Question: Use Figure 23.7 Suppose the LIBOR rate when the first listed Eurodollar contract matures in January 2019 is 3.5%. What will be the profit or

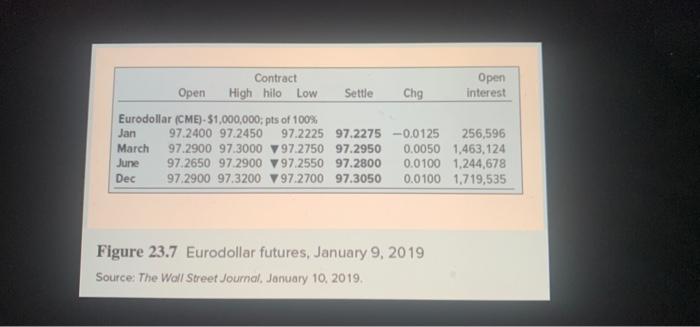

Use Figure 23.7 Suppose the LIBOR rate when the first listed Eurodollar contract matures in January 2019 is 3.5%. What will be the profit or loss to each side of the Eurodollar contract? (Do not round intermediate calculations and round final answer to 2 decimal places. Enter the amount as positive value.) Contract Open Open High hilo Low Settle Chg Interest Eurodollar (CME)- 51,000,000; pts of 100% Jan 97.2400 97.2450 97.2225 97.2275 -0.0125 256,596 March 97.2900 97.3000 97.2750 97.2950 0.0050 1,463,124 June 97.2650 97.2900 97.2550 97.2800 0.0100 1,244,678 Dec 97.2900 97.3200 97.2700 97.3050 0.0100 1.719,535 Figure 23.7 Eurodollar futures, January 9, 2019 Source: The Wall Street Journal, January 10, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts