Question: Use straight-line table below. Exhibit 8.3 MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates) For Property Placed in Service after December 31,

Use straight-line table below.

Exhibit 8.3

MACRS Accelerated Depreciation for Personal Property Assuming Half-Year Convention (Percentage Rates)

| For Property Placed in Service after December 31, 1986 | ||||||

|---|---|---|---|---|---|---|

| Recovery Year | 3-Year (200% DB) | 5-Year (200% DB) | 7-Year (200% DB) | 10-Year (200% DB) | 15-Year (150% DB) | 20-Year (150% DB) |

| 1 | 33.33 | 20.00 | 14.29 | 10.00 | 5.00 | 3.750 |

| 2 | 44.45 | 32.00 | 24.49 | 18.00 | 9.50 | 7.219 |

| 3 | 14.81 | 19.20 | 17.49 | 14.40 | 8.55 | 6.677 |

| 4 | 7.41 | 11.52 | 12.49 | 11.52 | 7.70 | 6.177 |

| 5 | 11.52 | 8.93 | 9.22 | 6.93 | 5.713 | |

| 6 | 5.76 | 8.92 | 7.37 | 6.23 | 5.285 | |

| 7 | 8.93 | 6.55 | 5.90 | 4.888 | ||

| 8 | 4.46 | 6.55 | 5.90 | 4.522 | ||

| 9 | 6.56 | 5.91 | 4.462 | |||

| 10 | 6.55 | 5.90 | 4.461 | |||

| 11 | 3.28 | 5.91 | 4.462 | |||

| 12 | 5.90 | 4.461 | ||||

| 13 | 5.91 | 4.462 | ||||

| 14 | 5.90 | 4.461 | ||||

| 15 | 5.91 | 4.462 | ||||

| 16 | 2.95 | 4.461 | ||||

| 17 | 4.462 | |||||

| 18 | 4.461 | |||||

| 19 | 4.462 | |||||

| 20 | 4.461 | |||||

| 21 | 2.231 | |||||

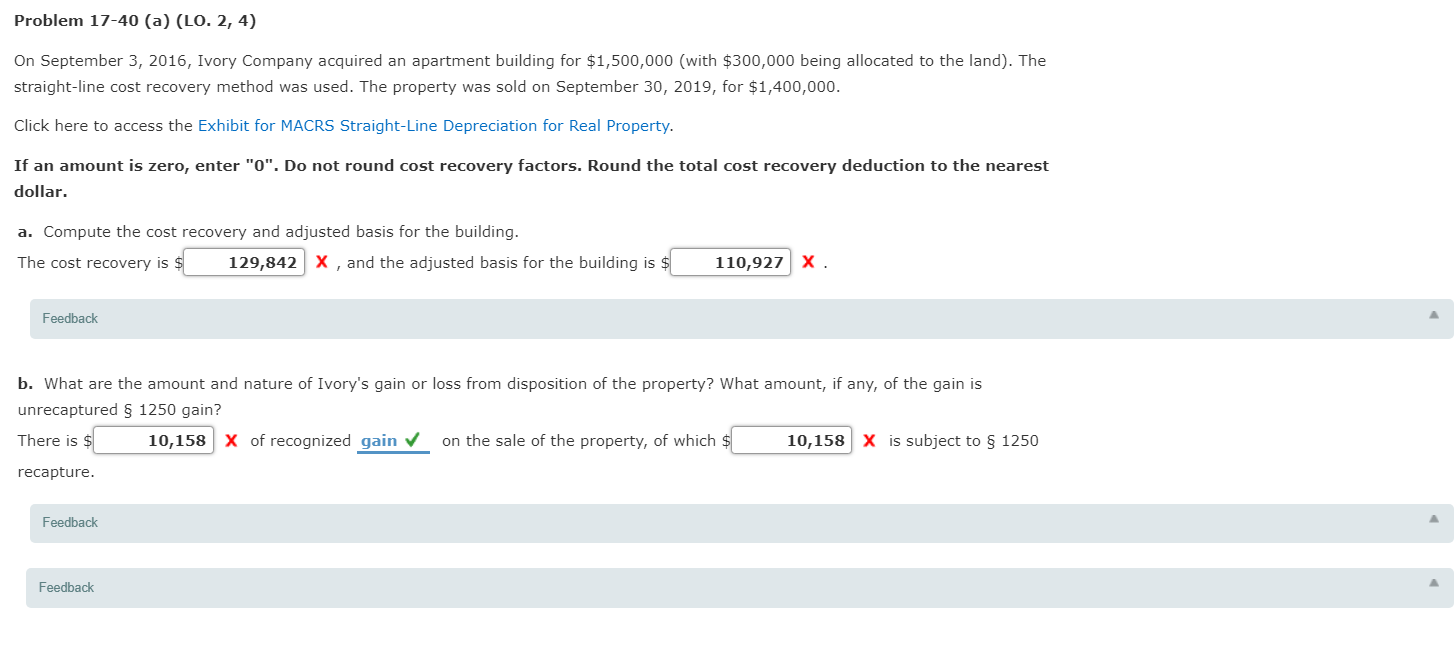

Problem 17-40 (a) (LO. 2, 4) On September 3, 2016, Ivory Company acquired an apartment building for $1,500,000 (with $300,000 being allocated to the land). The straight-line cost recovery method was used. The property was sold on September 30, 2019, for $1,400,000. Click here to access the Exhibit for MACRS Straight-Line Depreciation for Real Property. If an amount is zero, enter "0". Do not round cost recovery factors. Round the total cost recovery deduction to the nearest dollar. a. Compute the cost recovery and adjusted basis for the building. The cost recovery is $ 129,842 X, and the adjusted basis for the building is $ 110,927 X. Feedback b. What are the amount and nature of Ivory's gain or loss from disposition of the property? What amount, if any, of the gain is unrecaptured 1250 gain? There is $ 10,158 X of recognized gain on the sale of the property, of which $ 10,158 X is subject to 1250 recapture. Feedback Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts