Question: use MARR 15%/year and calculate it without using excel and try not to solve in table form. po Section 4.4.1 Discounted Payback Period for a

use MARR 15%/year and calculate it without using excel and try not to solve in table form.

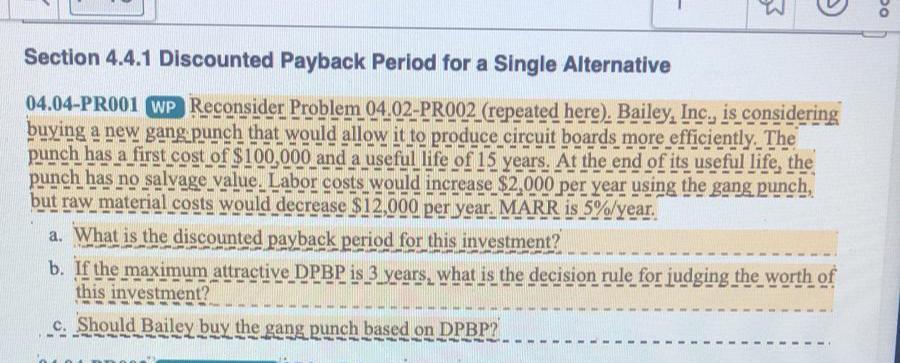

po Section 4.4.1 Discounted Payback Period for a Single Alternative 04.04-PR001 WP Reconsider Problem 04.02-PR002 (repeated here). Bailey, Inc. is considering buying a new gang punch that would allow it to produce circuit boards more efficiently. The punch has a first cost of $100,000 and a useful life of 15 years. At the end of its useful life, the punch has no salvage_value. Labor costs would increase $2,000 per year using the gang punch, but raw material costs would decrease $12,000 per year. MARR is 5%/year. a. What is the discounted payback period for this investment? b. If the maximum attractive DPBP is 3 years, what is the decision rule for judging the worth of this investment? c. Should Bailey buy the gang punch based on DPBP2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts