Question: Use Excel: Question 6 Consider a corporate bond with face value $1,000, maturing in 2 years, 6% annual coupon rate, and semi-annual coupon payments. The

Use Excel:

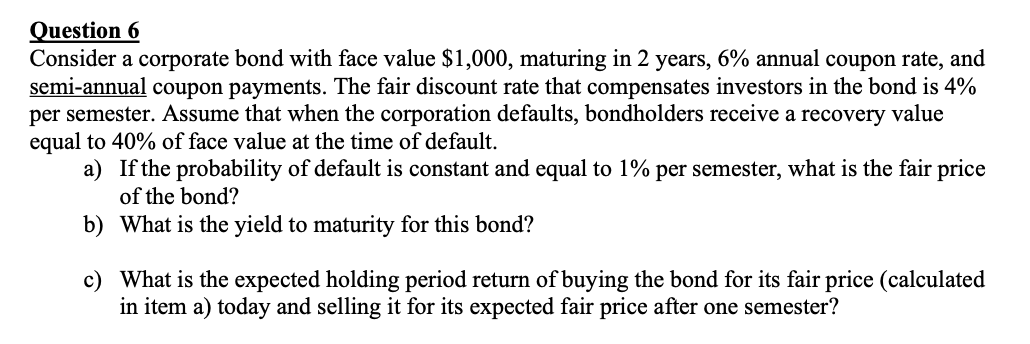

Question 6 Consider a corporate bond with face value $1,000, maturing in 2 years, 6% annual coupon rate, and semi-annual coupon payments. The fair discount rate that compensates investors in the bond is 4% per semester. Assume that when the corporation defaults, bondholders receive a recovery value equal to 40% of face value at the time of default. a) If the probability of default is constant and equal to 1% per semester, what is the fair price of the bond? b) What is the yield to maturity for this bond? c) What is the expected holding period return of buying the bond for its fair price (calculated in item a) today and selling it for its expected fair price after one semester

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts