Question: Use Table 12-2 to calculate the present value (in $) of the ordinary annuity. (Enter a number. Round your answer to the nearest cent.) Annuity

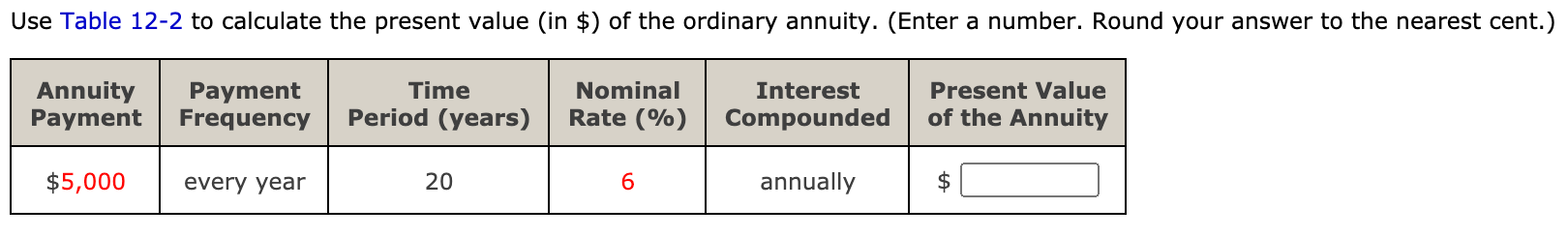

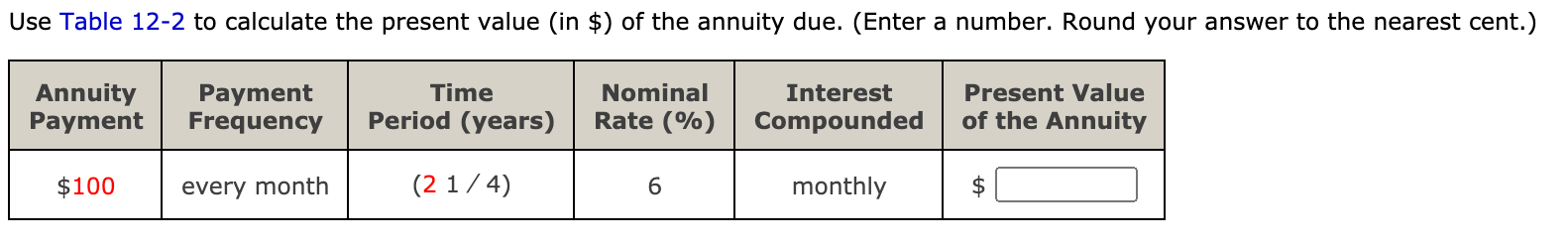

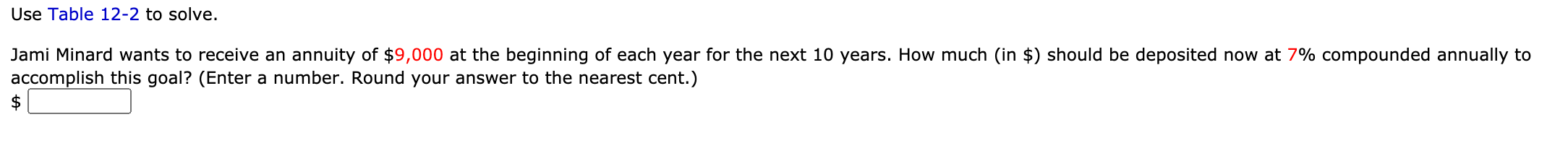

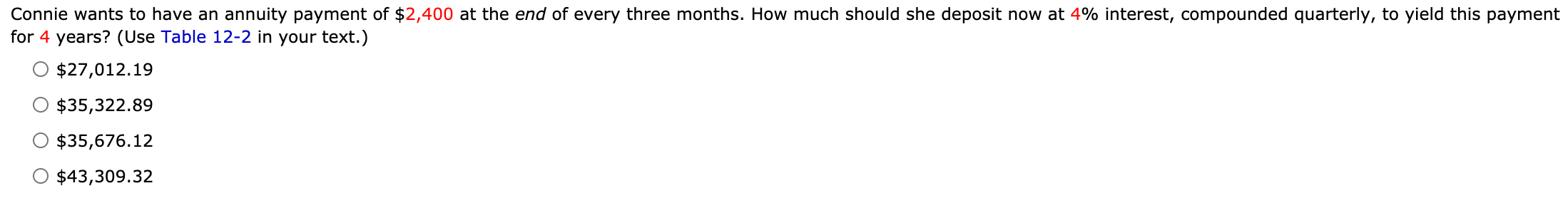

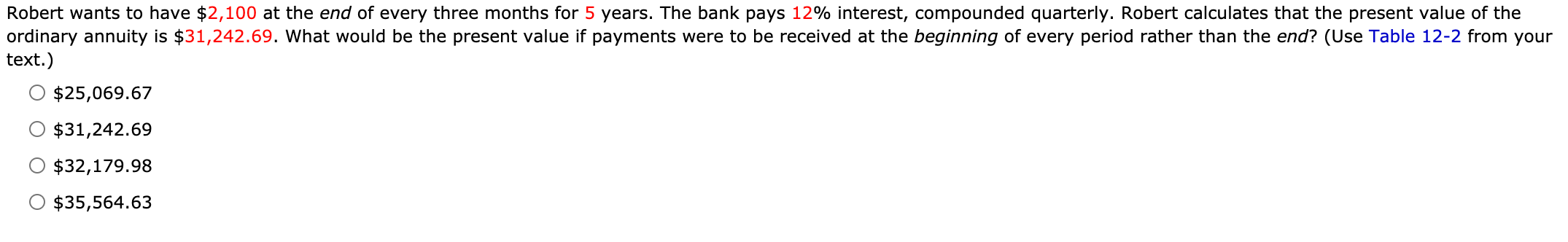

Use Table 12-2 to calculate the present value (in $) of the ordinary annuity. (Enter a number. Round your answer to the nearest cent.) Annuity Payment Payment Frequency Time Period (years) Nominal Rate (%) Interest Compounded Present Value of the Annuity $5,000 every year 20 6 annually $ Use Table 12-2 to calculate the present value (in $) of the annuity due. (Enter a number. Round your answer to the nearest cent.) Annuity Payment Payment Frequency Time Period (years) Nominal Rate (%) Interest Compounded Present Value of the Annuity $100 every month (21/4) 6 monthly $ Use Table 12-2 to solve. Jami Minard wants to receive an annuity of $9,000 at the beginning of each year for the next 10 years. How much (in $) should be deposited now at 7% compounded annually to accomplish this goal? (Enter a number. Round your answer to the nearest cent.) $ Connie wants to have an annuity payment of $2,400 at the end of every three months. How much should she deposit now at 4% interest, compounded quarterly, to yield this payment for 4 years? (Use Table 12-2 in your text.) $27,012.19 $35,322.89 $35,676.12 $43,309.32 Robert wants to have $2,100 at the end of every three months for 5 years. The bank pays 12% interest, compounded quarterly. Robert calculates that the present value of the ordinary annuity is $31,242.69. What would be the present value if payments were to be received at the beginning of every period rather than the end? (Use Table 12-2 from your text.) $25,069.67 $31,242.69 $32,179.98 O $35,564.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts