Question: Use foe Problems 4 - 7 . For cach project, calculate the NPV , IRR, profitability index ( PI ) and the payback period. For

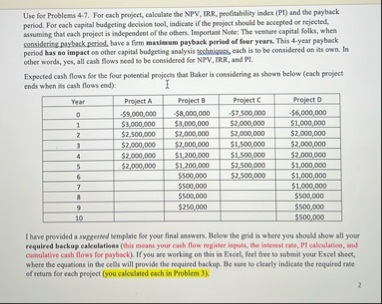

Use foe Problems For cach project, calculate the NPV IRR, profitability index PI and the payback period. For cach capital budgeting decision tool, indicate if the projoct should be accepted or rejected, assuming that each project is independent of the offers. Important Note: The versare capital follos, when considerine payback period, have a firm maximum payback period of four years. This year payback period has no impact on other capital budgeting analysis technigess, each is to be considered on its own. In other words, yes, all cash flows need to be considered for NPV IRR, and PL

Expected cash flows for the four potential projects that Baker is considering as shown below each project ends when its cash flows end:

tableYearProject AProject BProject CProject D$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

I have provided a suggeshtemplate for your final answers. Bellow the grid is where you should show all your required backup calculations dhis means your cash flow reginerr inpuls, the inserest rate, Pi calculation, and camulative cash flows for payback If you are worling on this in Froet, fiel froe to submit your Excel sheet, where the equations in the cells will provide the required backup. Be sare to cloraly indicate the required rate of return for each preject you calculated cach in Problem

Remember that each capinal budgeting method fould be calculated and analyzed on a standaloee basis.

tableYear,Project APreject BProject CProject DPointsReq. Return use decimula NPV mared NPV aceceptrejectIRR xx $IRR acceptrejectPI blew desimals, Pl acceptireject,,,,Pophack Period SxyrarsPayback acceptireject,,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock