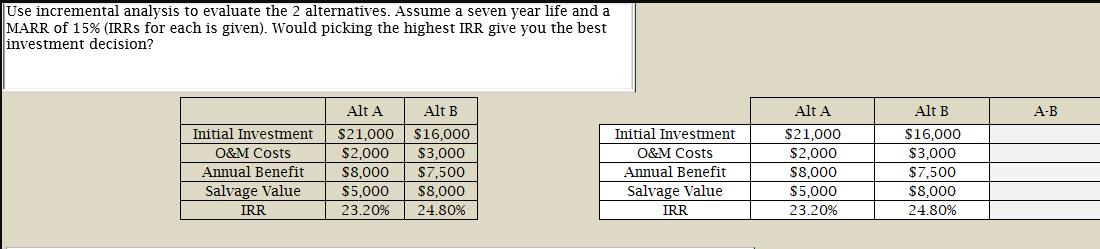

Question: Use incremental analysis to evaluate the 2 alternatives. Assume a seven year life and a MARR of 15% (IRRS for each is given). Would

Use incremental analysis to evaluate the 2 alternatives. Assume a seven year life and a MARR of 15% (IRRS for each is given). Would picking the highest IRR give you the best investment decision? Initial Investment O&M Costs Annual Benefit Salvage Value IRR Alt A $21,000 $2,000 $8,000 $5,000 23.20% Alt B $16,000 $3,000 $7,500 $8,000 24.80% Initial Investment O&M Costs Annual Benefit Salvage Value IRR Alt A $21,000 $2,000 $8,000 $5,000 23.20% Alt B $16,000 $3,000 $7,500 $8,000 24.80% A-B

Step by Step Solution

There are 3 Steps involved in it

ANSWER Incremental analysis compares the difference between two alternatives In this case the two al... View full answer

Get step-by-step solutions from verified subject matter experts