Question: use solution You are faced with making a decision on a large capital investment proposal. The capital investment amount is $640,000. Estimated annual revenue at

use solution

use solution

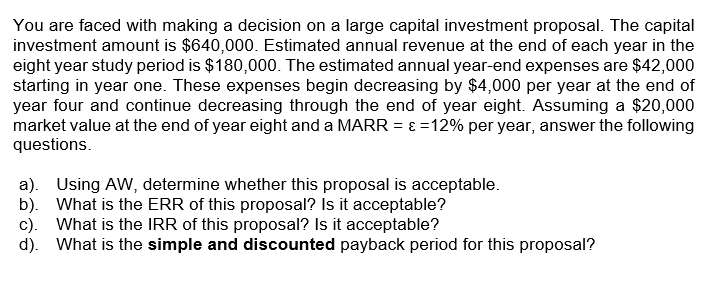

You are faced with making a decision on a large capital investment proposal. The capital investment amount is $640,000. Estimated annual revenue at the end of each year in the eight year study period is $180,000. The estimated annual year-end expenses are $42,000 starting in year one. These expenses begin decreasing by $4,000 per year at the end of year four and continue decreasing through the end of year eight. Assuming a $20,000 market value at the end of year eight and a MARR = { =12% per year, answer the following questions. a). Using AW, determine whether this proposal is acceptable. b). What is the ERR of this proposal? Is it acceptable? c) What is the IRR of this proposal? Is it acceptable? d). What is the simple and discounted payback period for this proposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts