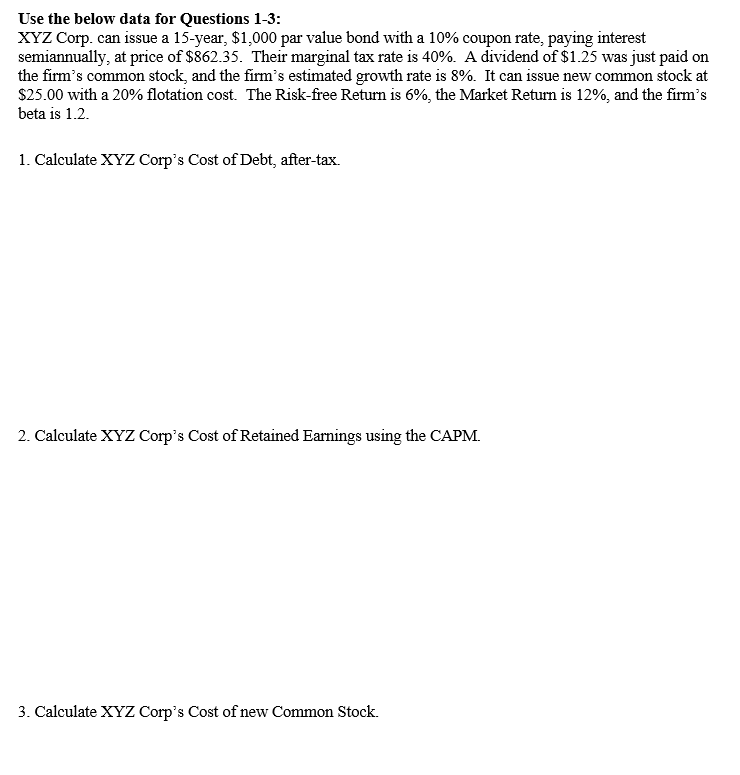

Question: Use the below data for Questions 1 - 3 : XYZ Corp. can issue a 1 5 - year, $ 1 , 0 0 0

Use the below data for Questions :

XYZ Corp. can issue a year, $ par value bond with a coupon rate, paying interest

semiannually, at price of $ Their marginal tax rate is A dividend of $ was just paid on

the firm's common stock, and the firm's estimated growth rate is It can issue new common stock at

$ with a flotation cost. The Riskfree Return is the Market Return is and the firm's

beta is

Calculate XYZ Corp's Cost of Debt, aftertax.

Calculate XYZ Corp's Cost of Retained Earnings using the CAPM.

Calculate XYZ Corp's Cost of new Common Stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock