Question: Use Raptor for the following problem helping an IRS agent to calculate income tax based on user income and filing status. We will use loops

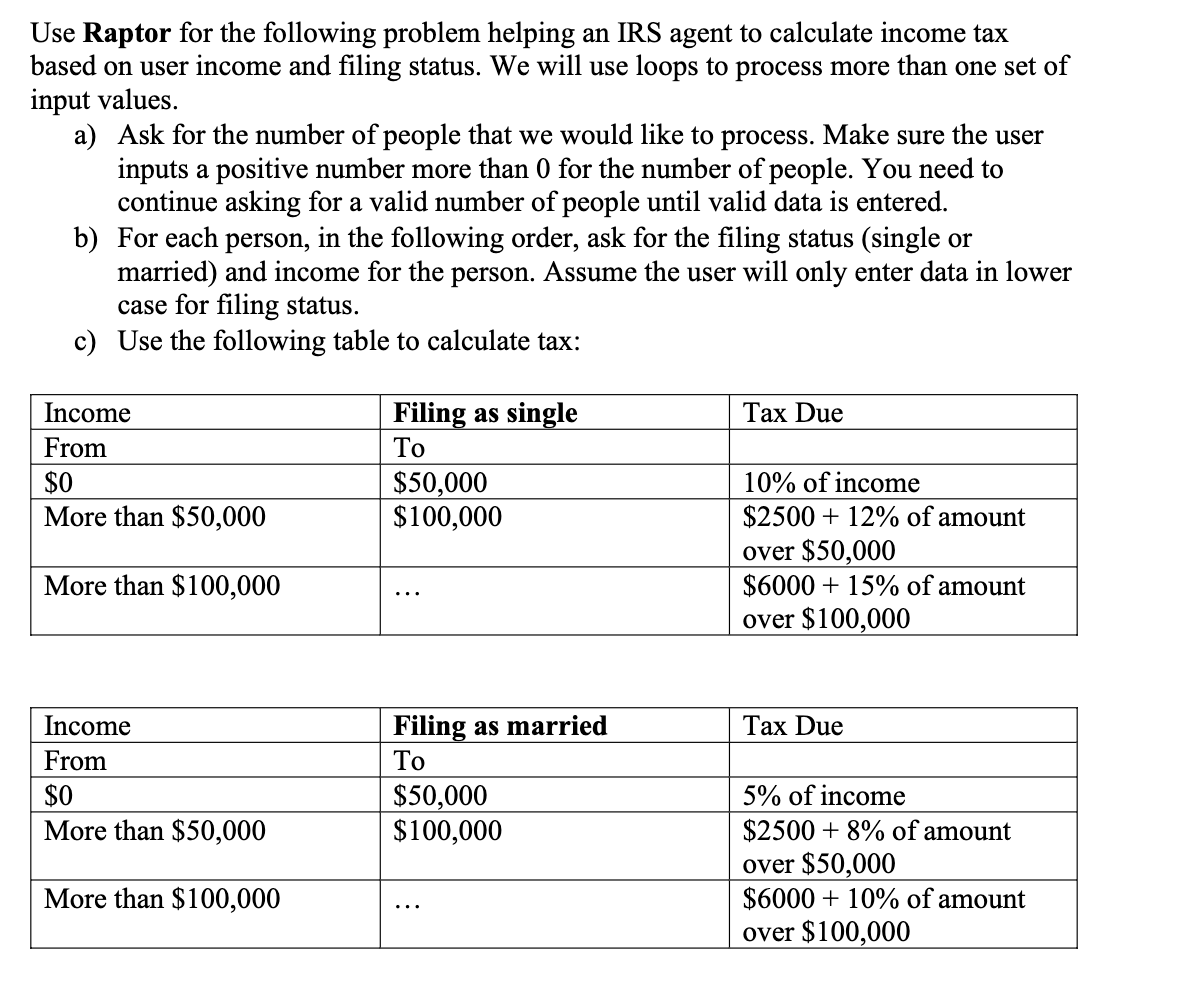

Use Raptor for the following problem helping an IRS agent to calculate income tax based on user income and filing status. We will use loops to process more than one set of input values. a) Ask for the number of people that we would like to process. Make sure the user inputs a positive number more than 0 for the number of people. You need to continue asking for a valid number of people until valid data is entered. b) For each person, in the following order, ask for the filing status (single or married) and income for the person. Assume the user will only enter data in lower case for filing status. c) Use the following table to calculate tax: Tax Due Income From $0 More than $50,000 Filing as single To $50,000 $100,000 10% of income $2500 + 12% of amount over $50,000 $6000 + 15% of amount over $100,000 More than $100,000 Tax Due Income From $0 More than $50,000 Filing as married To $50,000 $100,000 5% of income $2500 + 8% of amount over $50,000 $6000 + 10% of amount over $100,000 More than $100,000 Use Raptor for the following problem helping an IRS agent to calculate income tax based on user income and filing status. We will use loops to process more than one set of input values. a) Ask for the number of people that we would like to process. Make sure the user inputs a positive number more than 0 for the number of people. You need to continue asking for a valid number of people until valid data is entered. b) For each person, in the following order, ask for the filing status (single or married) and income for the person. Assume the user will only enter data in lower case for filing status. c) Use the following table to calculate tax: Tax Due Income From $0 More than $50,000 Filing as single To $50,000 $100,000 10% of income $2500 + 12% of amount over $50,000 $6000 + 15% of amount over $100,000 More than $100,000 Tax Due Income From $0 More than $50,000 Filing as married To $50,000 $100,000 5% of income $2500 + 8% of amount over $50,000 $6000 + 10% of amount over $100,000 More than $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts