Question: Use Figure 2 0 . 1 , which lists prices of various CAE options. Use the data in the figure to calculate the payoff and

Use Figure which lists prices of various CAE options. Use the data in the figure to calculate the payoff and the profits for investments in each of the following June expiration options, assuming that the stock price on the expiration date is $Do not round intermediate calculations. Round your answers to decimal places. Leave no cells blankbe certain to enter wherever required. Negative amounts should be indicated by a minus sign. Omit the $ sign in your response.

Payoff ProfitLoss

a Call option, X $ $

$

b Put option, X $ $

$

c Call option, X $ $

$

d Put option, X $ $

$

e Call option, X $ $

$

f Put option, X $ $

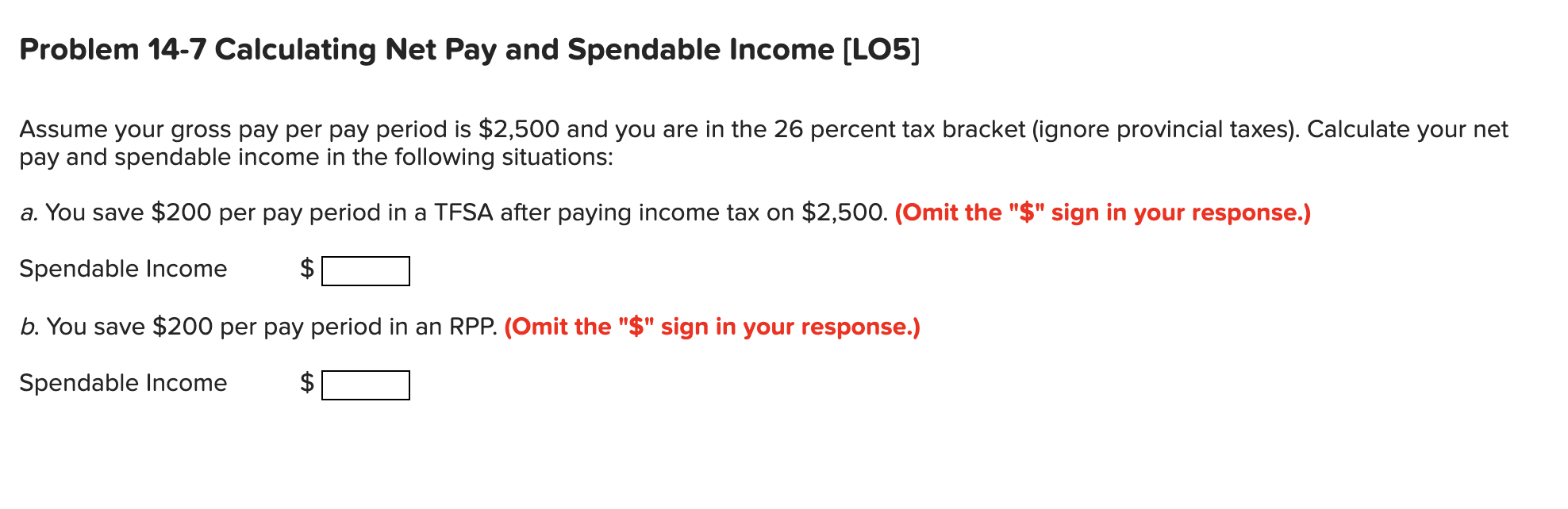

$Problem Calculating Net Pay and Spendable Income LO

Assume your gross pay per pay period is $ and you are in the percent tax bracket ignore provincial taxes Calculate your net

pay and spendable income in the following situations:

a You save $ per pay period in a TFSA after paying income tax on $Omit the $ sign in your response.

Spendable Income

b You save $ per pay period in an RPPOmit the $ sign in your response.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock