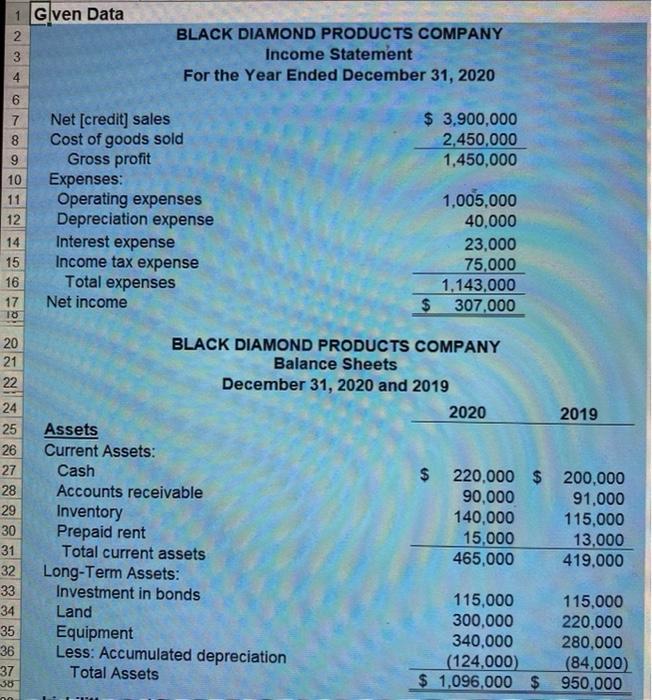

Question: use given data and all ratio formulas to do, please use similar format 1 Glven Data 2 3 BLACK DIAMOND PRODUCTS COMPANY Income Statement For

![$ 3,900,000 2,450,000 1,450,000 9 10 11 12 Net [credit] sales Cost](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66faee648d871_06066faee642605a.jpg)

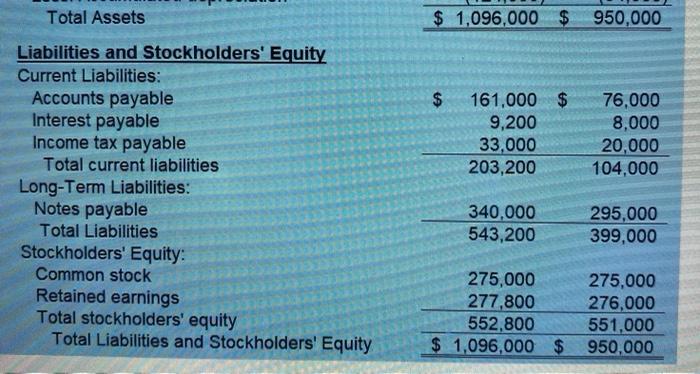

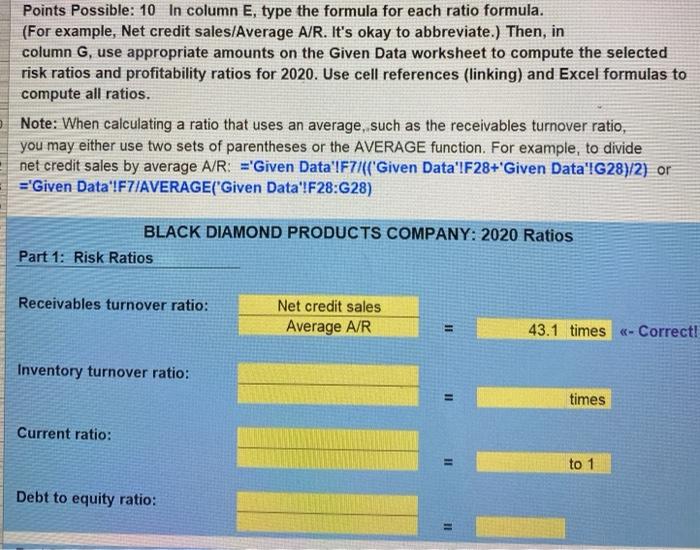

1 Glven Data 2 3 BLACK DIAMOND PRODUCTS COMPANY Income Statement For the Year Ended December 31, 2020 4 6 7 co $ 3,900,000 2,450,000 1,450,000 9 10 11 12 Net [credit] sales Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income 14 15 16 17 13 1,005,000 40,000 23,000 75,000 1.143,000 307.000 $ 20 21 22 24 25 26 27 28 29 30 31 32 33 34 35 36 37 BLACK DIAMOND PRODUCTS COMPANY Balance Sheets December 31, 2020 and 2019 2020 2019 Assets Current Assets: Cash $ 220,000 $ 200.000 Accounts receivable 90,000 91,000 Inventory 140,000 115,000 Prepaid rent 15,000 13,000 Total current assets 465,000 419.000 Long-Term Assets: Investment in bonds 115,000 115,000 Land 300,000 220.000 Equipment 340,000 280,000 Less: Accumulated depreciation (124,000) (84,000) Total Assets $ 1,096,000 $950,000 38 - $ 1,096,000 $ 950,000 $ $ 161,000 9,200 33,000 203,200 76,000 8,000 20,000 104,000 Total Assets Liabilities and Stockholders' Equity Current Liabilities: Accounts payable Interest payable Income tax payable Total current liabilities Long-Term Liabilities: Notes payable Total Liabilities Stockholders' Equity: Common stock Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 340.000 543,200 295,000 399,000 275,000 277,800 552,800 $ 1,096,000 $ 275,000 276,000 551,000 950,000 Points Possible: 10 In column E, type the formula for each ratio formula. (For example, Net credit sales/Average A/R. It's okay to abbreviate.) Then, in column G, use appropriate amounts on the Given Data worksheet to compute the selected risk ratios and profitability ratios for 2020. Use cell references (linking) and Excel formulas to compute all ratios. Note: When calculating a ratio that uses an average, such as the receivables turnover ratio, you may either use two sets of parentheses or the AVERAGE function. For example, to divide net credit sales by average A/R: ='Given Data'!F7/(('Given Data'lF28+'Given Data'lG28)/2) or ="Given Data'!F7/AVERAGE("Given Data'!F28:G28) BLACK DIAMOND PRODUCTS COMPANY: 2020 Ratios Part 1: Risk Ratios Receivables turnover ratio: Net credit sales Average A/R 43.1 times - Correct! Inventory turnover ratio: times Current ratio: to 1 Debt to equity ratio: 11 8 Part 2: Profitability Ratios 9 Gross profit ratio: 0 -1 3 4 Return on assets: 5 III 7 8 Profit margin: 19 61 Asset turnover: 2 53 times 5 RISK RATIOS Liquidity Receivablas turnover ratio LR Net credit sales Average accounts receivables 365 days Recewables turnover ratio Average collection period Inventory tumover ratio Average days in inventory Cost of goods sold Average inventory 365 days Inventory tumover ratio Current assets Current liabilities Current ratio Acid-test ratio Cash + Current Investments + Accounts receivablo Current liabilities Solvoncy Dabt to equity ratio 9 Total labilities Stockholders equity Times interest earned ratio Net Income + Interest expense - Tal expense Interest Expense PROFITABILITY RATIOS Grono profit ratio Gross profit Not sales Return on assets Net income Average total asset Not income Net sales Profit margin 2 Asset turnover 7 Return on equity Not sales Average total stats Net income Average stockholders equity 10 Return on the market value of equity 10 Earings por share 10 Net Income Stock prica x Number of shares outstanding Net income Preferred stock dividendo Average shares of common stock outstanding Stock price Earnings por share Price-carringstatio 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts