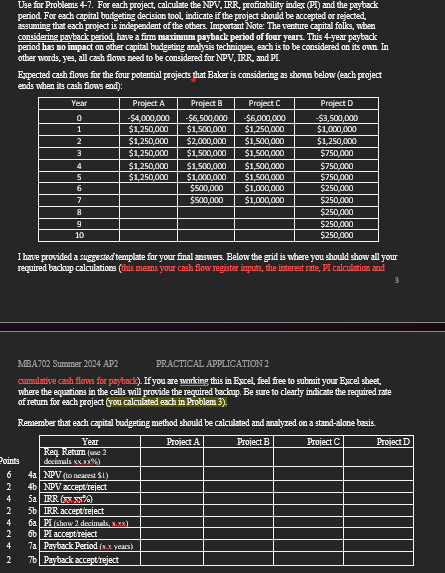

Question: Use for Problems 4 - 7 . For each project, calculate the NPV , IRR, profitability index ( PI ) and the payback Use for

Use for Problems For each project, calculate the NPV IRR, profitability index PI and the payback Use for Problems For ench project, calculate the NPV IRR, profithoility indes PI and the paybork

period For each capital buigeting decision tool, indicate if the project thould be accepted or rejected,

assuming that each project is independent of the others. Important Note: The venture cepital folks, when

connidering payback period, hase a fimm naxinum payback period of four years. This year payback

period has no inpact on other capital budgeting amalyyis techriques, exch is to be considered on its ove In

other words, yes, all cash flons need to be convidered for and PI

Expected couh flows for the four potential projects that Baker is conLidering as show below each project

ends when its cash flows end:

I have prowided a suggosted template for your finsl anewers. Below the grid is where you should show all your

required backup calculations thais means your cask flow register inputs, the ivteret rate, PI calculatica and

cammlative cash flows for porbach If you are working this in Excel, feel free to sulnoit your Exrel shest.

where the equationa in the cells will prowide the required beckup. Be sure to clearly indicate the required rate

of retum for each project you calculated each in Problem

Remember that each capital budgeting method should be calculbted and anolyzed on a stamdalone besis. table#PToBat AProject BProgect,ProbatDBetatableReqretuimkhowworktabletableRRtabletableRRtabletableRRtabletableRR

period. For each capital budgeting decision tool, indicate if the project should be accepted or rejected,

assuming that each project is independent of the others. Important Note: The venture capital folks, when

considering payback period, have a firm maximum payback period of four years. This year payback

period has no impact on other capital budgeting analysis techniques, each is to be considered on its own. In

other words, yes, all cash flows need to be considered for IRR, and PI

Expected cash flows for the four potential projects that Baker is considering as shown below each project

ends when its cash flows end:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock