Question: -USE JUPYTER- Given the W-shape price sequence: 100, 90, 80, 70, 60, 50, 60, 70, 80, 90, 100, 90, 80, 70, 60, 50, 60, 70,

-USE JUPYTER-

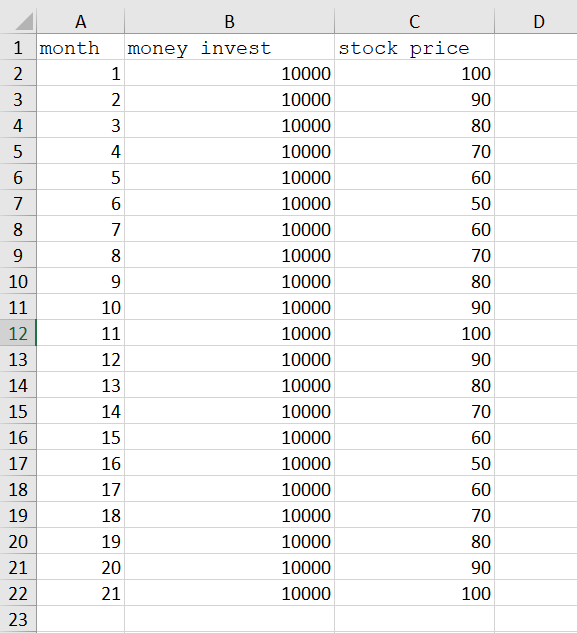

Given the W-shape price sequence: 100, 90, 80, 70, 60, 50, 60, 70, 80, 90, 100, 90, 80, 70, 60, 50, 60, 70, 80, 90, 100 and the inverse W-shape price sequence: 50, 60, 70, 80, 90, 100, 90, 80, 70, 60, 50, 60, 70, 80, 90, 100, 90, 80, 70, 60, 50 Please compare and discuss the performance discrepancy of the DCA and the lump-sum method for these two cases. Also compute the IRR, respectively; and discuss why the DCA has different behavior in these two cases even though the profit/loss of the lump-sum method is the same at the end of the investment course.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock