Question: use excel to answer this question, thanks! Question 3: (3 points) Using Thomson Reuters' Eikon, answering the following questions related to the 7 yr US

use excel to answer this question, thanks!

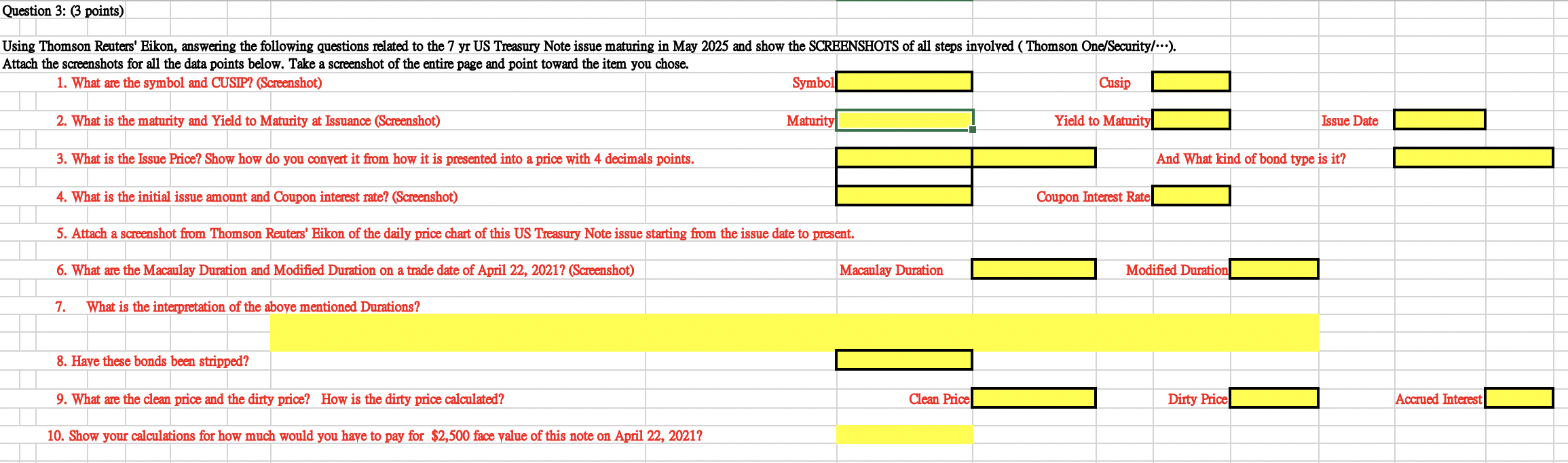

Question 3: (3 points) Using Thomson Reuters' Eikon, answering the following questions related to the 7 yr US Treasury Note issue maturing in May 2025 and show the SCREENSHOTS of all steps involved (Thomson One/Security/...). Attach the screenshots for all the data points below. Take a screenshot of the entire page and point toward the item you chose. 1. What are the symbol and CUSIP? (Screenshot) Symbol Cusip 2. What is the maturity and Yield to Maturity at Issuance (Screenshot) Maturity Yield to Maturity Issue Date 3. What is the Issue Price? Show how do you convert it from how it is presented into a price with 4 decimals points. And What kind of bond type is it? 4. What is the initial issue amount and Coupon interest rate? (Screenshot) Coupon Interest Rate 5. Attach a screenshot from Thomson Reuters' Eikon of the daily price chart of this US Treasury Note issue starting from the issue date to present. 6. What are the Macaulay Duration and Modified Duration on a trade date of April 22, 2021? (Screenshot) Macaulay Duration Modified Duration 7. What is the interpretation of the above mentioned Durations? 8. Have these bonds been stripped? 9. What are the clean price and the dirty price? How is the dirty price calculated? Clean Price Dirty Price Accrued Interest 10. Show your calculations for how much would you have to pay for $2,500 face value of this note on April 22, 2021? Question 3: (3 points) Using Thomson Reuters' Eikon, answering the following questions related to the 7 yr US Treasury Note issue maturing in May 2025 and show the SCREENSHOTS of all steps involved (Thomson One/Security/...). Attach the screenshots for all the data points below. Take a screenshot of the entire page and point toward the item you chose. 1. What are the symbol and CUSIP? (Screenshot) Symbol Cusip 2. What is the maturity and Yield to Maturity at Issuance (Screenshot) Maturity Yield to Maturity Issue Date 3. What is the Issue Price? Show how do you convert it from how it is presented into a price with 4 decimals points. And What kind of bond type is it? 4. What is the initial issue amount and Coupon interest rate? (Screenshot) Coupon Interest Rate 5. Attach a screenshot from Thomson Reuters' Eikon of the daily price chart of this US Treasury Note issue starting from the issue date to present. 6. What are the Macaulay Duration and Modified Duration on a trade date of April 22, 2021? (Screenshot) Macaulay Duration Modified Duration 7. What is the interpretation of the above mentioned Durations? 8. Have these bonds been stripped? 9. What are the clean price and the dirty price? How is the dirty price calculated? Clean Price Dirty Price Accrued Interest 10. Show your calculations for how much would you have to pay for $2,500 face value of this note on April 22, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts