Question: Use Excel to create a scatter plot for these two variables. Comment on whether you believe there is a relationship between percent changes in market

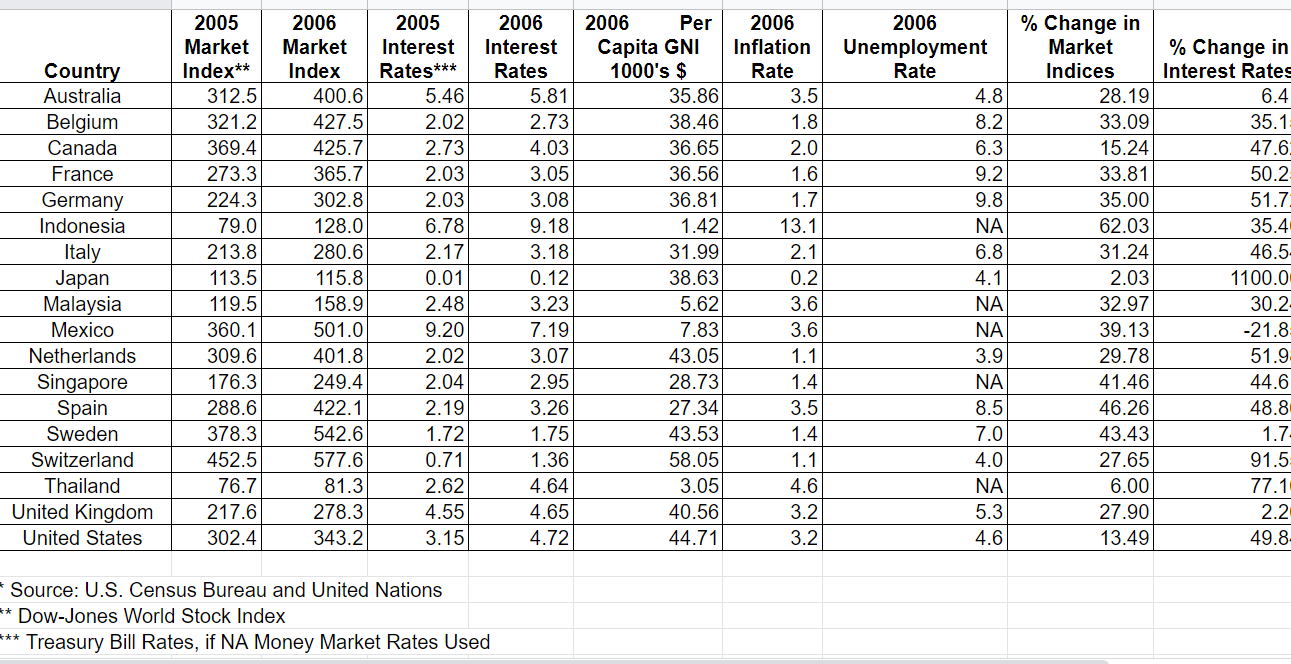

Use Excel to create a scatter plot for these two variables. Comment on whether you believe there is a relationship between percent changes in market indices and percent changes in interest rates. If you see a relationship, is it a positive or a negative one? As the change in interest rates increases, do you believe the change in stock market indices increases or decreases? How can you explain this? Do you see an unusual observation (i.e., outlier), which might be excluded from this sample of data? If so, what country is it?

Use Excel to conduct a regression analysis of these two variables. Use the data from all eighteen counties. Let percent changes in the interest rate be the independent or explanatory variable (X) and percent changes in stock market indices be the dependent variable (Y). (The dependent variable is what you are trying to predict.) Interpret your regression findings by discussing the coefficient of determination (i.e., R-square), the regression coefficient of interest rate change, and the p-value. Is the regression coefficient of X significantly different than zero? What does this mean? Use a significance of .05

% Change in Interest Rates 6.4 35.1 Country Australia Belgium Canada France Germany Indonesia Italy Japan Malaysia Mexico Netherlands Singapore Spain Sweden Switzerland Thailand United Kingdom United States 2005 Market Index** 312.5 321.2 369.4 273.3 224.3 79.0 213.8 113.5 119.5 360.1 309.6 176.3 288.6 378.3 452.5 76.7 217.6 302.4 2006 Market Index 400.6 427.5 425.7 365.7 302.8 128.0 280.6 115.8 158.9 501.0 401.8 249.4 422.1 542.6 577.6 81.3 278.3 343.2 2005 Interest Rates*** 5.46 2.02 2.73 2.03 2.03 6.78 2.17 0.01 2.48 9.20 2.02 2.04 2.19 1.72 0.71 2.62 4.55 3.15 2006 Interest Rates 5.81 2.73 4.03 3.05 3.08 9.18 3.18 0.12 3.23 7.19 3.07 2.95 3.26 1.75 1.36 4.64 4.65 4.72 2006 Per Capita GNI 1000's $ 35.86 38.46 36.65 36.56 36.81 1.42 31.99 38.63 5.62 7.83 43.05 28.73 27.34 43.53 58.05 3.05 40.56 44.71 2006 Inflation Rate 3.5 1.8 2.0 1.6 1.7 13.1 2.1 0.2 3.6 3.6 1.1 1.4 3.5 1.4 1.1 4.6 3.2 3.2 2006 Unemployment Rate 4.8 8.2 6.3 9.2 9.8 NA 6.8 4.1 NA % Change in Market Indices 28.19 33.09 15.24 33.81 35.00 62.03 31.24 2.03 32.97 39.13 29.78 41.46 46.26 43.43 27.65 6.00 27.90 13.49 47.6 50.2 51.7 35.4 46.5 1100.0 30.2 -21.8 51.9 44.6 48.8 1.7 91.5 NA 3.9 NA 8.5 7.0 4.0 5.3 4.6 77.1 NNO- 2.2 49.8 Source: U.S. Census Bureau and United Nations ** Dow Jones World Stock Index *** Treasury Bill Rates, if NA Money Market Rates Used % Change in Interest Rates 6.4 35.1 Country Australia Belgium Canada France Germany Indonesia Italy Japan Malaysia Mexico Netherlands Singapore Spain Sweden Switzerland Thailand United Kingdom United States 2005 Market Index** 312.5 321.2 369.4 273.3 224.3 79.0 213.8 113.5 119.5 360.1 309.6 176.3 288.6 378.3 452.5 76.7 217.6 302.4 2006 Market Index 400.6 427.5 425.7 365.7 302.8 128.0 280.6 115.8 158.9 501.0 401.8 249.4 422.1 542.6 577.6 81.3 278.3 343.2 2005 Interest Rates*** 5.46 2.02 2.73 2.03 2.03 6.78 2.17 0.01 2.48 9.20 2.02 2.04 2.19 1.72 0.71 2.62 4.55 3.15 2006 Interest Rates 5.81 2.73 4.03 3.05 3.08 9.18 3.18 0.12 3.23 7.19 3.07 2.95 3.26 1.75 1.36 4.64 4.65 4.72 2006 Per Capita GNI 1000's $ 35.86 38.46 36.65 36.56 36.81 1.42 31.99 38.63 5.62 7.83 43.05 28.73 27.34 43.53 58.05 3.05 40.56 44.71 2006 Inflation Rate 3.5 1.8 2.0 1.6 1.7 13.1 2.1 0.2 3.6 3.6 1.1 1.4 3.5 1.4 1.1 4.6 3.2 3.2 2006 Unemployment Rate 4.8 8.2 6.3 9.2 9.8 NA 6.8 4.1 NA % Change in Market Indices 28.19 33.09 15.24 33.81 35.00 62.03 31.24 2.03 32.97 39.13 29.78 41.46 46.26 43.43 27.65 6.00 27.90 13.49 47.6 50.2 51.7 35.4 46.5 1100.0 30.2 -21.8 51.9 44.6 48.8 1.7 91.5 NA 3.9 NA 8.5 7.0 4.0 5.3 4.6 77.1 NNO- 2.2 49.8 Source: U.S. Census Bureau and United Nations ** Dow Jones World Stock Index *** Treasury Bill Rates, if NA Money Market Rates Used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts