Question: USE Exce; Cullumber Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures Ltd. The contract is

USE Exce;

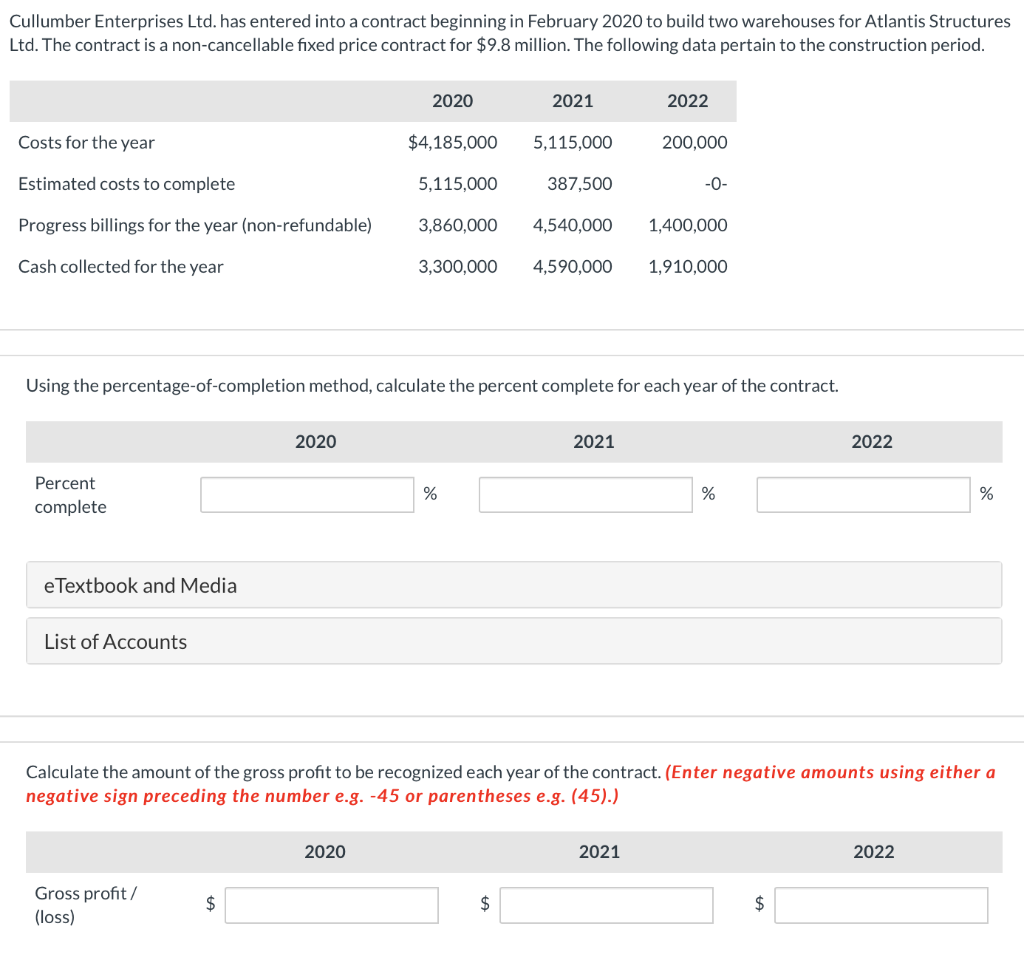

Cullumber Enterprises Ltd. has entered into a contract beginning in February 2020 to build two warehouses for Atlantis Structures Ltd. The contract is a non-cancellable fixed price contract for $9.8 million. The following data pertain to the construction period. 2020 2021 2022 Costs for the year $4,185,000 5,115,000 200,000 Estimated costs to complete 5,115,000 387,500 -0- Progress billings for the year (non-refundable) 3.860,000 4,540,000 1,400,000 Cash collected for the year 3,300,000 4,590,000 1,910,000 Using the percentage-of-completion method, calculate the percent complete for each year of the contract. 2020 2021 2022 Percent complete % % % e Textbook and Media List of Accounts Calculate the amount of the gross profit to be recognized each year of the contract. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 2021 2022 Gross profit/ (loss) $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts