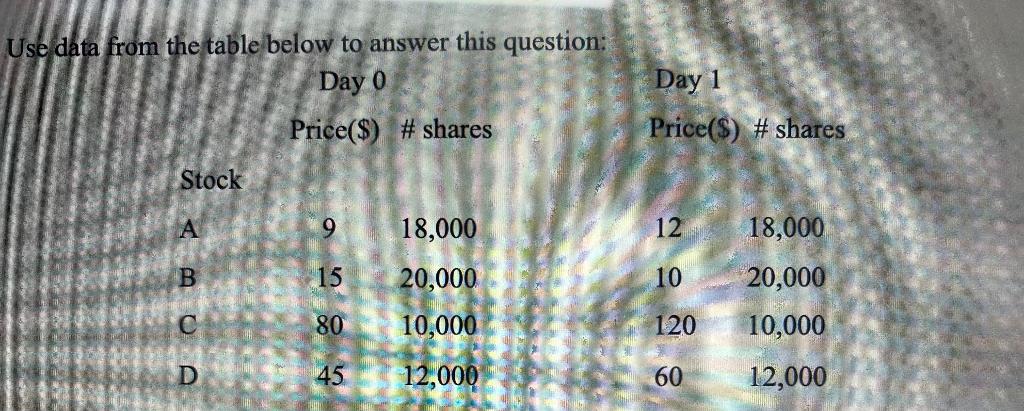

Question: Use data from table below to answer the question Note; the columns, #shares, on day 0 and day 1 indicate the total share outstanding for

Use data from table below to answer the question

Note; the columns, #shares, on day 0 and day 1 indicate the total share outstanding for each stock.

Suppose we want to control construct indices using all four stocks above, and we choose the divisor for the price-weighted index on day 0 to be 4 and the divisor for the value-weighted index to be 10,000. Also, assume the equal-weighted index starts at 100,000 on day 0.

-

Calculate the index level for price-weighted, value-weighted, and equal-weighted indices at day 0.

-

Calculate the index level for price-weighted, value-weighted, and equal-weighted indices at day 1.

-

Calculate the return of each index by the end of day 1.

-

after the market is closed on day one, company C declares a 20% cash dividend per share, leading to a reduction in stock price from $120.00 to $96(=$120*(1-20%)). Which indices need to be adjusted? How will you make the adjustments?

Use data from the table below to answer this question: Day 0 Day 1 Price(s) # shares Price($) # shares Stock A 9 18,000 12 18,000 B 15 10 20,000 10,000 C 80 120 20,000 10,000 12,000 D 45 12,000 60 Use data from the table below to answer this question: Day 0 Day 1 Price(s) # shares Price($) # shares Stock A 9 18,000 12 18,000 B 15 10 20,000 10,000 C 80 120 20,000 10,000 12,000 D 45 12,000 60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts