Question: *USE ONLY THIS DISCOUNT TABLE Mollie plc is a technological platform services business. It is considering launching into a new geographical region on another continent.

*USE ONLY THIS DISCOUNT TABLE

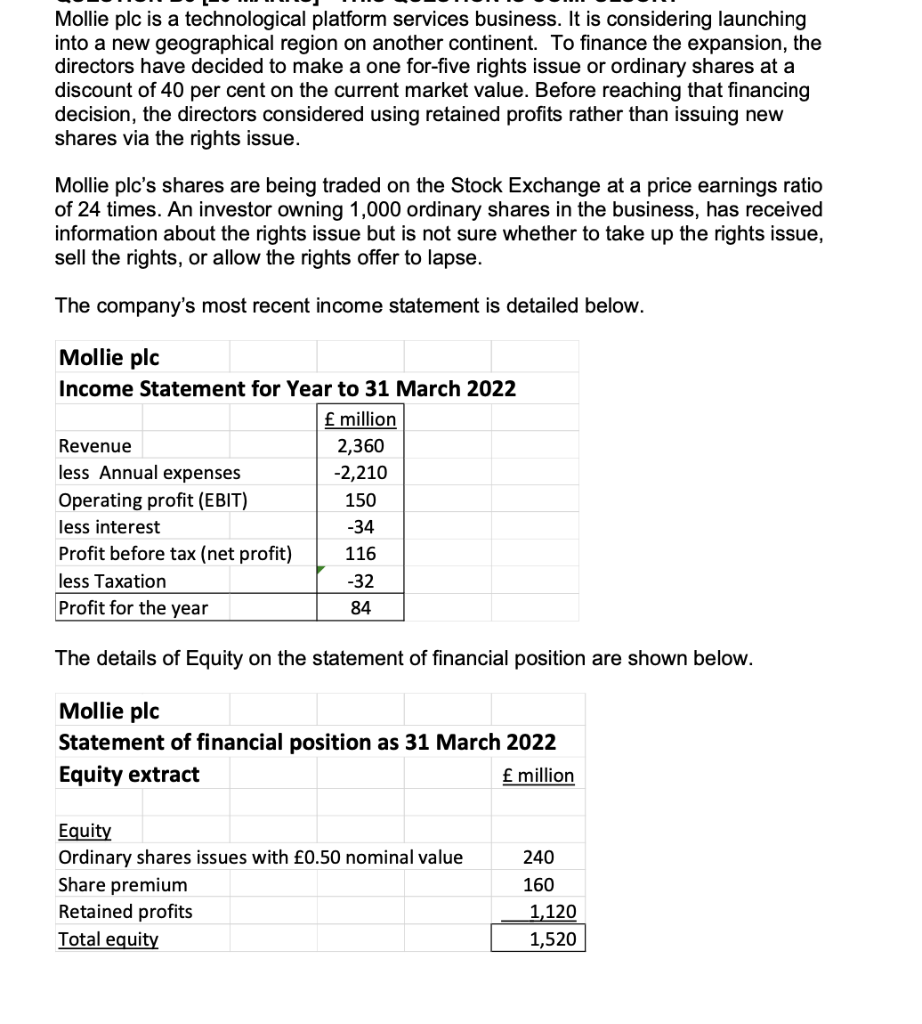

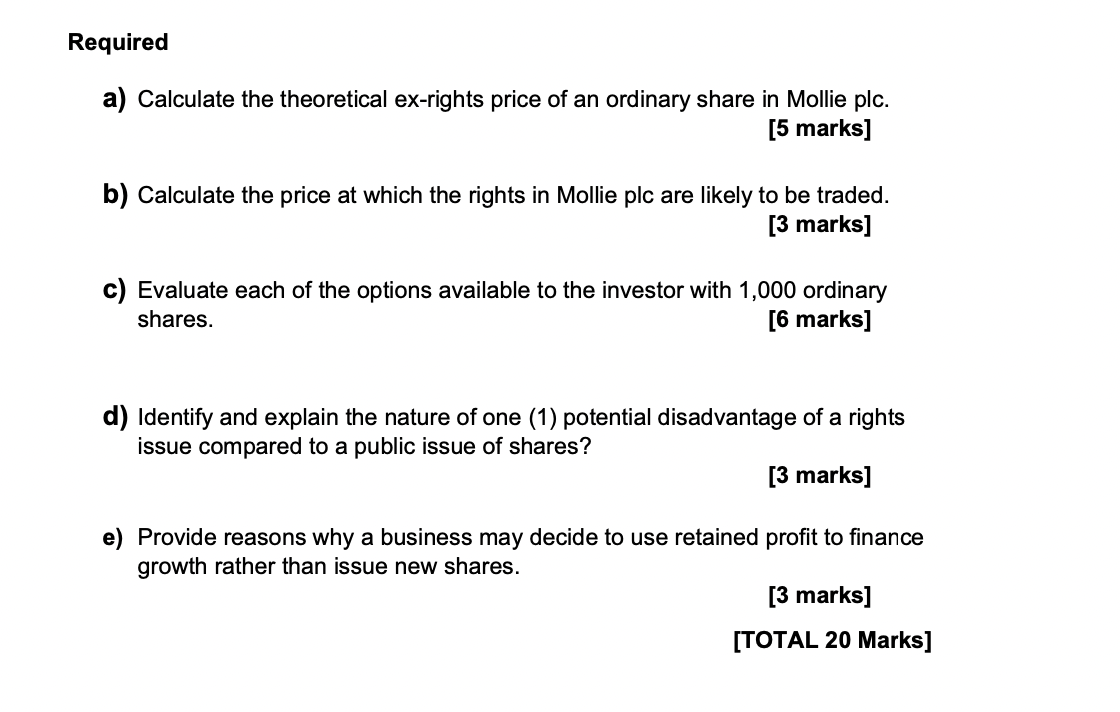

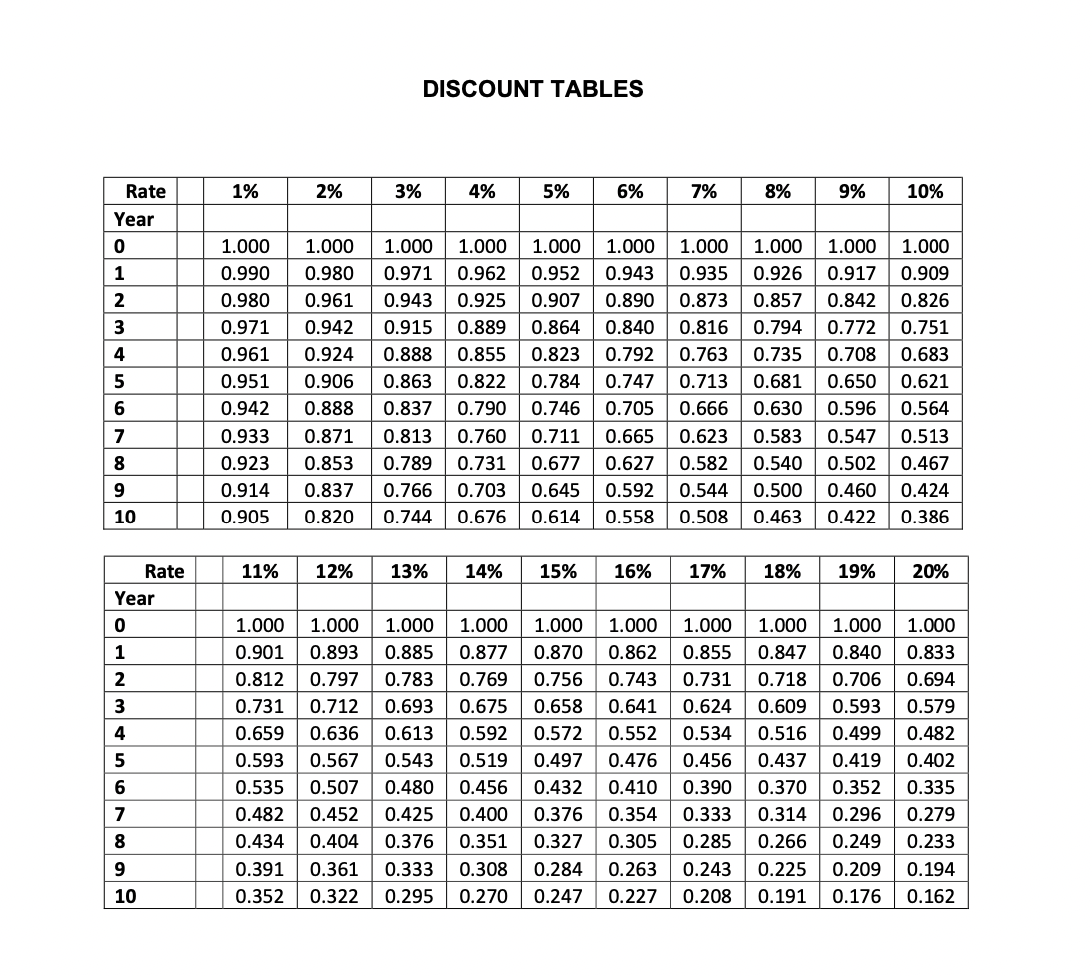

Mollie plc is a technological platform services business. It is considering launching into a new geographical region on another continent. To finance the expansion, the directors have decided to make a one for-five rights issue or ordinary shares at a discount of 40 per cent on the current market value. Before reaching that financing decision, the directors considered using retained profits rather than issuing new shares via the rights issue. Mollie plc's shares are being traded on the Stock Exchange at a price earnings ratio of 24 times. An investor owning 1,000 ordinary shares in the business, has received information about the rights issue but is not sure whether to take up the rights issue, sell the rights, or allow the rights offer to lapse. The company's most recent income statement is detailed below. Mollie plc Income Statement for Year to 31 March 2022 f million Revenue 2,360 less Annual expenses -2,210 Operating profit (EBIT) less interest -34 Profit before tax (net profit) 116 less Taxation -32 Profit for the year 84 150 The details of Equity on the statement of financial position are shown below. Mollie plc Statement of financial position as 31 March 2022 Equity extract f million 240 Equity Ordinary shares issues with 0.50 nominal value Share premium Retained profits Total equity 160 1,120 1,520 Required a) Calculate the theoretical ex-rights price of an ordinary share in Mollie plc. [5 marks] b) Calculate the price at which the rights in Mollie plc are likely to be traded. [3 marks] c) Evaluate each of the options available to the investor with 1,000 ordinary shares. [6 marks] d) Identify and explain the nature of one (1) potential disadvantage of a rights issue compared to a public issue of shares? [3 marks] e) Provide reasons why a business may decide to use retained profit to finance growth rather than issue new shares. [3 marks] [TOTAL 20 Marks] DISCOUNT TABLES 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% Rate Year 0 1 2 3 4 5 6 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 1.000 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 1.000 1.000 0.971 0.962 0.943 0.925 0.915 0.889 0.888 0.855 0.863 0.822 0.837 0.790 0.813 0.760 0.789 0.731 0.766 0.703 0.744 0.676 1.000 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 1.000 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 7 8 9 10 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Rate Year 0 1 2 3 4 5 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 1.000 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 1.000 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 1.000 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 6 7 8 9 10 Mollie plc is a technological platform services business. It is considering launching into a new geographical region on another continent. To finance the expansion, the directors have decided to make a one for-five rights issue or ordinary shares at a discount of 40 per cent on the current market value. Before reaching that financing decision, the directors considered using retained profits rather than issuing new shares via the rights issue. Mollie plc's shares are being traded on the Stock Exchange at a price earnings ratio of 24 times. An investor owning 1,000 ordinary shares in the business, has received information about the rights issue but is not sure whether to take up the rights issue, sell the rights, or allow the rights offer to lapse. The company's most recent income statement is detailed below. Mollie plc Income Statement for Year to 31 March 2022 f million Revenue 2,360 less Annual expenses -2,210 Operating profit (EBIT) less interest -34 Profit before tax (net profit) 116 less Taxation -32 Profit for the year 84 150 The details of Equity on the statement of financial position are shown below. Mollie plc Statement of financial position as 31 March 2022 Equity extract f million 240 Equity Ordinary shares issues with 0.50 nominal value Share premium Retained profits Total equity 160 1,120 1,520 Required a) Calculate the theoretical ex-rights price of an ordinary share in Mollie plc. [5 marks] b) Calculate the price at which the rights in Mollie plc are likely to be traded. [3 marks] c) Evaluate each of the options available to the investor with 1,000 ordinary shares. [6 marks] d) Identify and explain the nature of one (1) potential disadvantage of a rights issue compared to a public issue of shares? [3 marks] e) Provide reasons why a business may decide to use retained profit to finance growth rather than issue new shares. [3 marks] [TOTAL 20 Marks] DISCOUNT TABLES 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% Rate Year 0 1 2 3 4 5 6 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 1.000 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 1.000 1.000 0.971 0.962 0.943 0.925 0.915 0.889 0.888 0.855 0.863 0.822 0.837 0.790 0.813 0.760 0.789 0.731 0.766 0.703 0.744 0.676 1.000 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 1.000 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 7 8 9 10 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% Rate Year 0 1 2 3 4 5 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 1.000 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 1.000 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 1.000 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 1.000 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 6 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts