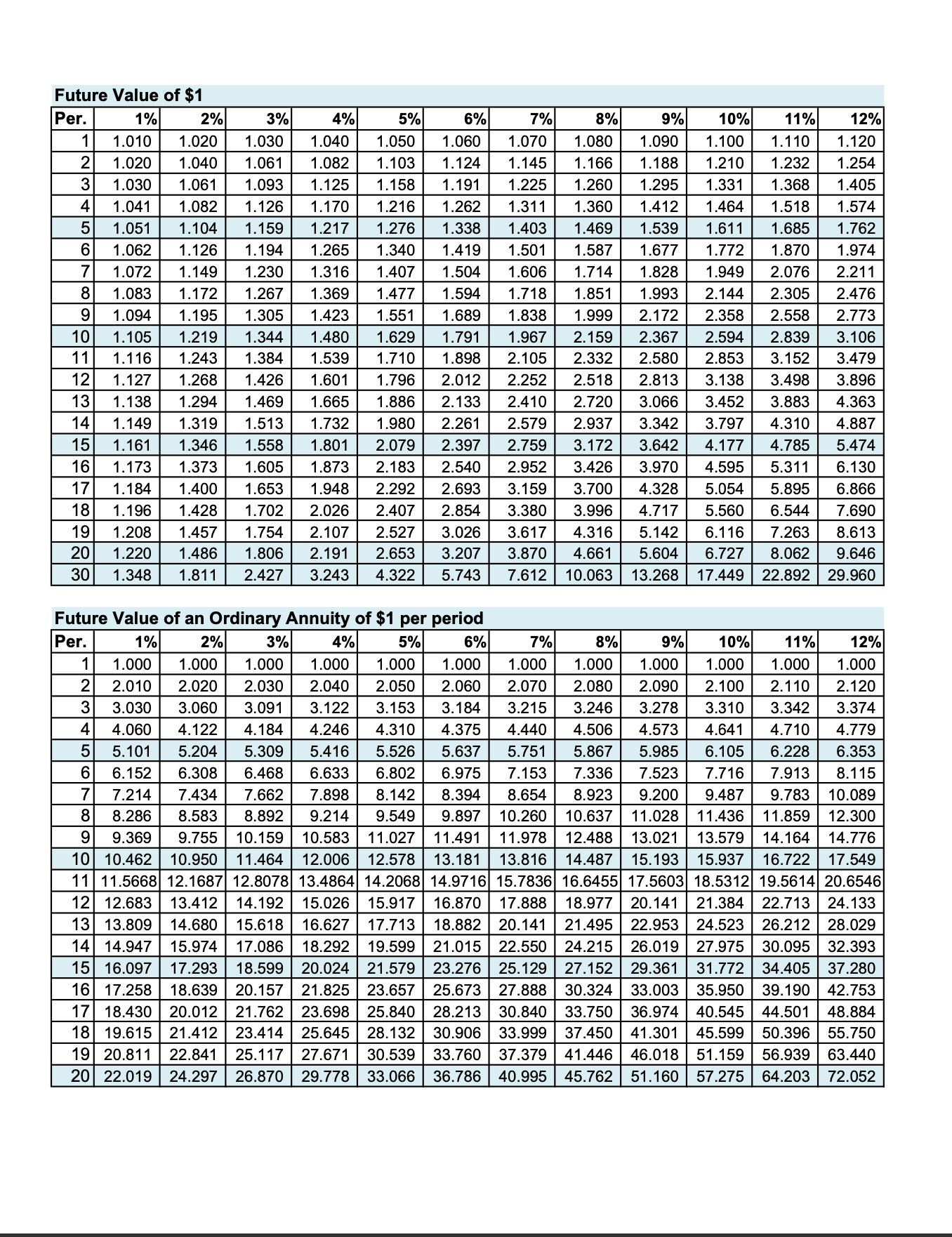

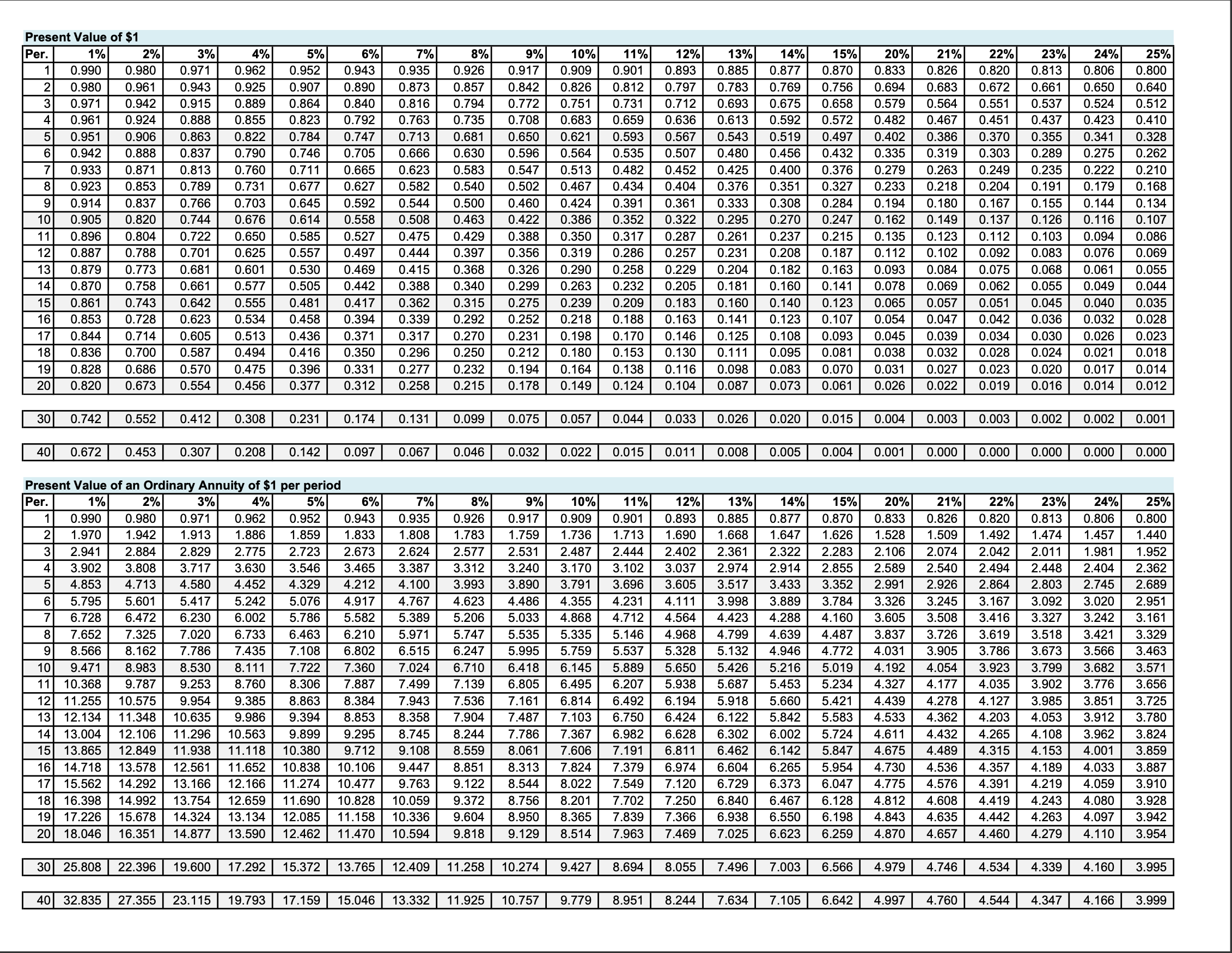

Question: Use Future Value and Present Value Tables Chuck Russo, a high school math teacher, wants to set up an IRA account into which he will

Use Future Value and Present Value Tables

Chuck Russo, a high school math teacher, wants to set up an IRA account into which he will

deposit $2,000 per year. He plans to teach for 20 more years and then retire. If the interest on

his account is 7% compounded annually, how much will be in his account when he retires?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts