Question: use question on first image to get answer for image 2 question. Help (Expected rate of return and risk) Summerville Inc is considering an investment

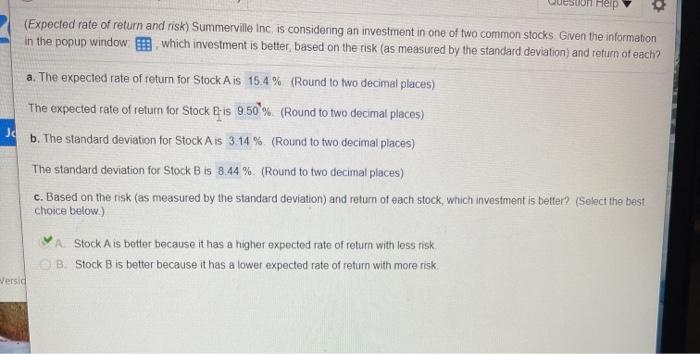

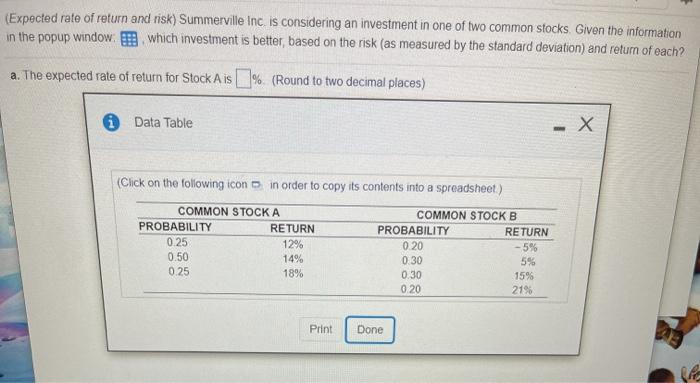

Help (Expected rate of return and risk) Summerville Inc is considering an investment in one of two common stocks Given the information in the popup window which investment is better based on the risk (as measured by the standard deviation) and return of each? J a. The expected rate of return for Stock Ais 15.4 % (Round to two decimal places) The expected rate of return for Stock Eis 9.50% (Round to two decimal places) b. The standard deviation for Stock Ais 3.14% (Round to two decimal places) The standard deviation for Stock B is 8.44 % (Round to two decimal places) C. Based on the risk (as measured by the standard deviation) and return of each stock, which investment is better? (Select the best choice below) A: Stock Ais botter because it has a higher expected rate of return with loss risk. B. Stock B is better because it has a lower expected rate of return with more risk Versid (Expected rate of return and risk) Summerville Inc is considering an investment in one of two common stocks. Given the information in the popup window which investment is better, based on the risk (as measured by the standard deviation) and return of each? a. The expected rate of return for Stock Ais % (Round to two decimal places) i Data Table (Click on the following icon in order to copy its contents into a spreadsheet) COMMON STOCKA PROBABILITY RETURN 0.25 12% 0.50 14% 0.25 18% COMMON STOCKB PROBABILITY RETURN 0.20 - 5% 0.30 5% 0.30 15% 0.20 21% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts