Question: use tables and answer A , B and C Jason Jackson is attempting to evaluate 2 possible portfolios consisting of the same 5 assets but

use tables and answer A , B and C

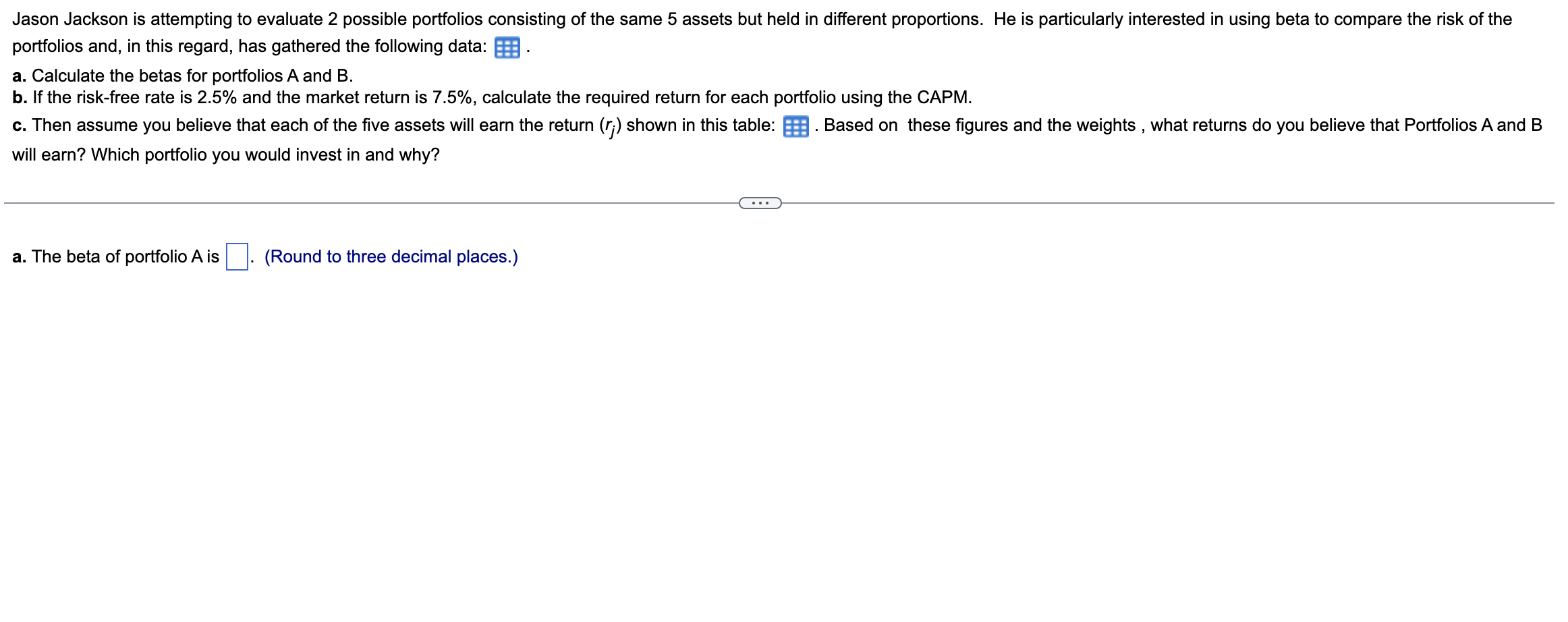

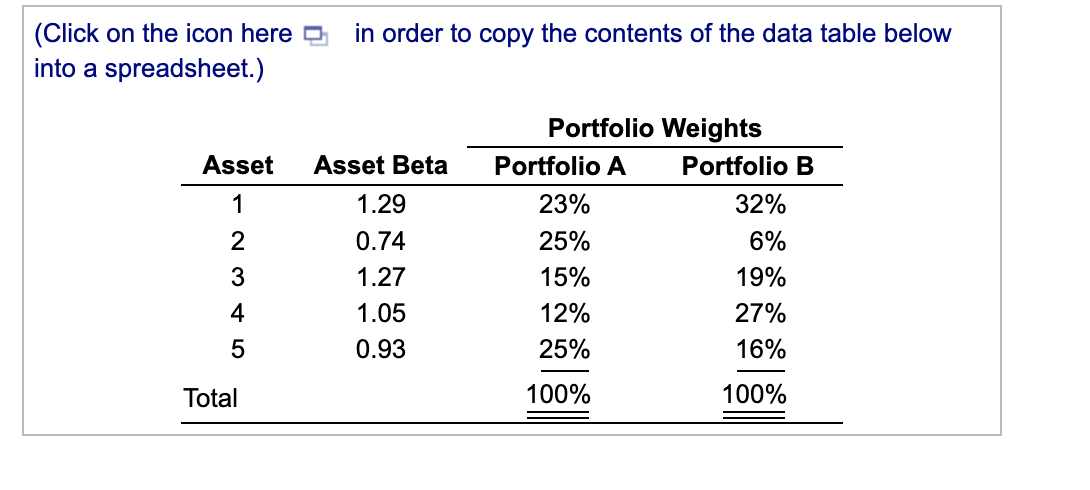

Jason Jackson is attempting to evaluate 2 possible portfolios consisting of the same 5 assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and, in this regard, has gathered the following data: a. Calculate the betas for portfolios A and B. b. If the risk-free rate is 2.5% and the market return is 7.5%, calculate the required return for each portfolio using the CAPM. c. Then assume you believe that each of the five assets will earn the return (rj) shown in this table: . Based on these figures and the weights, what returns do you believe that Portfolios A and B will earn? Which portfolio you would invest in and why? a. The beta of portfolio A is (Round to three decimal places.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts