Question: use information from #1 to solve for the rest Use the following information to answer question 17. Suppose there are three potential states of the

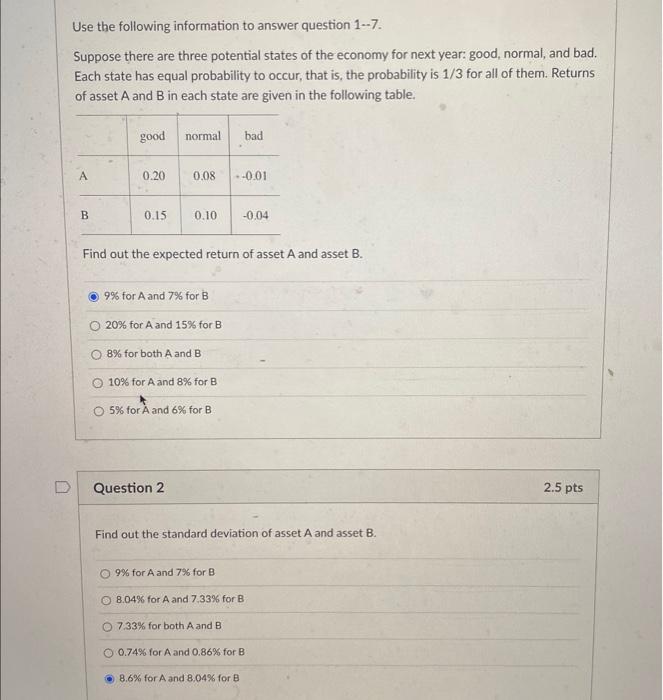

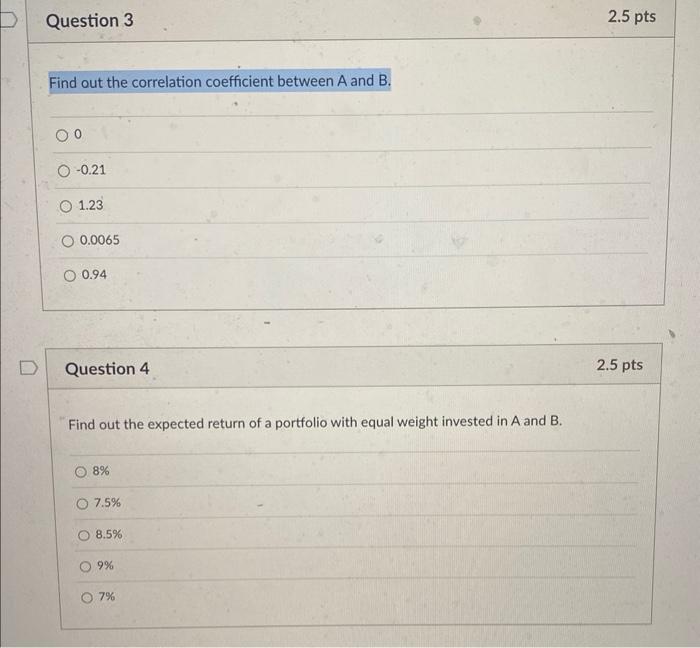

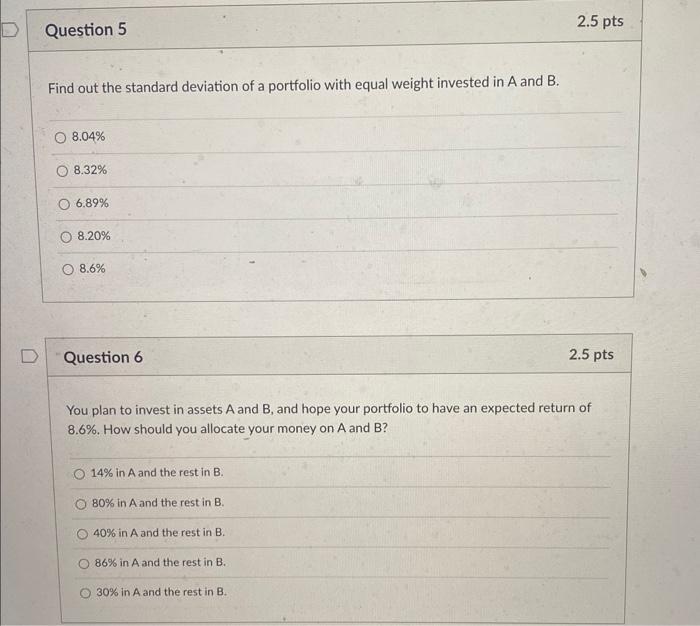

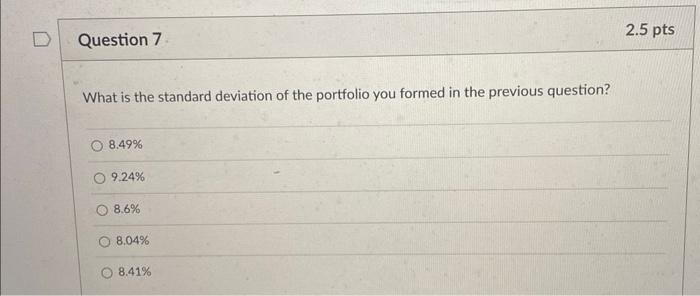

Use the following information to answer question 17. Suppose there are three potential states of the economy for next year: good, normal, and bad. Each state has equal probability to occur, that is, the probability is 1/3 for all of them. Returns of asset A and B in each state are given in the following table. Find out the expected return of asset A and asset B. 9% for A and 7% for B 20% for A and 15% for B 8% for both A and B 10% for A and 8% for B 5% for A and 6% for B Question 2 2.5pts Find out the standard deviation of asset A and asset B. 9% for A and 7% for B 8.04% for A and 7.33% for B 733% for both A and B 0.74% for A and 0.86% for B 8.6% for A and 8.04% for B Find out the correlation coefficient between A and B. 0 0.21 1.23 0.0065 0.94 Question 4 2.5 pts Find out the expected return of a portfolio with equal weight invested in A and B. 8% 7.5% 8.5% 9% 7% Find out the standard deviation of a portfolio with equal weight invested in A and B. 8.04% 8.32% 6.89% 8.20% 8.6% Question 6 2.5pts You plan to invest in assets A and B, and hope your portfolio to have an expected return of 8.6%. How should you allocate your money on A and B ? 14% in A and the rest in B. 80% in A and the rest in B. 40% in A and the rest in B. 86% in A and the rest in B. 30% in A and the rest in B. What is the standard deviation of the portfolio you formed in the previous question? 8.49% 9.24% 8.6% 8.04% 8.41%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts