Question: use same numbers from question 1 and 2, provide answer please Q1) ABC Residential Investors, LLP, is considering the purchase of a 120-unit apartment complex

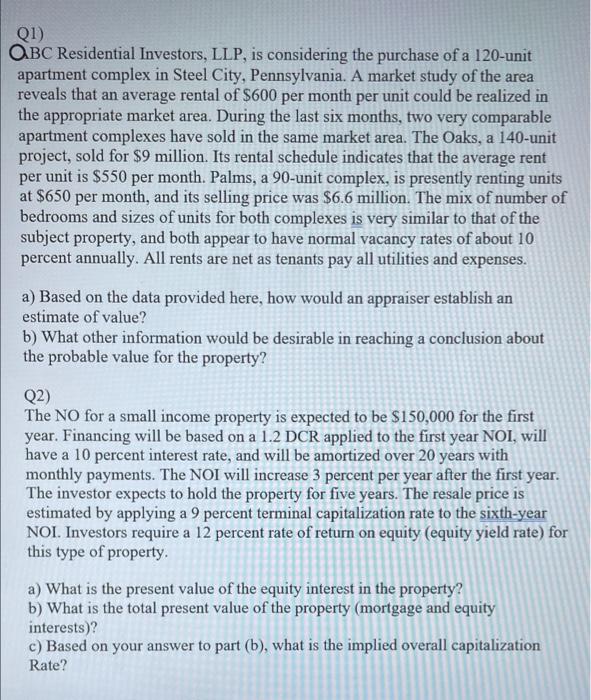

Q1) ABC Residential Investors, LLP, is considering the purchase of a 120-unit apartment complex in Steel City, Pennsylvania. A market study of the area reveals that an average rental of $600 per month per unit could be realized in the appropriate market area. During the last six months, two very comparable apartment complexes have sold in the same market area. The Oaks, a 140-unit project, sold for $9 million. Its rental schedule indicates that the average rent per unit is $550 per month. Palms, a 90-unit complex, is presently renting units at $650 per month, and its selling price was $6.6 million. The mix of number of bedrooms and sizes of units for both complexes is very similar to that of the subject property, and both appear to have normal vacancy rates of about 10 percent annually. All rents are net as tenants pay all utilities and expenses. a) Based on the data provided here, how would an appraiser establish an estimate of value? b) What other information would be desirable in reaching a conclusion about the probable value for the property? Q2) The NO for a small income property is expected to be $150,000 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 3 percent per year after the first year. The investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year NOI. Investors require a 12 percent rate of return on equity (equity yield rate) for this type of property a) What is the present value of the equity interest in the property? b) What is the total present value of the property (mortgage and equity interests)? c) Based on your answer to part (b), what is the implied overall capitalization Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts