Question: use excel for this problem and show all formulas. thanks CASE-PARTA Shrieves Casting Company is considering adding a new product line to its product mix,

use excel for this problem and show all formulas. thanks

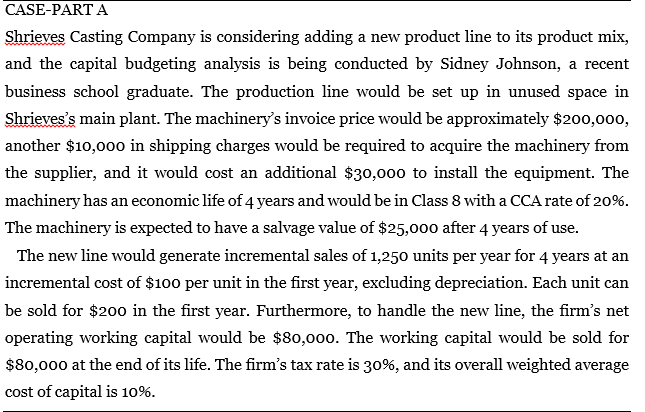

CASE-PARTA Shrieves Casting Company is considering adding a new product line to its product mix, and the capital budgeting analysis is being conducted by Sidney Johnson, a recent business school graduate. The production line would be set up in unused space in Shrieves's main plant. The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required to acquire the machinery from the supplier, and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years and would be in Class 8 with a CCA rate of 20%. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. Furthermore, to handle the new line, the firm's net operating working capital would be $80,000. The working capital would be sold for $80,000 at the end of its life. The firm's tax rate is 30%, and its overall weighted average cost of capital is 10%. CASE-PART B The company would like to rerun the original information if sales only reaches 900 units per year. REQUIRED: DETERMINE WHETHER THE COMPANY GO AHEAD WITH THIS PROJECT OF ADDING A NEW PRODUCT LINE FOR PART A & B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts