Question: Use R to solve the question. It does not need to download the file. Use the getoptionchain function in quantmod package to get the information.

Use R to solve the question.

It does not need to download the file.

Use the getoptionchain function in quantmod package to get the information.

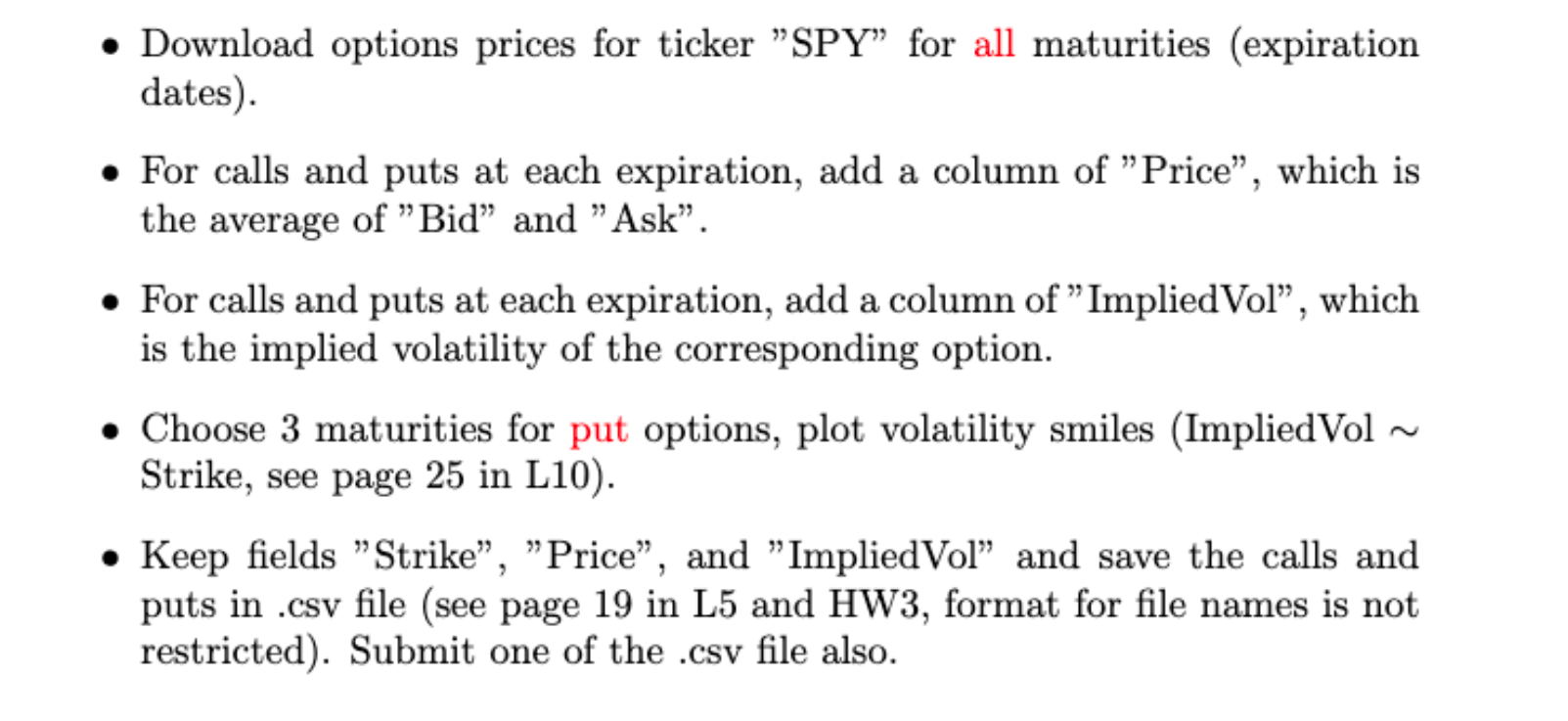

Download options prices for ticker "SPY for all maturities (expiration dates). For calls and puts at each expiration, add a column of Price, which is the average of "Bid" and "Ask". For calls and puts at each expiration, add a column of "Implied Vol, which is the implied volatility of the corresponding option. Choose 3 maturities for put options, plot volatility smiles (Implied Vol ~ Strike, see page 25 in L10). Keep fields "Strike", "Price", and "Implied Vol and save the calls and puts in .csv file (see page 19 in L5 and HW3, format for file names is not restricted). Submit one of the .csv file also. Download options prices for ticker "SPY for all maturities (expiration dates). For calls and puts at each expiration, add a column of Price, which is the average of "Bid" and "Ask". For calls and puts at each expiration, add a column of "Implied Vol, which is the implied volatility of the corresponding option. Choose 3 maturities for put options, plot volatility smiles (Implied Vol ~ Strike, see page 25 in L10). Keep fields "Strike", "Price", and "Implied Vol and save the calls and puts in .csv file (see page 19 in L5 and HW3, format for file names is not restricted). Submit one of the .csv file also

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts