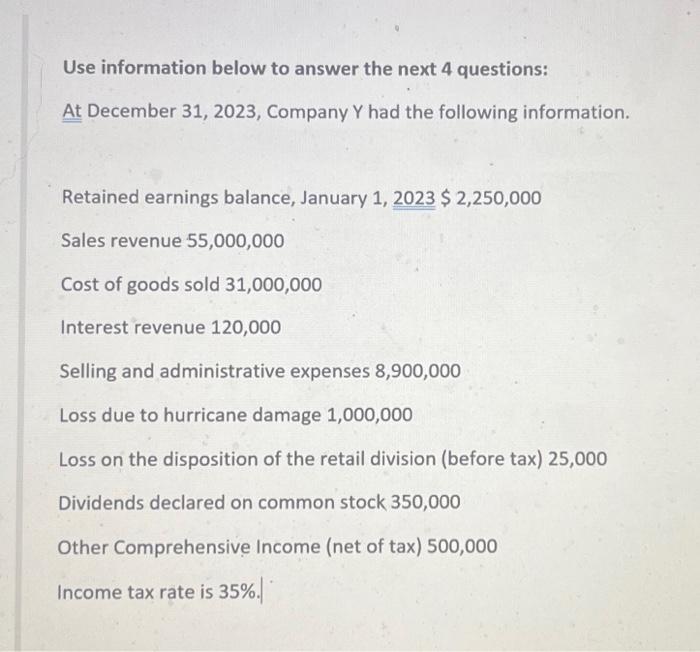

Question: Use information below to answer the next 4 questions: At December 31, 2023, Company Y had the following information. Retained earnings balance, January 1,2023$2,250,000 Sales

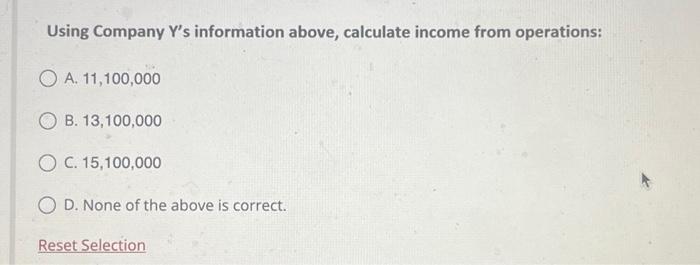

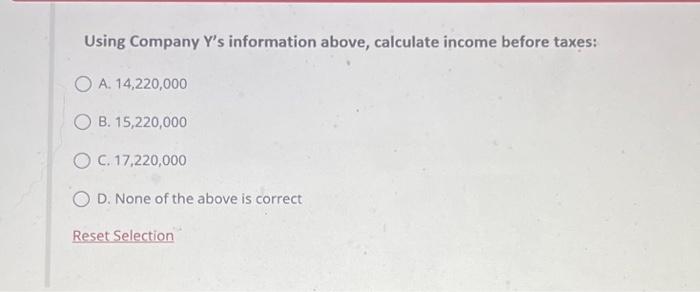

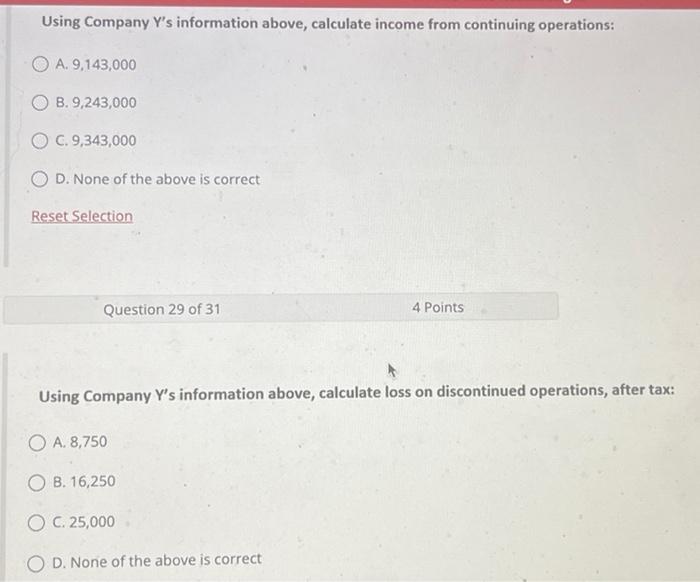

Use information below to answer the next 4 questions: At December 31, 2023, Company Y had the following information. Retained earnings balance, January 1,2023$2,250,000 Sales revenue 55,000,000 Cost of goods sold 31,000,000 Interest revenue 120,000 Selling and administrative expenses 8,900,000 Loss due to hurricane damage 1,000,000 Loss on the disposition of the retail division (before tax) 25,000 Dividends declared on common stock 350,000 Other Comprehensive Income (net of tax) 500,000 Income tax rate is 35%. Using Company Y's information above, calculate income from operations: A. 11,100,000 B. 13,100,000 C. 15,100,000 D. None of the above is correct. Using Company Y's information above, calculate income before taxes: A. 14,220,000 B. 15,220,000 C. 17,220,000 D. None of the above is correct Using Company Y's information above, calculate income from continuing operations: A. 9,143,000 B. 9,243,000 C. 9,343,000 D. None of the above is correct Reset Selection Question 29 of 31 4 Points Using Company Y s information above, calculate loss on discontinued operations, after tax: A. 8,750 B. 16,250 C. 25,000 D. None of the above is correct If net income is 9,226,750, what is comprehensive income at December 31,2023 ? A. 8,626,750 B. 8,726,750 C. 8,826,750 D. None of the above is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts