Question: USE THE ADDED CONSTRAINT AT THE TOP TO FORMULATE ANSWER PLZ! With the added constraint: High end return options should be at least twice as

USE THE ADDED CONSTRAINT AT THE TOP TO FORMULATE ANSWER PLZ!

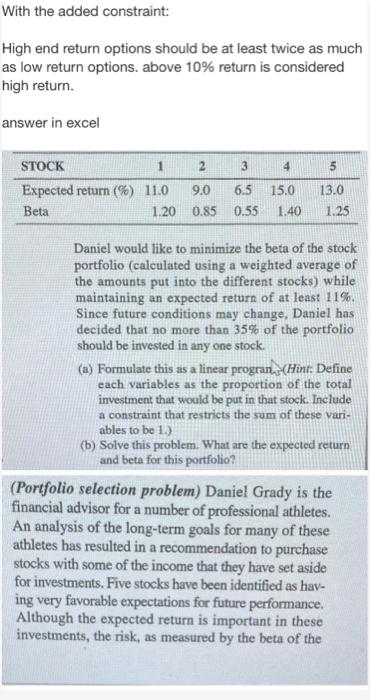

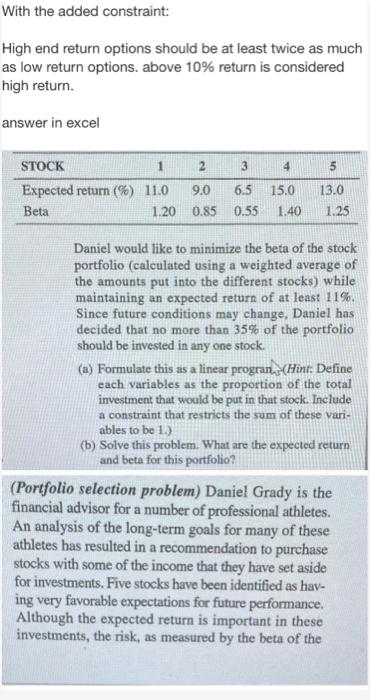

With the added constraint: High end return options should be at least twice as much as low return options. above 10% return is considered high return. answer in excel 4 5 STOCK 1 2 3 Expected return (%) 11.0 9.0 6.5 Beta 1.20 0.85 0.55 15.0 1.40 13.0 1.25 Daniel would like to minimize the beta of the stock portfolio (calculated using a weighted average of the amounts put into the different stocks) while maintaining an expected return of at least 11%. Since future conditions may change. Daniel has decided that no more than 35% of the portfolio should be invested in any one stock. (a) Formulate this as a linear progran. (Hint: Define each variables as the proportion of the total investment that would be put in that stock. Include a constraint that restricts the sum of these vari- ables to be 1.) (b) Solve this problem. What are the expected return and beta for this portfolio? (Portfolio selection problem) Daniel Grady is the financial advisor for a number of professional athletes. An analysis of the long-term goals for many of these athletes has resulted in a recommendation to purchase stocks with some of the income that they have set aside for investments. Five stocks have been identified as hav- ing very favorable expectations for future performance. Although the expected return is important in these investments, the risk, as measured by the beta of the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock