Question: Use the below cash statement: - Prepare a summary analysis of the Statement of Cash Flows for all three years presented (set all inflows and

Use the below cash statement:

- Prepare a summary analysis of the Statement of Cash Flows for all three years presented (set all inflows and outflows to 100%). Analyze the cash flows for all three years based on your summary analysis. Potential questions to answer in your discussion: what percentage of cash inflows supplied by operations; what are the other significant items in cash inflows; is there a change in the percentage of operations in cash inflows from 2019 to 2020 (is this change good or bad for the company); which items constitute the biggest portion of cash outflows.

- Calculate activity ratios (Accounts Receivable Turnover, Inventory Turnover, Accounts Payable Turnover, Fixed Asset Turnover, Total Asset Turnover) for all years presented. Assess the company based on its activity ratios. Comment on any significant year-to-year changes. Discuss whether the company is managing its assets efficiently compared to industry median values

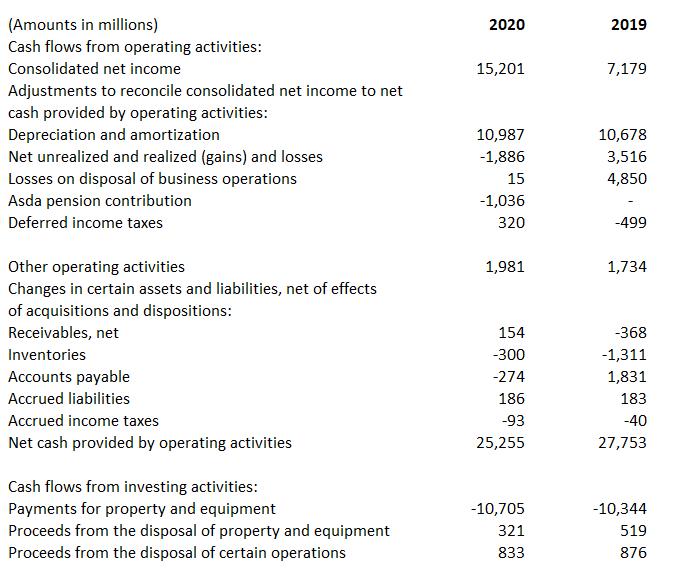

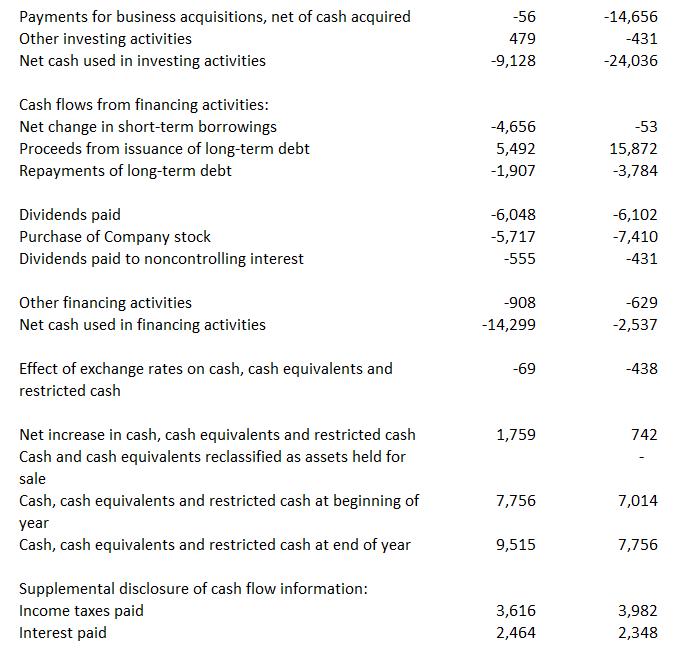

(Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Net unrealized and realized (gains) and losses Losses on disposal of business operations Asda pension contribution Deferred income taxes Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions and dispositions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations 2020 15,201 10,987 -1,886 15 -1,036 320 1,981 154 -300 -274 186 -93 25,255 -10,705 321 833 2019 7,179 10,678 3,516 4,850 -499 1,734 -368 -1,311 1,831 183 -40 27,753 -10,344 519 876

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Prepare a summary analysis of the Statement of Cash Flows for all three years presented set all inflows and outflows to 100 Analyze the cash flows for ... View full answer

Get step-by-step solutions from verified subject matter experts