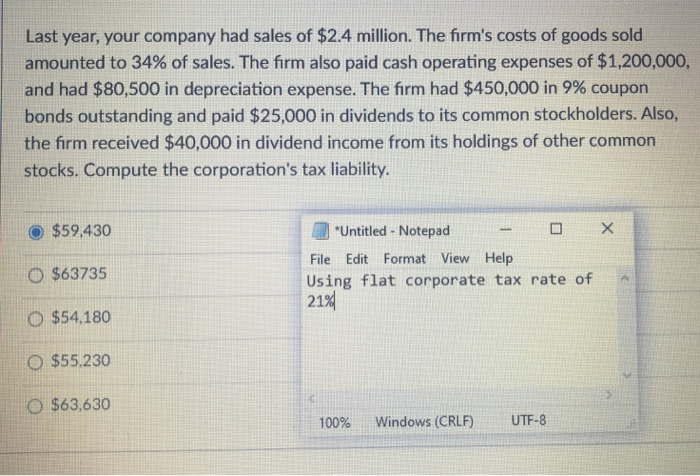

Question: Use flat 21% tax rate for question 2 Last year, your company had sales of $2.4 million. The firm's costs of goods sold amounted to

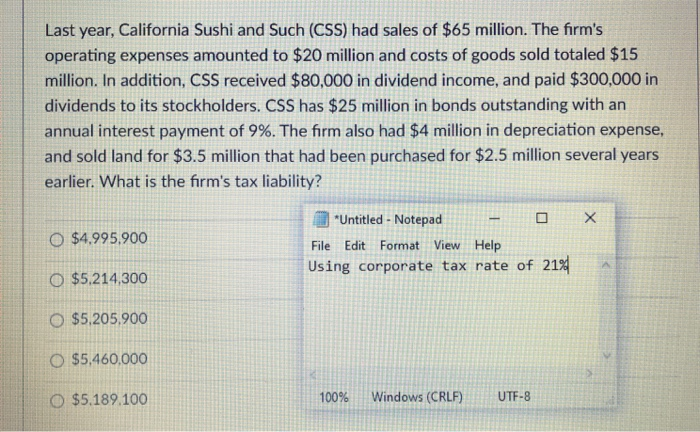

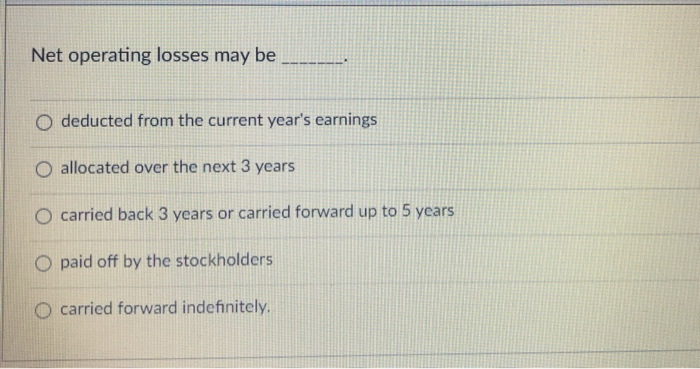

Last year, your company had sales of $2.4 million. The firm's costs of goods sold amounted to 34% of sales. The firm also paid cash operating expenses of $1,200,000, and had $80,500 in depreciation expense. The firm had $450,000 in 9% coupon bonds outstanding and paid $25,000 in dividends to its common stockholders. Also, the firm received $40,000 in dividend income from its holdings of other common stocks. Compute the corporation's tax liability. $59,430 *Untitled - Notepad File Edit Format View Help Using flat corporate tax rate of 21% 0 $63735 $54,180 $55.230 O $63,630 100% Windows (CRLF) UTF-8 Last year, California Sushi and Such (CSS) had sales of $65 million. The firm's operating expenses amounted to $20 million and costs of goods sold totaled $15 million. In addition, CSS received $80,000 in dividend income, and paid $300,000 in dividends to its stockholders. CSS has $25 million in bonds outstanding with an annual interest payment of 9%. The firm also had $4 million in depreciation expense, and sold land for $3.5 million that had been purchased for $2.5 million several years earlier. What is the firm's tax liability? O $4.995.900 *Untitled - Notepad File Edit Format View Help Using corporate tax rate of 219 A O $5,214,300 O $5,205.900 O $5,460,000 O $5.189.100 100% Windows (CRLF) UTF-8 Net operating losses may be O deducted from the current year's earnings O allocated over the next 3 years carried back 3 years or carried forward up to 5 years paid off by the stockholders carried forward indefinitely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts