Question: Use template below. It is important to understand that when interpreting financial statements, the numbers alone may not provide the whole financial picture of an

Use template below.

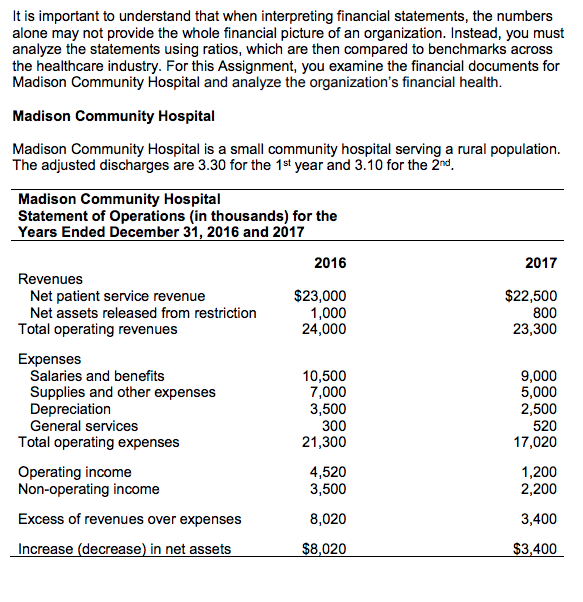

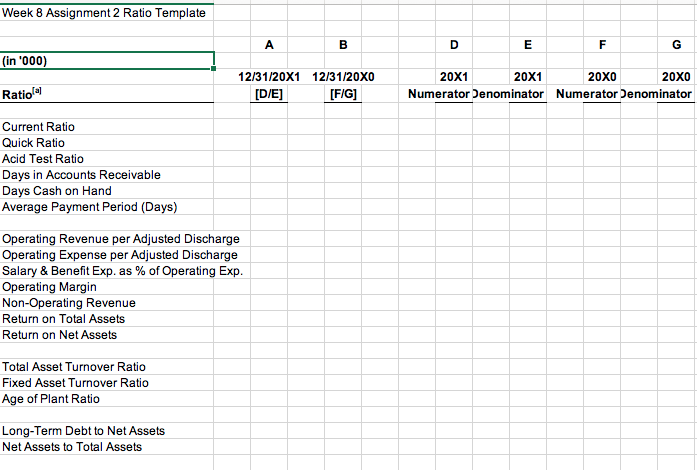

It is important to understand that when interpreting financial statements, the numbers alone may not provide the whole financial picture of an organization. Instead, you must analyze the statements using ratios, which are then compared to benchmarks across the healthcare industry. For this Assignment, you examine the financial documents for Madison Community Hospital and analyze the organization's financial health. Madison Community Hospital Madison Community Hospital is a small community hospital serving a rural population. The adjusted discharges are 3.30 for the 1st year and 3.10 for the 2nd. Madison Community Hospital Statement of Operations (in thousands) for the Years Ended December 31, 2016 and 2017 2016 2017 Revenues Net patient service revenue Net assets released from restriction Total operating revenues $23,000 1,000 24,000 $22,500 800 23,300 Expenses Salaries and benefits Supplies and other expenses Depreciation General services Total operating expenses 10,500 7,000 3,500 300 21,300 9,000 5,000 2,500 520 17,020 Operating income Non-operating income 4,520 3,500 1,200 2,200 Excess of revenues over expenses 8,020 3,400 Increase (decrease in net assets $8,020 $3,400 Week 8 Assignment 2 Ratio Template (in '000) Ratio 12/31/20X1 12/31/20XO [D/E] [F/G] 20X1 20X1 20X0 20X0 Numerator Denominator Numerator Denominator Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand Average Payment Period (Days) Operating Revenue per Adjusted Discharge Operating Expense per Adjusted Discharge Salary & Benefit Exp. as % of Operating Exp. Operating Margin Non-Operating Revenue Return on Total Assets Return on Net Assets Total Asset Turnover Ratio Fixed Asset Turnover Ratio Age of Plant Ratio Long-Term Debt to Net Assets Net Assets to Total Assets It is important to understand that when interpreting financial statements, the numbers alone may not provide the whole financial picture of an organization. Instead, you must analyze the statements using ratios, which are then compared to benchmarks across the healthcare industry. For this Assignment, you examine the financial documents for Madison Community Hospital and analyze the organization's financial health. Madison Community Hospital Madison Community Hospital is a small community hospital serving a rural population. The adjusted discharges are 3.30 for the 1st year and 3.10 for the 2nd. Madison Community Hospital Statement of Operations (in thousands) for the Years Ended December 31, 2016 and 2017 2016 2017 Revenues Net patient service revenue Net assets released from restriction Total operating revenues $23,000 1,000 24,000 $22,500 800 23,300 Expenses Salaries and benefits Supplies and other expenses Depreciation General services Total operating expenses 10,500 7,000 3,500 300 21,300 9,000 5,000 2,500 520 17,020 Operating income Non-operating income 4,520 3,500 1,200 2,200 Excess of revenues over expenses 8,020 3,400 Increase (decrease in net assets $8,020 $3,400 Week 8 Assignment 2 Ratio Template (in '000) Ratio 12/31/20X1 12/31/20XO [D/E] [F/G] 20X1 20X1 20X0 20X0 Numerator Denominator Numerator Denominator Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand Average Payment Period (Days) Operating Revenue per Adjusted Discharge Operating Expense per Adjusted Discharge Salary & Benefit Exp. as % of Operating Exp. Operating Margin Non-Operating Revenue Return on Total Assets Return on Net Assets Total Asset Turnover Ratio Fixed Asset Turnover Ratio Age of Plant Ratio Long-Term Debt to Net Assets Net Assets to Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts