Question: Use excel to solve the question in bold and please show the steps and formulas. I - . K K L H A B C

Use excel to solve the question in bold and please show the steps and formulas.

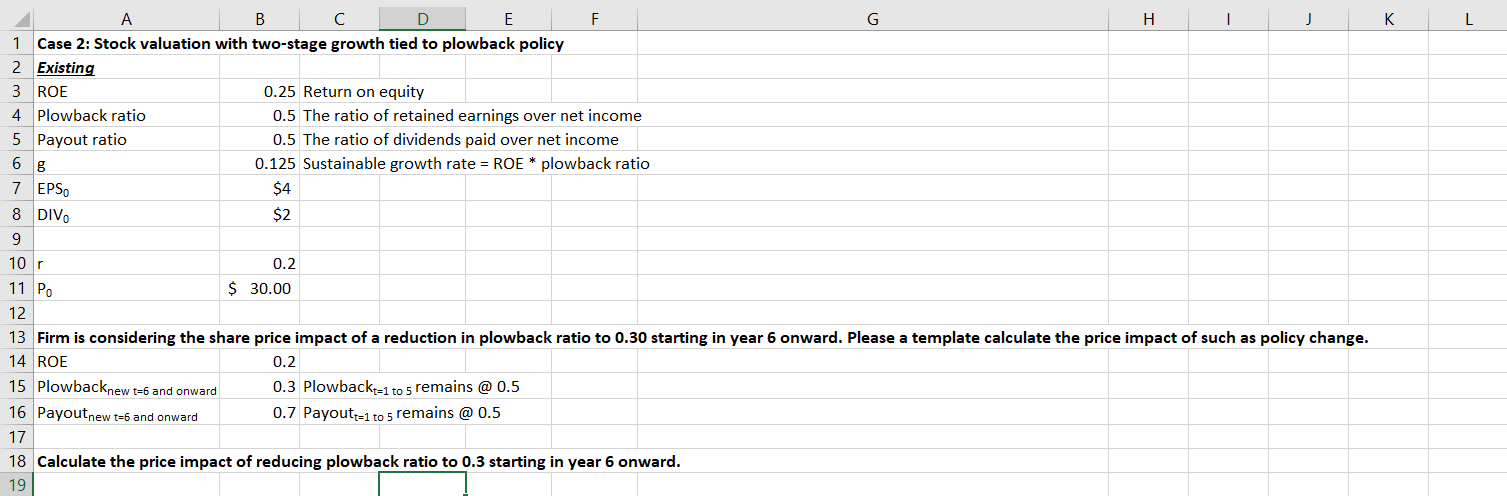

I - . K K L H A B C D E F G 1 Case 2: Stock valuation with two-stage growth tied to plowback policy 2 Existing 3 ROE 0.25 Return on equity 4 Plowback ratio 0.5 The ratio of retained earnings over net income 5 Payout ratio 0.5 The ratio of dividends paid over net income 68 0.125 Sustainable growth rate = ROE * plowback ratio 7 EPSO $4 8 DIVO $2 9 10 r 0.2 11 Po $ 30.00 12 13 Firm is considering the share price impact of a reduction in plowback ratio to 0.30 starting in year 6 onward. Please a template calculate the price impact of such as policy change. 14 ROE 0.2 15 Plowbacknew t=6 and onward 0.3 Plowbackt-1 to 5 remains @ 0.5 16 Payoutnew t=6 and onward 0.7 Payout=1 to 5 remains @ 0.5 17 18 Calculate the price impact of reducing plowback ratio to 0.3 starting in year 6 onward. 19 I - . K K L H A B C D E F G 1 Case 2: Stock valuation with two-stage growth tied to plowback policy 2 Existing 3 ROE 0.25 Return on equity 4 Plowback ratio 0.5 The ratio of retained earnings over net income 5 Payout ratio 0.5 The ratio of dividends paid over net income 68 0.125 Sustainable growth rate = ROE * plowback ratio 7 EPSO $4 8 DIVO $2 9 10 r 0.2 11 Po $ 30.00 12 13 Firm is considering the share price impact of a reduction in plowback ratio to 0.30 starting in year 6 onward. Please a template calculate the price impact of such as policy change. 14 ROE 0.2 15 Plowbacknew t=6 and onward 0.3 Plowbackt-1 to 5 remains @ 0.5 16 Payoutnew t=6 and onward 0.7 Payout=1 to 5 remains @ 0.5 17 18 Calculate the price impact of reducing plowback ratio to 0.3 starting in year 6 onward. 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts