Question: Use the assumptions below build a pro forma cash flow statement for the next 3 years with and without leverage. Find the BTIRR and

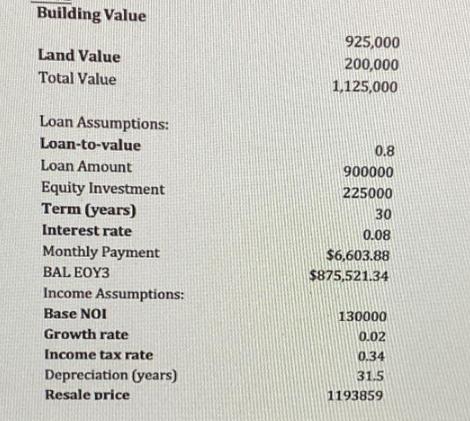

Use the assumptions below build a pro forma cash flow statement for the next 3 years with and without leverage. Find the BTIRR and ATRIRR for each scenario. Compute the BEIR. Is there positive or negative financial leverage? Building Value Land Value Total Value Loan Assumptions: Loan-to-value Loan Amount Equity Investment Term (years) Interest rate Monthly Payment BAL EOY3 Income Assumptions: Base NOI Growth rate Income tax rate Depreciation (years) Resale price 925,000 200,000 1,125,000 0.8 900000 225000 30 0.08 $6,603.88 $875,521.34 130000 0.02 0.34 31.5 1193859 Use the assumptions below build a pro forma cash flow statement for the next 3 years with and without leverage. Find the BTIRR and ATRIRR for each scenario. Compute the BEIR. Is there positive or negative financial leverage? Building Value Land Value Total Value Loan Assumptions: Loan-to-value Loan Amount Equity Investment Term (years) Interest rate Monthly Payment BAL EOY3 Income Assumptions: Base NOI Growth rate Income tax rate Depreciation (years) Resale price 925,000 200,000 1,125,000 0.8 900000 225000 30 0.08 $6,603.88 $875,521.34 130000 0.02 0.34 31.5 1193859

Step by Step Solution

There are 3 Steps involved in it

The answer provided below has been developed in a clear step by step mannerStep 1 Solution according ... View full answer

Get step-by-step solutions from verified subject matter experts