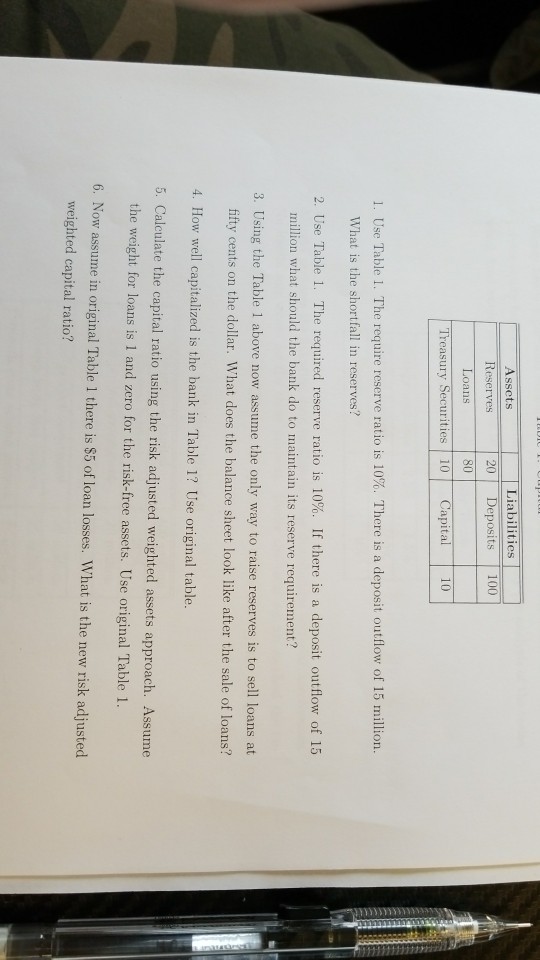

Question: Use Table 1. The require reserve ratio is 10%. There is a deposit outflow of 15 million. What is the shortfall in reserves? Use Table

Use Table 1. The require reserve ratio is 10%. There is a deposit outflow of 15 million. What is the shortfall in reserves? Use Table 1. The required reserve ratio is 10%. If there is a deposit outflow of 15 million what should the bank do to maintain its reserve requirement? Using the Table 1 above now assume the only way to raise reserves is to sell loans at fifty cents on the dollar. What does the balance sheet look like after the sale of loans? How well capitalized is the bank in Table 1? Use original table. Calculate the capital ratio using the risk adjusted weighted assets approach. Assume the weight for loans is 1 and zero for the risk-free assets. Use original Table 1. Now assume in original Table 1 there is $5 of loan losses. What is the new risk adjusted weighted capital ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts