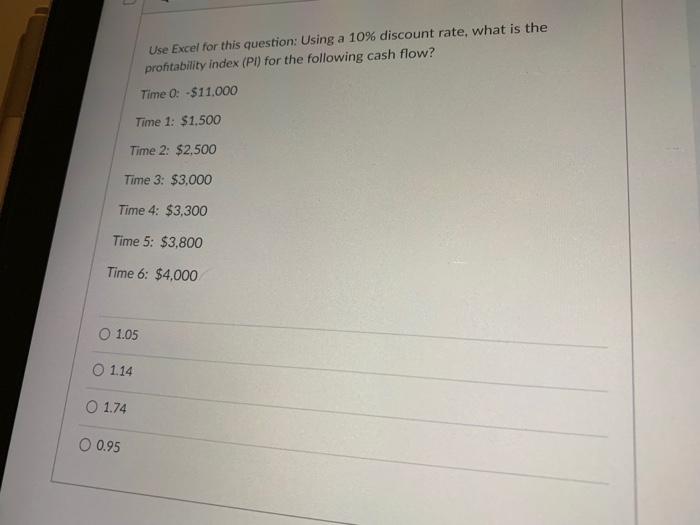

Question: Use Excel for this question: Using a 10% discount rate, what is the prohtability index (Pl) for the following cash flow? Time 0: -$11.000 Time

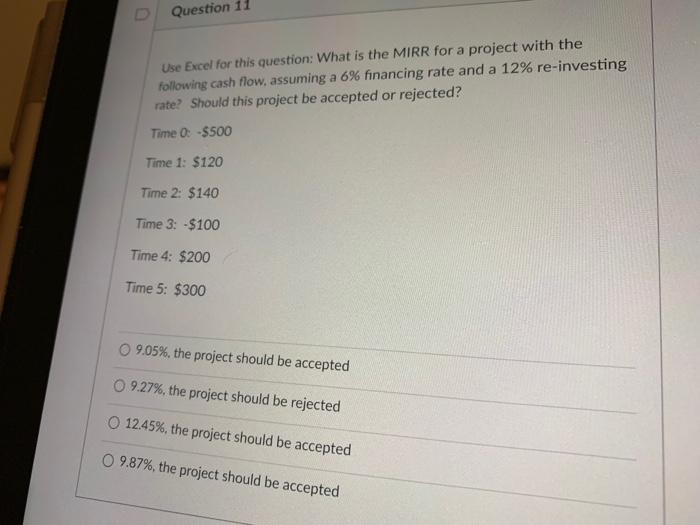

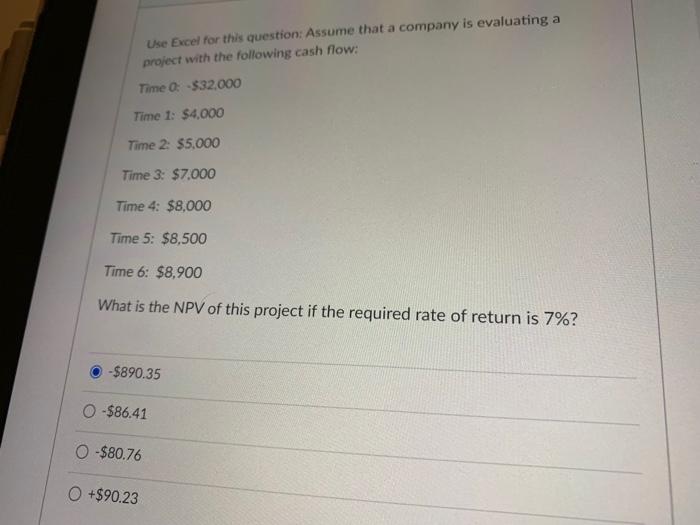

Use Excel for this question: Using a 10% discount rate, what is the prohtability index (Pl) for the following cash flow? Time 0: -$11.000 Time 1: $1.500 Time 2: $2,500 Time 3: $3,000 Time 4: $3,300 Time 5: $3,800 Time 6: $4,000 01.05 O 1.14 O 1.74 O 0.95 Question 11 Use Excel for this question: What is the MIRR for a project with the following cash flow, assuming a 6% financing rate and a 12% re-investing rate? Should this project be accepted or rejected? Time 0: -5500 Time 1: $120 Time 2: $140 Time 3: -$100 Time 4: $200 Time 5: $300 09.05%, the project should be accepted O 9.27%, the project should be rejected O 12.45%, the project should be accepted O 9.87%, the project should be accepted Use Excel for this question: Assume that a company is evaluating a project with the following cash flow: Time 0: $32,000 Time 1: $4.000 Time 2: $5.000 Time 3: $7.000 Time 4: $8,000 Time 5: $8,500 Time 6: $8,900 What is the NPV of this project if the required rate of return is 7%? -$890.35 0-$86.41 O $80.76 +$90.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts