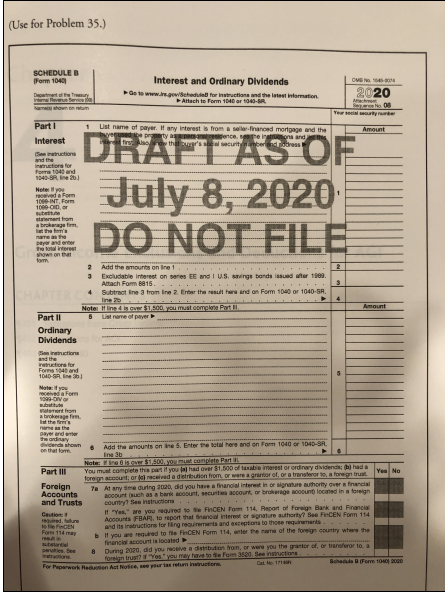

Question: (Use for Problem 35.) SCHEDULEB Form 1040 OM Interest and Ordinary Dividends Go to www.in.gowed for instructions and the latest information Aracht Form 1046 ar

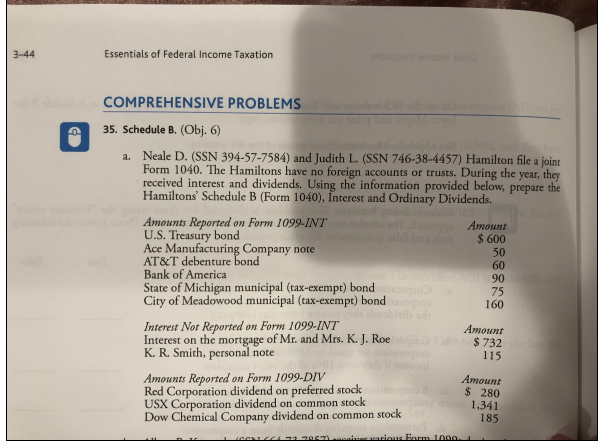

(Use for Problem 35.) SCHEDULEB Form 1040 OM Interest and Ordinary Dividends Go to www.in.gowed for instructions and the latest information Aracht Form 1046 ar 100 2020 home service Name hown on tum Achrom Amount List name of payer. If any interest from a financed mortgage and the property accons and how the guitar and dress Part 1 Interest Se intructions Intructions for For 1040 and 1940-SR. In 20 Not you received From 1000-INT, Form 1000-0, or erent from abgem that's perando July 8, 2020 DO NOT FILE show on Add the mounts on in 3 Excludable interest on series EE and I U.S. svinge bonds issued after 10 Attach Form 1915 Subtract line from line 2. Enter the result here and on Form 1040 or 1040-5R. line 2b Note Hindistoomlose Port Part II Listame of payer Ordinary Dividends Amount intruction and the ruction for Forma 1040 104D-SA. In 31 5 cea Form 9999-ON Sent from aber the dinary payer anderer Send som that. Add the amounts on tine ster the total here and on Form 1040 OF 104D-SR. Inb Notaris.CDN compart Part III You must complete this part if you had over $1.500 of anabe merest or ordinary dividende: Yes No foreign count or received a debution from Oregrutor for anot, a foreign truit Foreign Accounts Ta Alany Sme during 2020, did you have an interest in ornare authority over a financial Ooount has a burkoon, mis account or brokerage located in a foreign and Trusts court Stenstruction I "Yes" are you required to Me FRCEN F 114 Resort of Forg Bank and Financia Aoun FBARI. to report that financial interest or signature authority? Bee FNCEN Form 114 and its instructions for fingruments and seception to the requirements If you we required to the PHCEN Form 114, enter the name of the foreign country where the financial account is located During 2020, did you receive a distribution from, or were you the ratio of, or transforor to a foreign trust? Yes you may have to refom 3520. Sen uction For Paperwork Ron Act Notice ne pour tax return into. Scheda Form 1040 2000 For 114 3-44 Essentials of Federal Income Taxation a. COMPREHENSIVE PROBLEMS 35. Schedule B. (Obj. 6) Neale D. (SSN 394-57-7584) and Judith L. (SSN 746-38-4457) Hamilton file a joint Form 1040. The Hamiltons have no foreign accounts or trusts. During the year, they received interest and dividends. Using the information provided below, prepare the Hamiltons' Schedule B (Form 1040), Interest and Ordinary Dividends. Amounts Reported on Form 1099-INT Amount U.S. Treasury bond $ 600 Ace Manufacturing Company note 50 AT&T debenture bond 60 Bank of America 90 State of Michigan municipal (tax-exempt) bond 75 City of Meadowood municipal (tax-exempt) bond 160 Interest Not Reported on Form 1099-INT Amount Interest on the mortgage of Mr. and Mrs. K. J. Roe $ 732 K. R. Smith, personal note 115 Amounts Reported on Form 1099-DIV Amount Red Corporation dividend on preferred stock $ 280 USX Corporation dividend on common stock 1.341 Dow Chemical Company dividend on common stock 185 CCXULLAST in warious Form 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts