Question: Use RETROSPECTIVE METHOD to solve this problem. (Here is the answer given by Chegg, but it may not include the method, only the answers: https://www.chegg.com/homework-help/Mathematics-of-Investment-and-Credit-0th-edition-chapter-3.1-problem-4E-solution-9781625424853

Use RETROSPECTIVE METHOD to solve this problem. (Here is the answer given by Chegg, but it may not include the method, only the answers: https://www.chegg.com/homework-help/Mathematics-of-Investment-and-Credit-0th-edition-chapter-3.1-problem-4E-solution-9781625424853

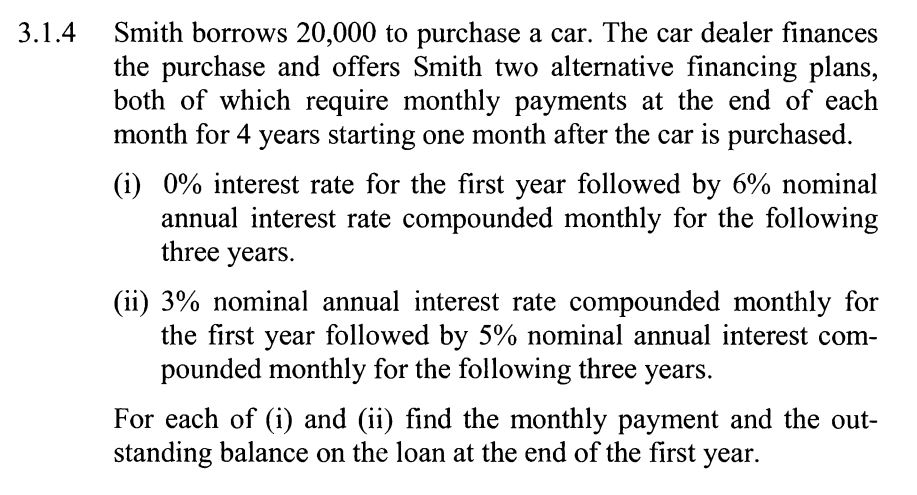

3.1.4 Smith borrows 20,000 to purchase a car. The car dealer finances the purchase and offers Smith two alternative financing plans, both of which require monthly payments at the end of each month for 4 years starting one month after the car is purchased. (i) 0% interest rate for the first year followed by 6% nominal annual interest rate compounded monthly for the following three years. (ii) 3% nominal annual interest rate compounded monthly for the first year followed by 5% nominal annual interest com- pounded monthly for the following three years. For each of (i) and (ii) find the monthly payment and the out- standing balance on the loan at the end of the first year. 3.1.4 Smith borrows 20,000 to purchase a car. The car dealer finances the purchase and offers Smith two alternative financing plans, both of which require monthly payments at the end of each month for 4 years starting one month after the car is purchased. (i) 0% interest rate for the first year followed by 6% nominal annual interest rate compounded monthly for the following three years. (ii) 3% nominal annual interest rate compounded monthly for the first year followed by 5% nominal annual interest com- pounded monthly for the following three years. For each of (i) and (ii) find the monthly payment and the out- standing balance on the loan at the end of the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts