Question: USE FORMULAS WHERE REQUIRED AND SHOW ALL WORKINGS. PLEASE REPLY IN MAX 30MINS ANSWER ALL QUESTIONS (viii) After having a long career of 28 years,

USE FORMULAS WHERE REQUIRED AND SHOW ALL WORKINGS.

PLEASE REPLY IN MAX 30MINS

ANSWER ALL QUESTIONS

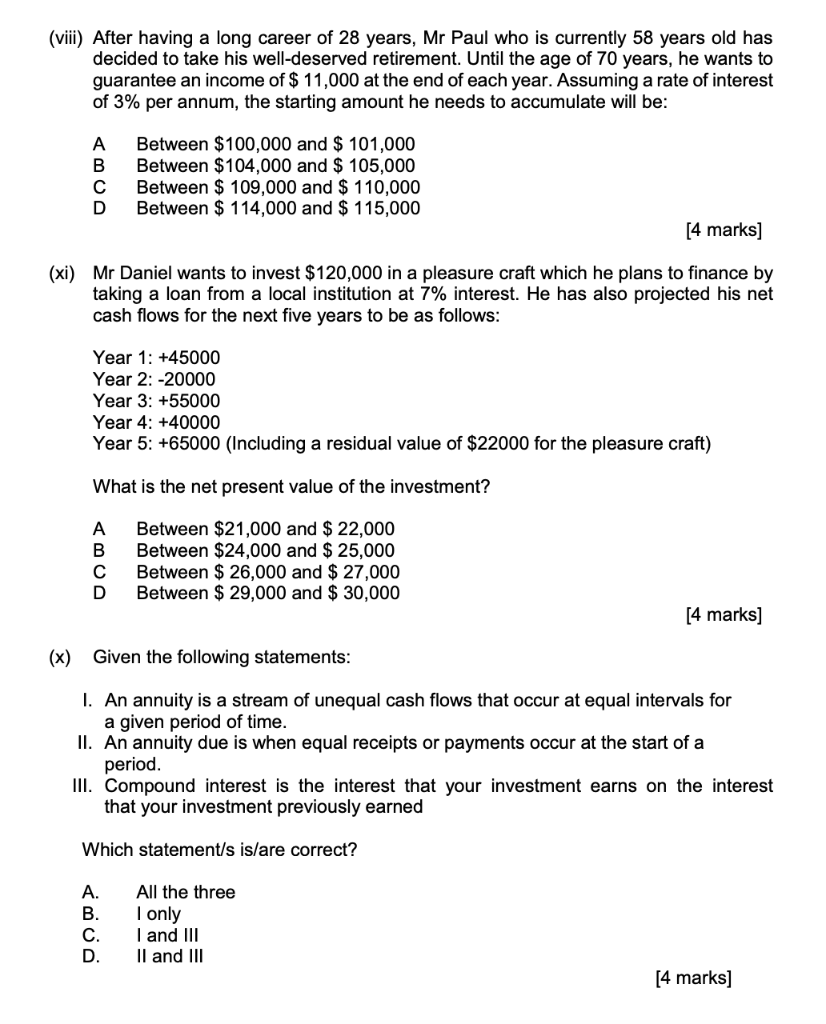

(viii) After having a long career of 28 years, Mr Paul who is currently 58 years old has decided to take his well-deserved retirement. Until the age of 70 years, he wants to guarantee an income of $ 11,000 at the end of each year. Assuming a rate of interest of 3% per annum, the starting amount he needs to accumulate will be: A B D Between $100,000 and $ 101,000 Between $104,000 and $ 105,000 Between $ 109,000 and $ 110,000 Between $ 114,000 and $ 115,000 [4 marks] (xi) Mr Daniel wants to invest $120,000 in a pleasure craft which he plans to finance by taking a loan from a local institution at 7% interest. He has also projected his net cash flows for the next five years to be as follows: Year 1: +45000 Year 2: -20000 Year 3: +55000 Year 4: +40000 Year 5: +65000 (Including a residual value of $22000 for the pleasure craft) What is the net present value of the investment? A B D Between $21,000 and $ 22,000 Between $24,000 and $ 25,000 Between $ 26,000 and $ 27,000 Between $ 29,000 and $ 30,000 [4 marks] (x) Given the following statements: 1. An annuity is a stream of unequal cash flows that occur at equal intervals for a given period of time. II. An annuity due is when equal receipts or payments occur at the start of a period. III. Compound interest is the interest that your investment earns on the interest that your investment previously earned Which statement/s is/are correct? A. B. C. D. All the three I only I and III II and III [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts