Question: Use (in Excel) the high-low method to determine the variable cost rate/FTE student, and the total fixed costs based on the quarterly expense budget for

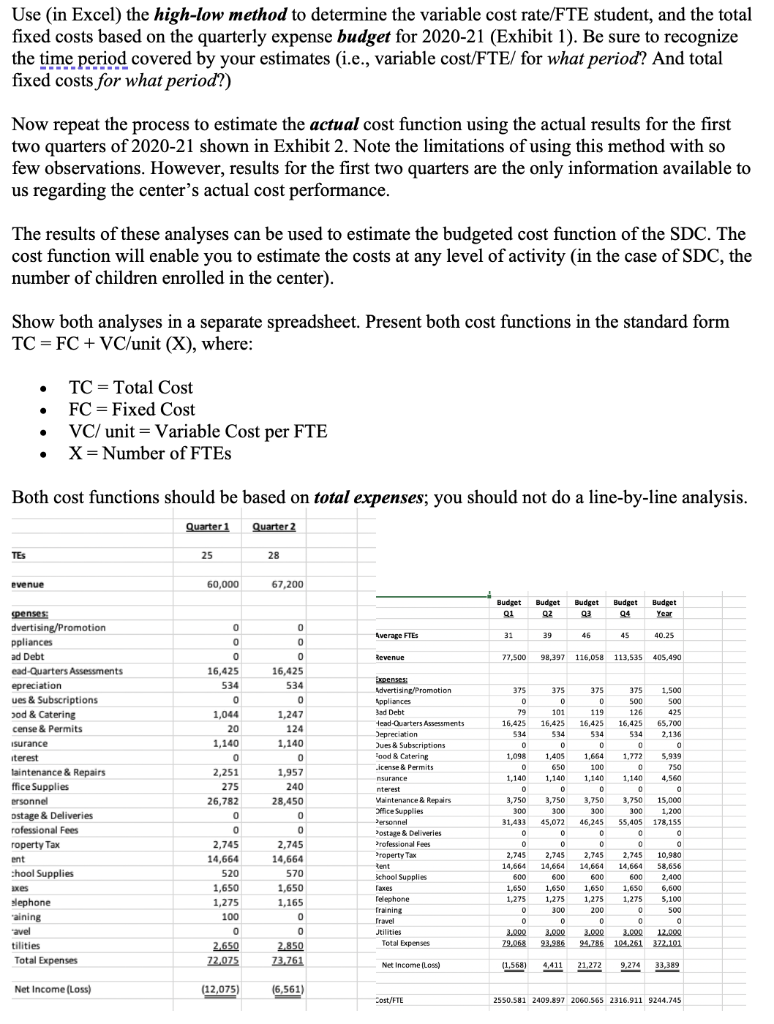

Use (in Excel) the high-low method to determine the variable cost rate/FTE student, and the total fixed costs based on the quarterly expense budget for 2020-21 (Exhibit 1). Be sure to recognize the time period covered by your estimates (i.e., variable cost/FTE/ for what period? And total fixed costs for what period?) Now repeat the process to estimate the actual cost function using the actual results for the first two quarters of 2020-21 shown in Exhibit 2. Note the limitations of using this method with so few observations. However, results for the first two quarters are the only information available to us regarding the center's actual cost performance. The results of these analyses can be used to estimate the budgeted cost function of the SDC. The cost function will enable you to estimate the costs at any level of activity (in the case of SDC, the number of children enrolled in the center). Show both analyses in a separate spreadsheet. Present both cost functions in the standard form TC = FC + VC/unit (X), where: TC TES Both cost functions should be based on total expenses; you should not do a line-by-line analysis. Quarter 1 Quarter 2 evenue Total Cost FC Fixed Cost VC/ unit Variable Cost per FTE X = Number of FTES spenses: dvertising/Promotion ppliances ad Debt ead-Quarters Assessments epreciation ues & Subscriptions bod & Catering cense & Permits Isurance iterest laintenance & Repairs ffice Supplies ersonnel ostage & Deliveries rofessional Fees roperty Tax ent chool Supplies axes elephone aining avel tilities Total Expenses Net Income (Loss) 25 60,000 0 0 0 16,425 534 0 1,044 20 1,140 0 2,251 275 26,782 0 0 2,745 14,664 520 1,650 1,275 100 0 2,650 72.075 (12,075) 28 67,200 0 0 0 16,425 534 0 1,247 124 1,140 0 1,957 240 28,450 0 0 2,745 14,664 570 1,650 1,165 0 0 2.850 73.761 (6,561) Average FTES Revenue Expenses: Advertising/Promotion. Appliances Bad Debt Head-Quarters Assessments Depreciation Jues & Subscriptions Food & Catering License & Permits nsurance nterest Maintenance & Repairs Office Supplies Personnel Postage & Deliveries Professional Fees Property Tax tent School Supplies Faxes Telephone Training Travel Jtilities Total Expenses Net Income (Loss) Cost/FTE Budget Budget Budget Budget Q1 Q2 Q3 Q4 31 77,500 98,397 0 0 39 3.000 79,068 (1,568) 46 45 116,058 113,535 375 0 1,500 500 425 79 16,425 534 375 0 101 16,425 534 0 0 1,098 1,405 0 650 1,140 1,140 0 0 3,750 3,750 300 300 31,433 45,072 0 0 0 0 0 0 2,745 2,745 2.745 2,745 10,980 14,664 14,664 14,664 14,664 58,656 600 600 600 2,400 1,650 1,650 1.650 6,600 5,100 500 0 12,000 372,101 375 375 0 500 119 126 16,425 16,425 65,700 534 534 2,136 0 0 1,772 5,939 0 750 4,560 0 15.000 300 1,200 55,405 178,155 0 0 0 0 1,664 100 1,140 1,140 0 0 3,750 3,750 300 46,245 0 600 1,650 1,275 1,275 1,275 200 1,275 300 0 3,000 0 3.000 3.000 93,986 94,786 104,261 4,411 21,272 9,274 33,389 Budget Year 0 0 40.25 405,490 2550.581 2409.897 2060.565 2316.911 9244.745 Use (in Excel) the high-low method to determine the variable cost rate/FTE student, and the total fixed costs based on the quarterly expense budget for 2020-21 (Exhibit 1). Be sure to recognize the time period covered by your estimates (i.e., variable cost/FTE/ for what period? And total fixed costs for what period?) Now repeat the process to estimate the actual cost function using the actual results for the first two quarters of 2020-21 shown in Exhibit 2. Note the limitations of using this method with so few observations. However, results for the first two quarters are the only information available to us regarding the center's actual cost performance. The results of these analyses can be used to estimate the budgeted cost function of the SDC. The cost function will enable you to estimate the costs at any level of activity (in the case of SDC, the number of children enrolled in the center). Show both analyses in a separate spreadsheet. Present both cost functions in the standard form TC = FC + VC/unit (X), where: TC TES Both cost functions should be based on total expenses; you should not do a line-by-line analysis. Quarter 1 Quarter 2 evenue Total Cost FC Fixed Cost VC/ unit Variable Cost per FTE X = Number of FTES spenses: dvertising/Promotion ppliances ad Debt ead-Quarters Assessments epreciation ues & Subscriptions bod & Catering cense & Permits Isurance iterest laintenance & Repairs ffice Supplies ersonnel ostage & Deliveries rofessional Fees roperty Tax ent chool Supplies axes elephone aining avel tilities Total Expenses Net Income (Loss) 25 60,000 0 0 0 16,425 534 0 1,044 20 1,140 0 2,251 275 26,782 0 0 2,745 14,664 520 1,650 1,275 100 0 2,650 72.075 (12,075) 28 67,200 0 0 0 16,425 534 0 1,247 124 1,140 0 1,957 240 28,450 0 0 2,745 14,664 570 1,650 1,165 0 0 2.850 73.761 (6,561) Average FTES Revenue Expenses: Advertising/Promotion. Appliances Bad Debt Head-Quarters Assessments Depreciation Jues & Subscriptions Food & Catering License & Permits nsurance nterest Maintenance & Repairs Office Supplies Personnel Postage & Deliveries Professional Fees Property Tax tent School Supplies Faxes Telephone Training Travel Jtilities Total Expenses Net Income (Loss) Cost/FTE Budget Budget Budget Budget Q1 Q2 Q3 Q4 31 77,500 98,397 0 0 39 3.000 79,068 (1,568) 46 45 116,058 113,535 375 0 1,500 500 425 79 16,425 534 375 0 101 16,425 534 0 0 1,098 1,405 0 650 1,140 1,140 0 0 3,750 3,750 300 300 31,433 45,072 0 0 0 0 0 0 2,745 2,745 2.745 2,745 10,980 14,664 14,664 14,664 14,664 58,656 600 600 600 2,400 1,650 1,650 1.650 6,600 5,100 500 0 12,000 372,101 375 375 0 500 119 126 16,425 16,425 65,700 534 534 2,136 0 0 1,772 5,939 0 750 4,560 0 15.000 300 1,200 55,405 178,155 0 0 0 0 1,664 100 1,140 1,140 0 0 3,750 3,750 300 46,245 0 600 1,650 1,275 1,275 1,275 200 1,275 300 0 3,000 0 3.000 3.000 93,986 94,786 104,261 4,411 21,272 9,274 33,389 Budget Year 0 0 40.25 405,490 2550.581 2409.897 2060.565 2316.911 9244.745

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts