Question: use excel please. A specialty hedge fund is considering the purchase of a Jackson Pollock painting It estimate the value of the painting to be

use excel please.

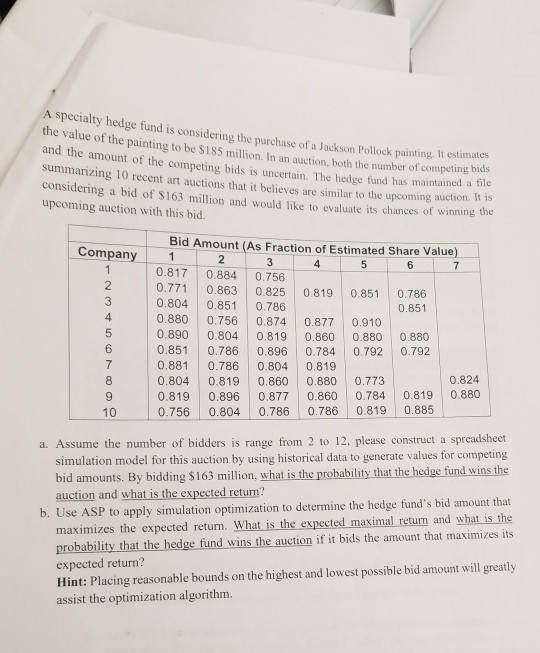

A specialty hedge fund is considering the purchase of a Jackson Pollock painting It estimate the value of the painting to be $185 million. In an auction, both the number of competing b and the amount of the competing bids is uncertain. The hedge fund has maintained a summarizing 10 recent art auctions that it believes are similar to the upcoming auctio considering a bid of $163 million and would like to evaluate its chances of upcoming auction with this bid. bids file n. It is winning the Bid Amount (As Fraction of Estimated Share Value) Company 1 5 0.817 0.884 0.756 0.771 0.863 0825 0.819 0.851 0.786 0.804 0.851 0.786 0.880 0.756 0.874 0.877 0.910 0.890 0.804 0.819 0.860 0.880 0.880 0.851 0.786 0.896 0.784 0.792 0.792 0.881 0.786 0.804 0.819 0.804 0.819 0.860 0.880 0.773 0.819 0.896 0.877 0.860 0.784 0.819 0.880 0.851 0.824 6 10 0.756 0.804 0.786 0.786 0.819 0.885 a. Assume the number of bidders is range from 2 to 12, please construct a spreadsheet simulation model for this auction by using historical data to generate values for competing bid amounts. By bidding $163 million, what is the probability that th auction and what is the expected return? nd wins the b. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return. What is the expected maximal return and what is the probability that the hedge fund wins the auction if it bids the amount that maximizes its expected return? assist the optimization algorithm. A specialty hedge fund is considering the purchase of a Jackson Pollock painting It estimate the value of the painting to be $185 million. In an auction, both the number of competing b and the amount of the competing bids is uncertain. The hedge fund has maintained a summarizing 10 recent art auctions that it believes are similar to the upcoming auctio considering a bid of $163 million and would like to evaluate its chances of upcoming auction with this bid. bids file n. It is winning the Bid Amount (As Fraction of Estimated Share Value) Company 1 5 0.817 0.884 0.756 0.771 0.863 0825 0.819 0.851 0.786 0.804 0.851 0.786 0.880 0.756 0.874 0.877 0.910 0.890 0.804 0.819 0.860 0.880 0.880 0.851 0.786 0.896 0.784 0.792 0.792 0.881 0.786 0.804 0.819 0.804 0.819 0.860 0.880 0.773 0.819 0.896 0.877 0.860 0.784 0.819 0.880 0.851 0.824 6 10 0.756 0.804 0.786 0.786 0.819 0.885 a. Assume the number of bidders is range from 2 to 12, please construct a spreadsheet simulation model for this auction by using historical data to generate values for competing bid amounts. By bidding $163 million, what is the probability that th auction and what is the expected return? nd wins the b. Use ASP to apply simulation optimization to determine the hedge fund's bid amount that maximizes the expected return. What is the expected maximal return and what is the probability that the hedge fund wins the auction if it bids the amount that maximizes its expected return? assist the optimization algorithm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts