Question: Use Miller's Model in capital structure theory to answer this question. Ark Investment is currently all equity financed and the current value of the firm

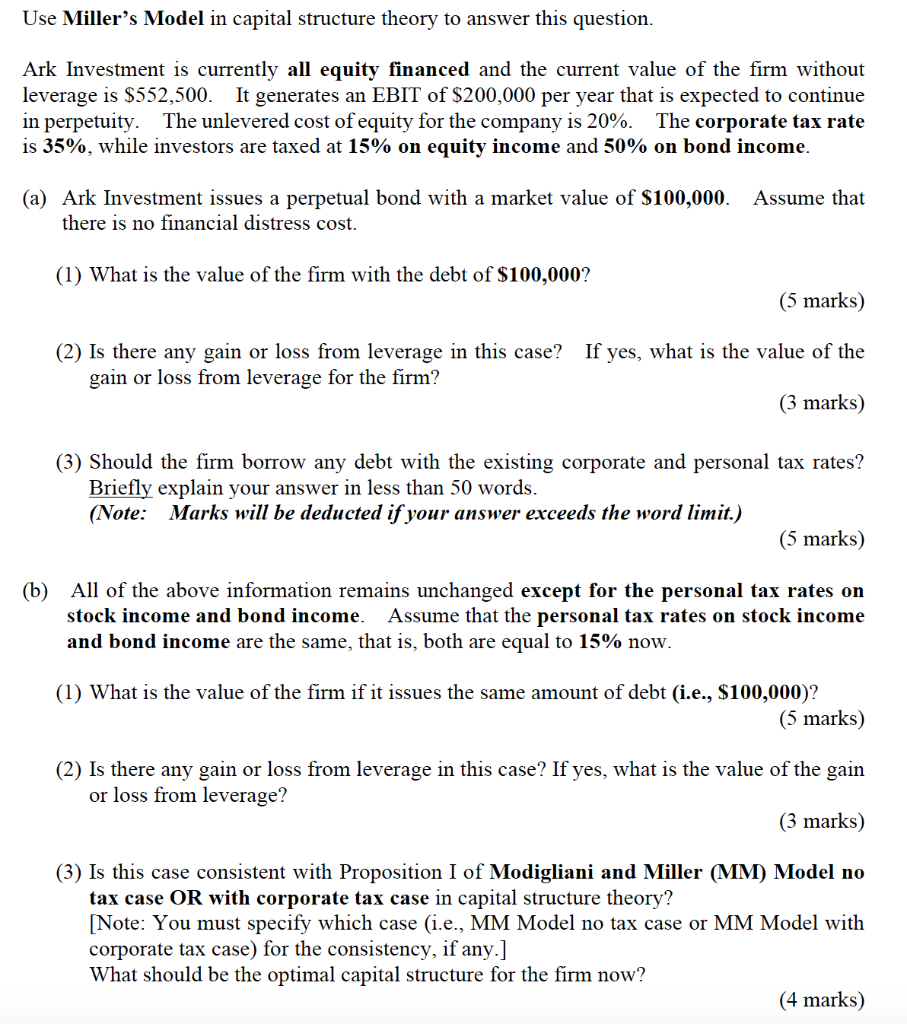

Use Miller's Model in capital structure theory to answer this question. Ark Investment is currently all equity financed and the current value of the firm without leverage is $552,500. It generates an EBIT of $200,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 20%. The corporate tax rate is 35%, while investors are taxed at 15% on equity income and 50% on bond income. Assume that (a) Ark Investment issues a perpetual bond with a market value of $100,000. there is no financial distress cost. (1) What is the value of the firm with the debt of $100,000? (5 marks) (2) Is there any gain or loss from leverage in this case? If yes, what is the value of the gain or loss from leverage for the firm? (3 marks) (3) Should the firm borrow any debt with the existing corporate and personal tax rates? Briefly explain your answer in less than 50 words. (Note: Marks will be deducted if your answer exceeds the word limit.) (5 marks) (b) All of the above information remains unchanged except for the personal tax rates on stock income and bond income. Assume that the personal tax rates on stock income and bond income are the same, that is, both are equal to 15% now. (1) What is the value of the firm if it issues the same amount of debt (i.e., $100,000)? (5 marks) (2) Is there any gain or loss from leverage in this case? If yes, what is the value of the gain or loss from leverage? (3 marks) (3) Is this case consistent with Proposition I of Modigliani and Miller (MM) Model no tax case OR with corporate tax case in capital structure theory? [Note: You must specify which case (i.e., MM Model no tax case or MM Model with corporate tax case) for the consistency, if any.] What should be the optimal capital structure for the firm now? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts