Question: Use either R or Eviews for the following questions. Data is provided in txt format and Eviews. 1. Using the attached data of daily equity

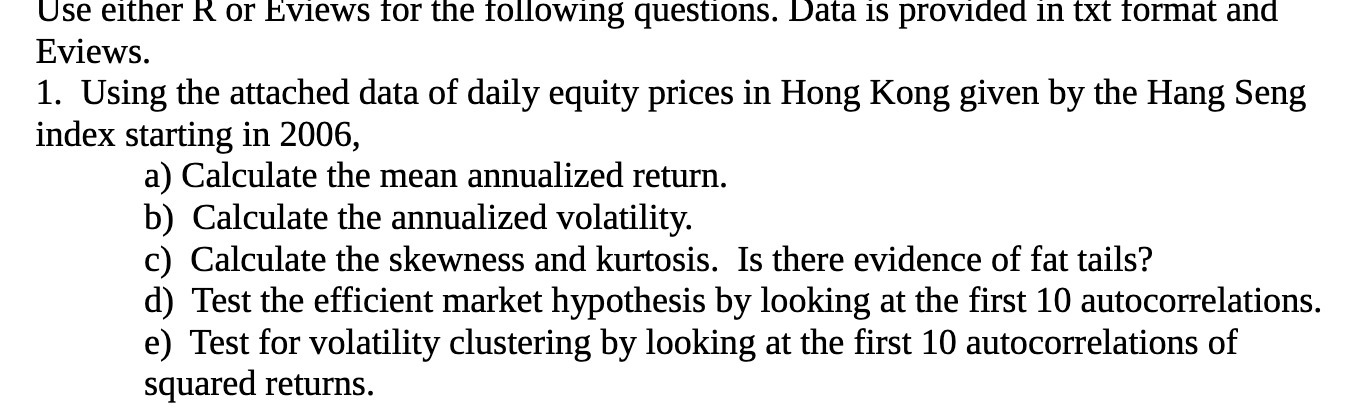

Use either R or Eviews for the following questions. Data is provided in txt format and Eviews. 1. Using the attached data of daily equity prices in Hong Kong given by the Hang Seng index starting in 2006, a) Calculate the mean annualized return. b) Calculate the annualized volatility. c) Calculate the skewness and kurtosis. Is there evidence of fat tails? d) Test the efficient market hypothesis by looking at the first 10 autocorrelations. e) Test for volatility clustering by looking at the first 10 autocorrelations of squared returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts