Question: use practice question for reference and answer blank question QUESTION Howard Company had the following inventory at the end of the year: Howard Company uses

use practice question for reference and answer blank question

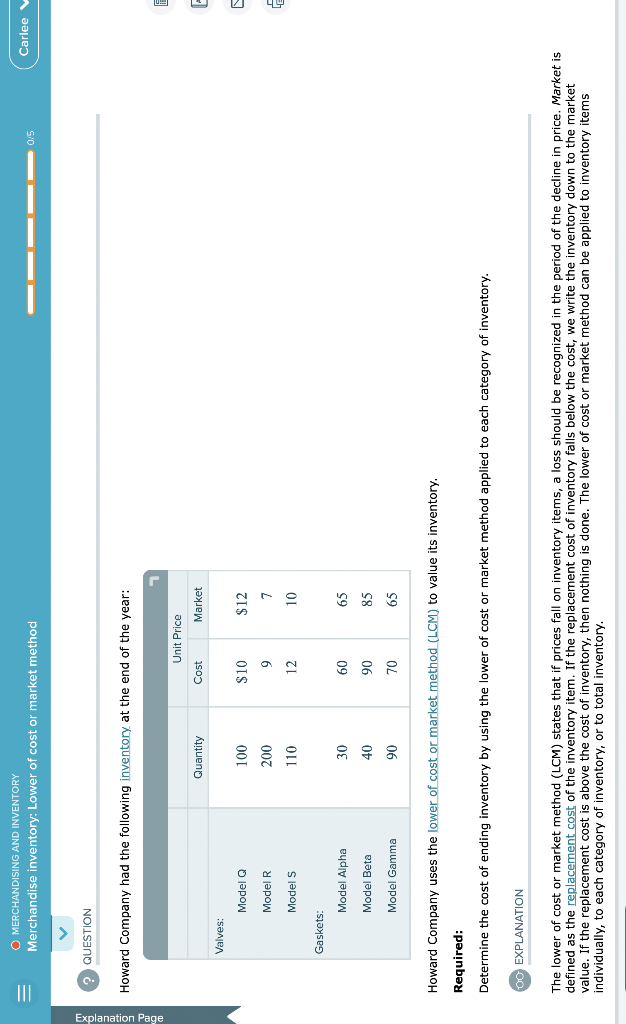

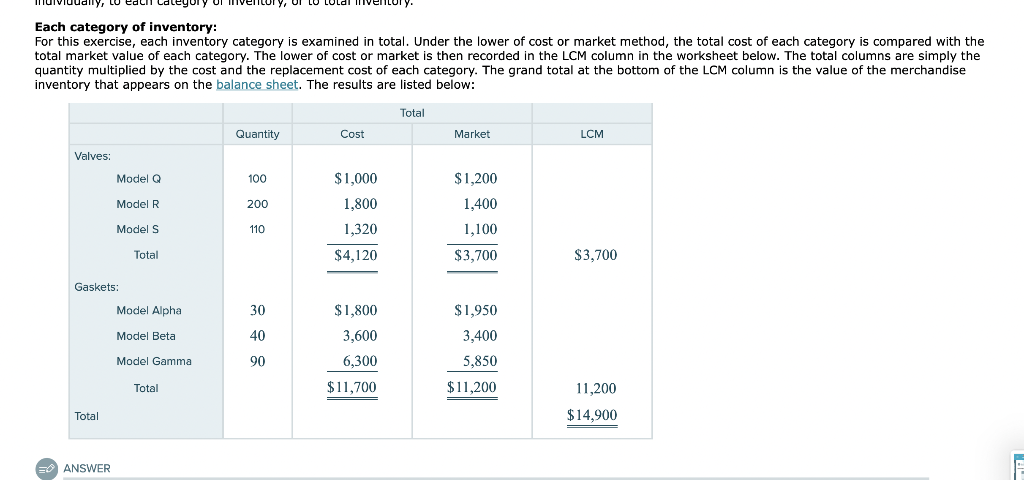

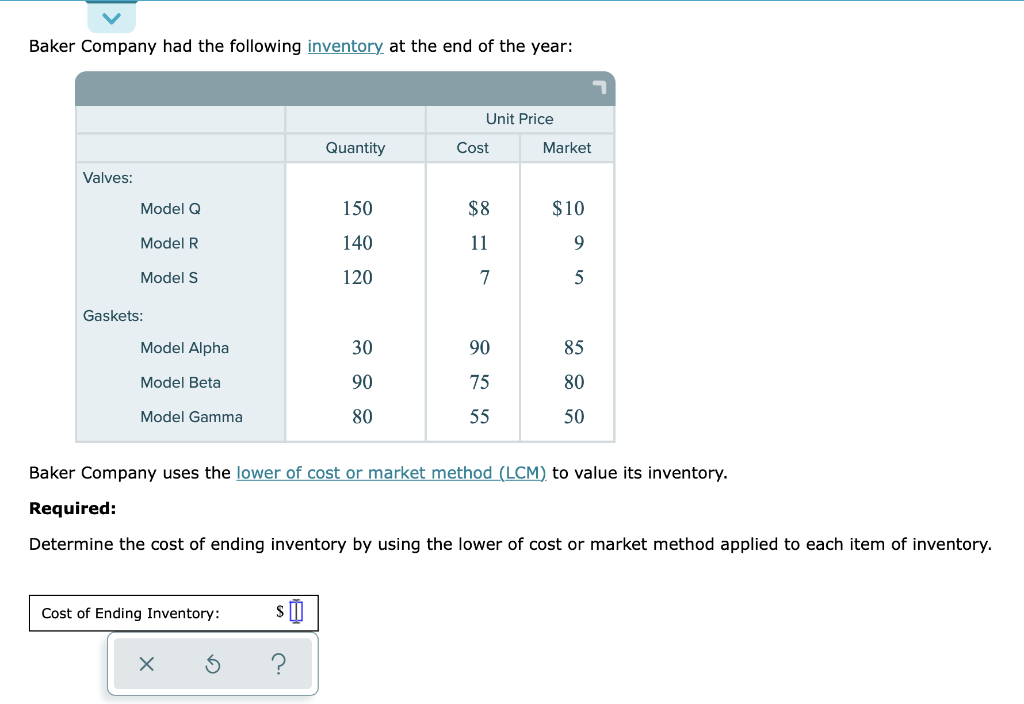

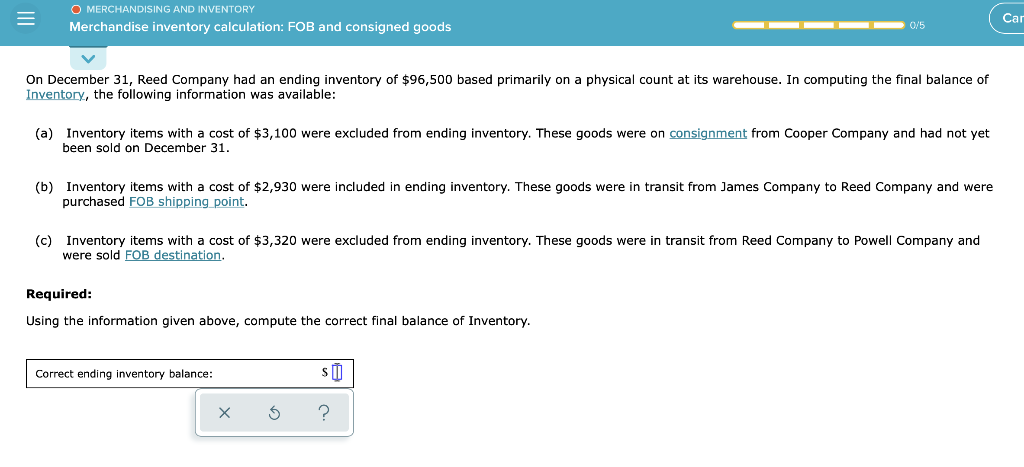

QUESTION Howard Company had the following inventory at the end of the year: Howard Company uses the lower of cost or market method (LCM) to value its inventory. Required: Determine the cost of ending inventory by using the lower of cost or market method applied to each category of inventory. EXPLANATION The lower of cost or market method (LCM) states that if prices fall on inventory items, a loss should be recognized in the period of the decline in price. Market is defined as the replacement cost of the inventory item. If the replacement cost of inventory falls below the cost, we write the inventory down to the market value. If the replacement cost is above the cost of inventory, then nothing is done. The lower of cost or market method can be applied to inventory items individually, to each category of inventory, or to total inventory. Each category of inventory: For this exercise, each inventory category is examined in total. Under the lower of cost or market method, the total cost of each category is compared with the total market value of each category. The lower of cost or market is then recorded in the LCM column in the worksheet below. The total columns are simply the quantity multiplied by the cost and the replacement cost of each category. The grand total at the bottom of the LCM column is the value of the inventory that appears on the balance sheet. The results are listed below: Baker Company had the following inventory at the end of the year: Baker Company uses the lower of cost or market method (LCM) to value its inventory. Required: Determine the cost of ending inventory by using the lower of cost or market method applied to each item of inventory. On December 31 , Reed Company had an ending inventory of $96,500 based primarily on a physical count at its warehouse. In computing the final balance of Inventory, the following information was available: (a) Inventory items with a cost of $3,100 were excluded from ending inventory. These goods were on consignment from Cooper Company and had not been sold on December 31 . (b) Inventory items with a cost of $2,930 were included in ending inventory. These goods were in transit from James Company to Reed Company purchased FOB shipping point. (c) Inventory items with a cost of $3,320 were excluded from ending inventory. These goods were in transit from Reed Company to Powell Company and were sold FOB destination. QUESTION Howard Company had the following inventory at the end of the year: Howard Company uses the lower of cost or market method (LCM) to value its inventory. Required: Determine the cost of ending inventory by using the lower of cost or market method applied to each category of inventory. EXPLANATION The lower of cost or market method (LCM) states that if prices fall on inventory items, a loss should be recognized in the period of the decline in price. Market is defined as the replacement cost of the inventory item. If the replacement cost of inventory falls below the cost, we write the inventory down to the market value. If the replacement cost is above the cost of inventory, then nothing is done. The lower of cost or market method can be applied to inventory items individually, to each category of inventory, or to total inventory. Each category of inventory: For this exercise, each inventory category is examined in total. Under the lower of cost or market method, the total cost of each category is compared with the total market value of each category. The lower of cost or market is then recorded in the LCM column in the worksheet below. The total columns are simply the quantity multiplied by the cost and the replacement cost of each category. The grand total at the bottom of the LCM column is the value of the inventory that appears on the balance sheet. The results are listed below: Baker Company had the following inventory at the end of the year: Baker Company uses the lower of cost or market method (LCM) to value its inventory. Required: Determine the cost of ending inventory by using the lower of cost or market method applied to each item of inventory. On December 31 , Reed Company had an ending inventory of $96,500 based primarily on a physical count at its warehouse. In computing the final balance of Inventory, the following information was available: (a) Inventory items with a cost of $3,100 were excluded from ending inventory. These goods were on consignment from Cooper Company and had not been sold on December 31 . (b) Inventory items with a cost of $2,930 were included in ending inventory. These goods were in transit from James Company to Reed Company purchased FOB shipping point. (c) Inventory items with a cost of $3,320 were excluded from ending inventory. These goods were in transit from Reed Company to Powell Company and were sold FOB destination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts