Question: Use future value and present value calculations (Use Exhibit 1-A, Exhibit 1-B, and Exhibit 1-C) to determine the following: a. The future value of a

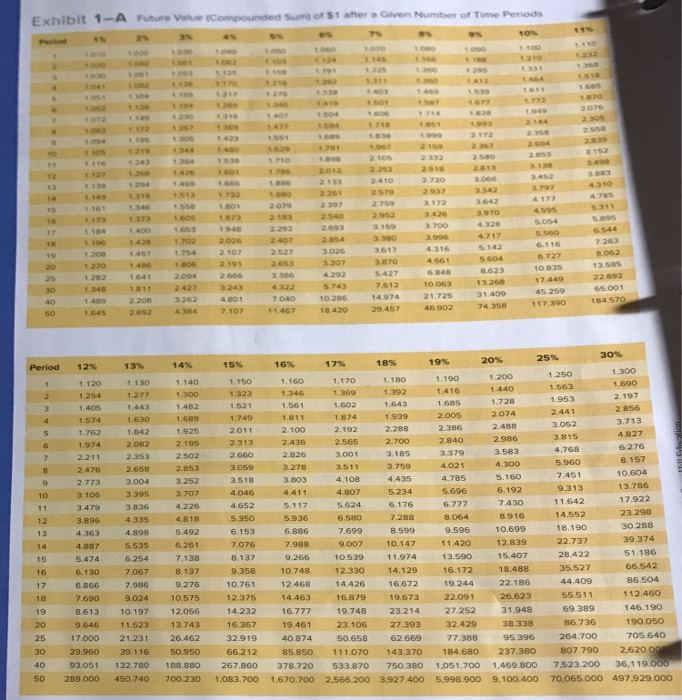

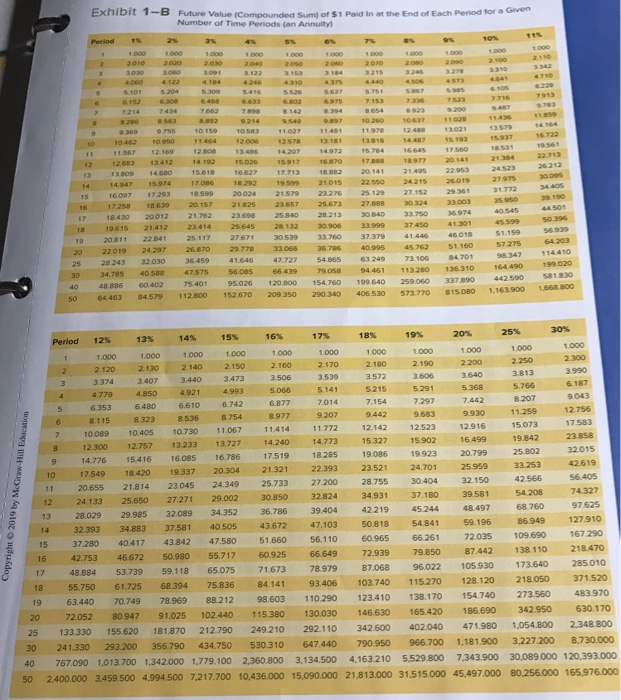

Exhibit 1-A Fiuture Value (Compounded Su) of $1 afher a Given Number of Time Penods 1.1051.219 344 2518 1.268 1426.1 3342 3 642 1.702 2.026 2407 2.854 3.617 2.527 8623 22.892 65.001 7.390 184.570 17.449 7612 4801 10.286 29.457 50 25% 14% 15% Period 12% 1.690 1.416 .346 1.561 1.392 1.643 1.369 1.728 2.074 1.482 1.521 1874 3.052 1842 2.100 2.288 2.986 6.276 3.379 3.583 2.353 3.759 2.476 10.604 13.786 17.922 23.298 30.288 39.374 7.451 5.160 6.192 7.430 8916 10.699 12.839 15.407 18.488 4.785 5.696 3.518 3.803 9.313 11.642 14.552 18.190 22.737 4046 4.807 5.234 3.3953.707 4.226 4818 10 5.624 5.936 3.896 4.363 4.887 5.474 6.153 8.599 4.898 5.535 6.254 7.067 7.988 9.266 10.748 9.007 10.147 10.539 12.330 14.426 11.420 13.590 16.172 19.244 7.076 51.186 28.422 35.527 66.542 8.137 14.129 16,672 86.504 112.460 146.19o 190.050 705.64o 44.409 6.866 7.690 9.024 10.575 12.375 14.463 16.879 19.673 22091 26.623 55.511 8.613 10.197 12.056 9.646 11.523 13.743 10.761 12.375 14.463 16.879 19.673 22.091 14.232 16.36719.461 23.106 27.39332.429 38.338 69.389 86.736 95.396 264.700 19.748 23.214 20 25 30 29.960 39.116 50.950 40 93.051 132.780 188.880 267.860 378.720 533.870 750.380 1,051.700 1,469.800 7,523.200 36,119.00o 50 289.000 450.740 700.230 1,083.700 1,670.700 2.566.200 3.927 400 5.998.900 9,100.400 70,065.000 497.929.000 17.000 21.231 26.462 40.874 50.658 62.669 77.388 66.212 85.850 11.070 143.370 184.680 237.380 807.790 2.620 Exhibit 1-B Future Value (Compounded Sumj of $1 Paid In at the End of Each Period for a Gven Number of Time Periods (an Annuity 20102020 20302.040 4184 4246 431075 444064573 61526308 8 286853 1o 10.462 10.950 11464 9897 10.260 106371102 1.436 975510.15910 583 11027 149111.978 12.4 132 2.0061257813181 13816 1448715.193 2683 13412 14.192 15.026 1591716.870 17 18 977 20141 214713 14.947 15974 17.08618.292 19.599 21.015 22550 24.215 2 2601927975 18.639 20.157 21825 23657 2S673 27.888 30.324 20012 21.762 23698 25.840 2213 30.840 33.75o 36974 18 19 19615 2141223414 25.645 28 132 30906 33999 7450 41301 45599 50396 19615 414 25.64 25.117 27671 30 539 33.760 37.379 41446 46018 22019 24207 26870 29.770 33066 36786 40995 45.762 51160 6459 41.646 47.727 54.865 63249 73 10684701 34.785 40047575 56085 66439 79058 94.461 113280 136310 95.026 120.800 154.760 199 640 259060 337.890 57 275 28.243 32.030 30 34.785 40 50 64463 84579 112.800152.670 164490 442.590 581.830 30 48.886 60.402 75.401 209.3502 290.340 406530 573.770 815.080 1,163.900 1,668 800 25% 1.000 2 2120 2130 21402.150 2.160 2.170 3.990 3.813 5.766 4.779 4.8504921 4.993 5.215 5 368 7.442 9.930 12916 16.499 19086 19923 20.799 20.304 21.321 22.393 23.521 24.701 25.959 32 150 39.581 42.219 45244 48.497 59.196 9043 12.756 17.583 23.858 32015 6877 6.610 8.323 8.536 8.754 10.089 10.405 10.73011067 11.414 7014 11.772 12.142 15.073 19.842 25.802 33.253 42.566 54.208 68.760 12.300 12757 13.233 13727 14.240 14.773 14.776 15.41616.085 16.786 15 327 15.902 17.519 20655 21.81423.045 24.349 25.733 27200 28.755 30.404 56.405 12 24,133 25.650 27.271 29.002 30.850 32824 34.931 37.180 28029 29.985 32089 34.352 36.786 39.404 14 32.393 34883 37581 40505 43.672 47.103 15 16 17 48.884 53.739 59.118 65.075 71.673 86.949 127.910 56.110 60.965 66261 7203 109.690 167290 79.850 87.442 138.110 218470 78979 87.068 96.022 105.930 173640 285010 50.818 54.841 37.280 40.417 43.842 47.580 51.660 42.753 46.67250.980 55.717 60925 66.649 72.939 55.750 61.725 68.394 75.836 84.141 93.406 103.740 63.440 70.749 78.969 88.212 98.603 110.290 123.410 138.170 105.930 173.640 285.010 115.270 128.120 218.050 371.520 154740 273.560 483970 18 19 91.025 102.440 115.380 130.030 146.630 165420 186690 342.950 630.170 342600 402.040 471.980 1,054800 2,348.800 81.900 3,227.200 8,730.000 40 767.090 1.013.700 1,342000 1,779.100 2,360.800 3,134.500 4.163.210 5.529.800 7.343900 30,089.000 120.393000 50 2.400.000 3,459 500 4994500 7,217.700 10,43.000 15,090.000 21,813.000 31,515.000 45,497000 80.256.000 165.976.000 20 25 133.330 155.620 181.870 212.790 249.210 292.110 342.600 402.040 471.980 1,054 30 241.330 293.200 356.790 434.750 530.310 647.440 790.950 966.700 1,1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts