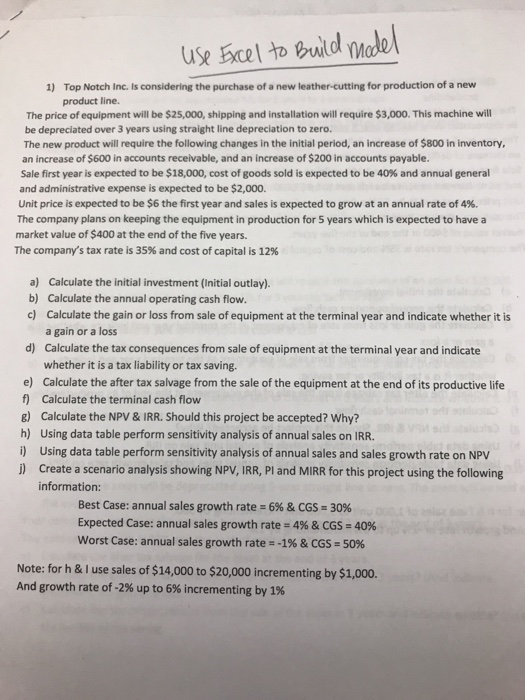

Question: use Ecel to Buld mde Top Notch Inc. Is considering the purchase of a new leather-cutting for production of a new product line. 1) The

use Ecel to Buld mde Top Notch Inc. Is considering the purchase of a new leather-cutting for production of a new product line. 1) The price of equipment will be $25,000, shipping and installation will require $3,000. This machine will be depreciated over 3 years using straight line depreciation to zero. The new product will require the following changes in the initial period, an increase of $800 in inventory an increase of $600 in accounts receivable, and an increase of $200 in accounts payable. Sale first year is expected to be $18,000, cost of goods sold is expected to be 40% and annual general and administrative expense is expected to be $2,000. Unit price is expected to be $6 the first year and sales is expected to grow at an annual rate of 4%. The company plans on keeping the equipment in production for 5 years which is expected to have a market value of $400 at the end of the five years. The company's tax rate is 35% and cost of capital is 12% a) Calculate the initial investment (Initial outlay) b) Calculate the annual operating cash flow c) Calculate the gain or loss from sale of equipment at the terminal year and indicate whether it is a gain or a loss d) Calculate the tax consequences from sale of equipment at the terminal year and indicate whether it is a tax liability or tax saving. e) Calculate the after tax salvage from the sale of the equipment at the end of its productive life f) Calculate the terminal cash flow 8) Calculate the NPV & IRR. Should this project be accepted? Why? h) Using data table perform sensitivity analysis of annual sales on IRR. i) Using data table perform sensitivity analysis of annual sales and sales growth rate on NPV j) Create a scenario analysis showing NPV, IRR, Pl and MIRR for this project using the following information: Best Case: annual sales growth rate-6% & CGS 30% Expected Case: annual sales growth rate 4% & CGS 4096 Worst Case: annual sales growth rate ::-196 & CGs-50% Note: for h & I use sales of $14,000 to $20,000 incrementing by $1,000. And growth rate of-2% up to 6% incrementing by 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts