $3,000,000 and will file an affidavit with the IRS agreeing to have nothing to do with the operations of the business for 10 years. Note that he has a basis is his stock of $1.4 million. However, there is a complication. He owns the building and land that the company works out of himself and receives lease payments of $120,000/year for the property. This would continue after he retires. These payments have been determined to be reasonable under IRS guidelines. Question: What are the tax consequences of this transaction (the redemption) to Frank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts