Question: Use Excel (or other approved spread sheet) to create a complete amortization schedule for the life of both financing options. Project: (due at the end

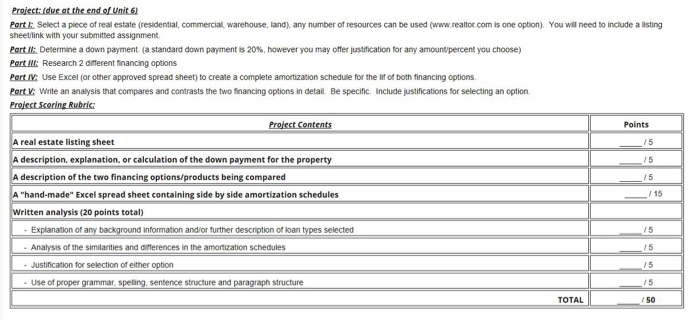

Project: (due at the end of Unit 6 Part I Select a piece of real estate (residential, commercial, warehouse, land), any number of resources can be used (www.realtor.com is one option). sheetlink with your submitted assignment. You will need to include a listing Part Determine a down payment (a standard down payment is 20 %, however you may offer justification for any amount/percent you choose) Part I Research 2 different financing options Part IV Use Excel (or other approved spread sheet) to create a complete amortization schedule for the lif of both financing options. Part V Write an analysis that compares and contrasts the two financing options in detail. Be specific. Include justifications for selecting an option. Project Scoring Rubric Project Contents Points A real estate listing sheet 15 A description, explanation, or calculation of the down payment for the property A description of the two financing options/products being compared A "hand-made" Excel spread sheet containing side by side amortization schedules Written analysis (20 points total) - Explanation of any background information and/or further description of loan types selected 15 15 15 15 - Analysis of the similarities and differences in the amortization schedules 15 Justification for selection of either option 15 - Use of proper grammar, speling, sentence structure and paragraph structure 15 TOTAL 50 Project: (due at the end of Unit 6 Part I Select a piece of real estate (residential, commercial, warehouse, land), any number of resources can be used (www.realtor.com is one option). sheetlink with your submitted assignment. You will need to include a listing Part Determine a down payment (a standard down payment is 20 %, however you may offer justification for any amount/percent you choose) Part I Research 2 different financing options Part IV Use Excel (or other approved spread sheet) to create a complete amortization schedule for the lif of both financing options. Part V Write an analysis that compares and contrasts the two financing options in detail. Be specific. Include justifications for selecting an option. Project Scoring Rubric Project Contents Points A real estate listing sheet 15 A description, explanation, or calculation of the down payment for the property A description of the two financing options/products being compared A "hand-made" Excel spread sheet containing side by side amortization schedules Written analysis (20 points total) - Explanation of any background information and/or further description of loan types selected 15 15 15 15 - Analysis of the similarities and differences in the amortization schedules 15 Justification for selection of either option 15 - Use of proper grammar, speling, sentence structure and paragraph structure 15 TOTAL 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts