Question: * * * USE EXCEL FORMULAS Note Receivable ( 6 Points ) On December 3 1 , 2 0 1 9 , Green Company finished

USE EXCEL FORMULAS

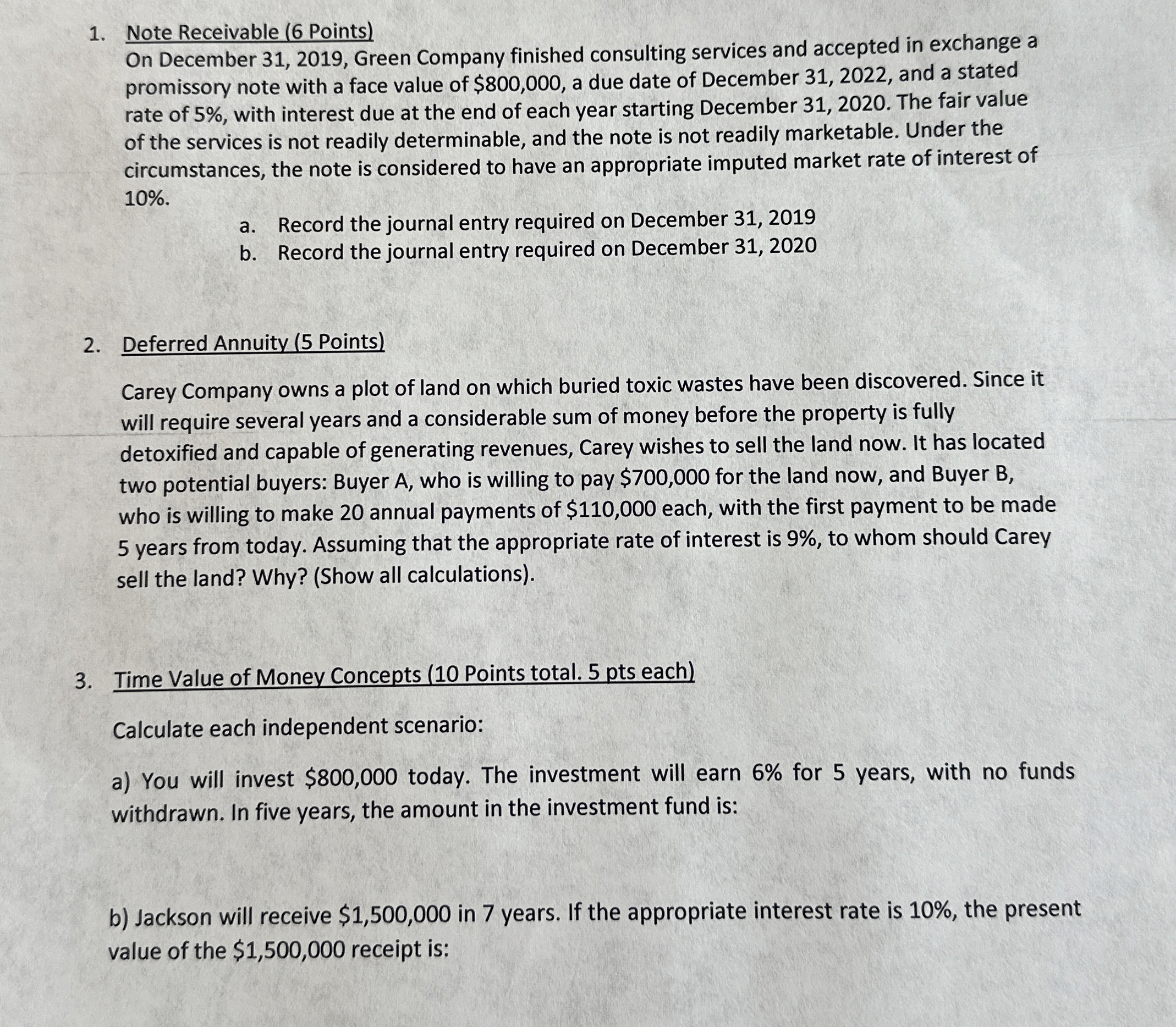

Note Receivable Points

On December Green Company finished consulting services and accepted in exchange a

promissory note with a face value of $ a due date of December and a stated

rate of with interest due at the end of each year starting December The fair value

of the services is not readily determinable, and the note is not readily marketable. Under the

circumstances, the note is considered to have an appropriate imputed market rate of interest of

a Record the journal entry required on December

b Record the journal entry required on December

Deferred Annuity Points

Carey Company owns a plot of land on which buried toxic wastes have been discovered. Since it

will require several years and a considerable sum of money before the property is fully

detoxified and capable of generating revenues, Carey wishes to sell the land now. It has located

two potential buyers: Buyer A who is willing to pay $ for the land now, and Buyer B

who is willing to make annual payments of $ each, with the first payment to be made

years from today. Assuming that the appropriate rate of interest is to whom should Carey

sell the land? Why? Show all calculations

Time Value of Money Concepts Points total. pts each

Calculate each independent scenario:

a$ today. The investment will earn for years, with no funds

withdrawn. In five years, the amount in the investment fund is:

b$ in years. If the appropriate interest rate is the present

value of the $ receipt is:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock