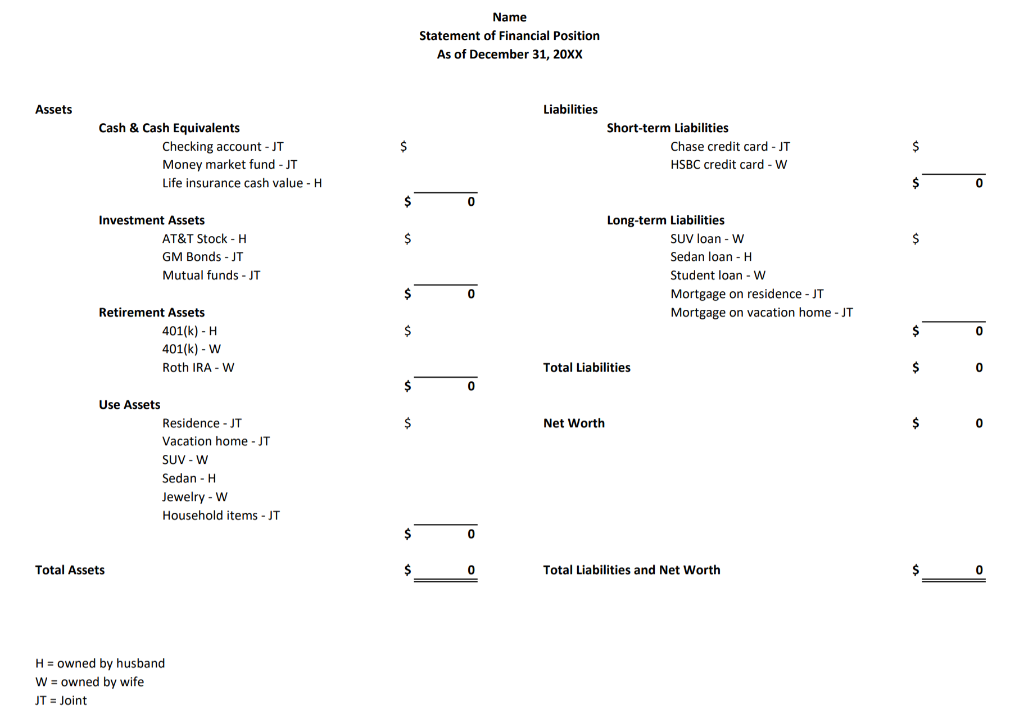

Question: Use the below information to complete the financial position statement. Information Given: Name Statement of Financial Position As of December 31, 20XX Assets Liabilities Cash

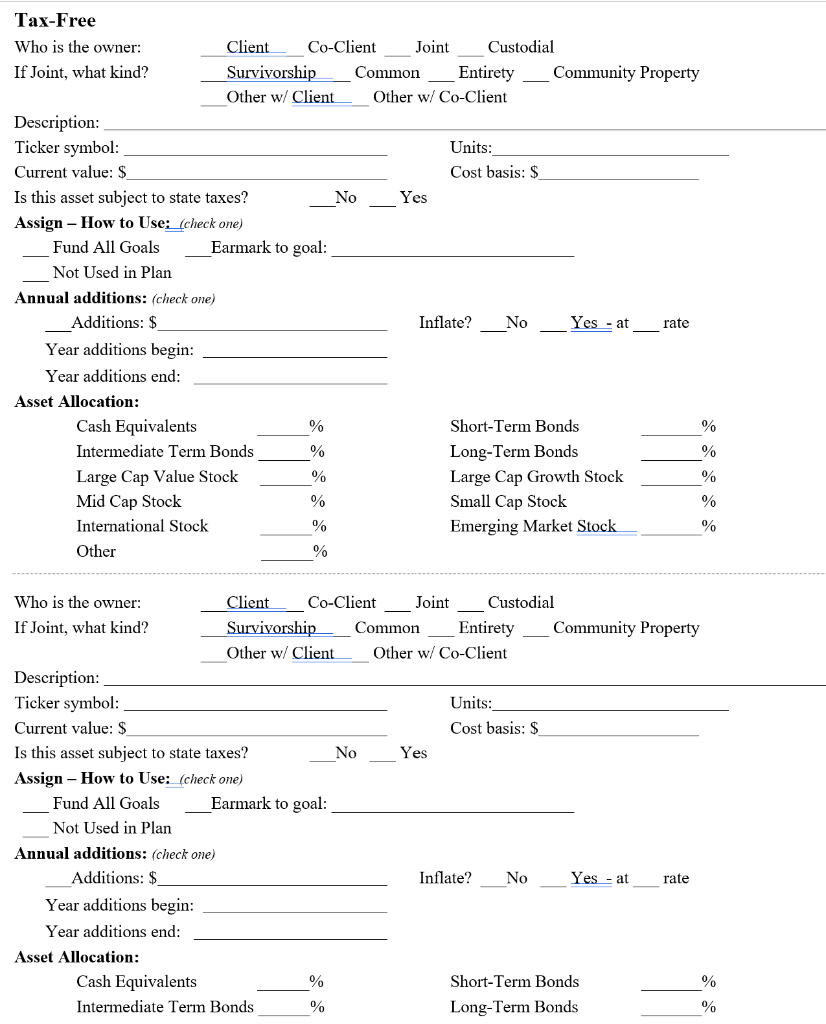

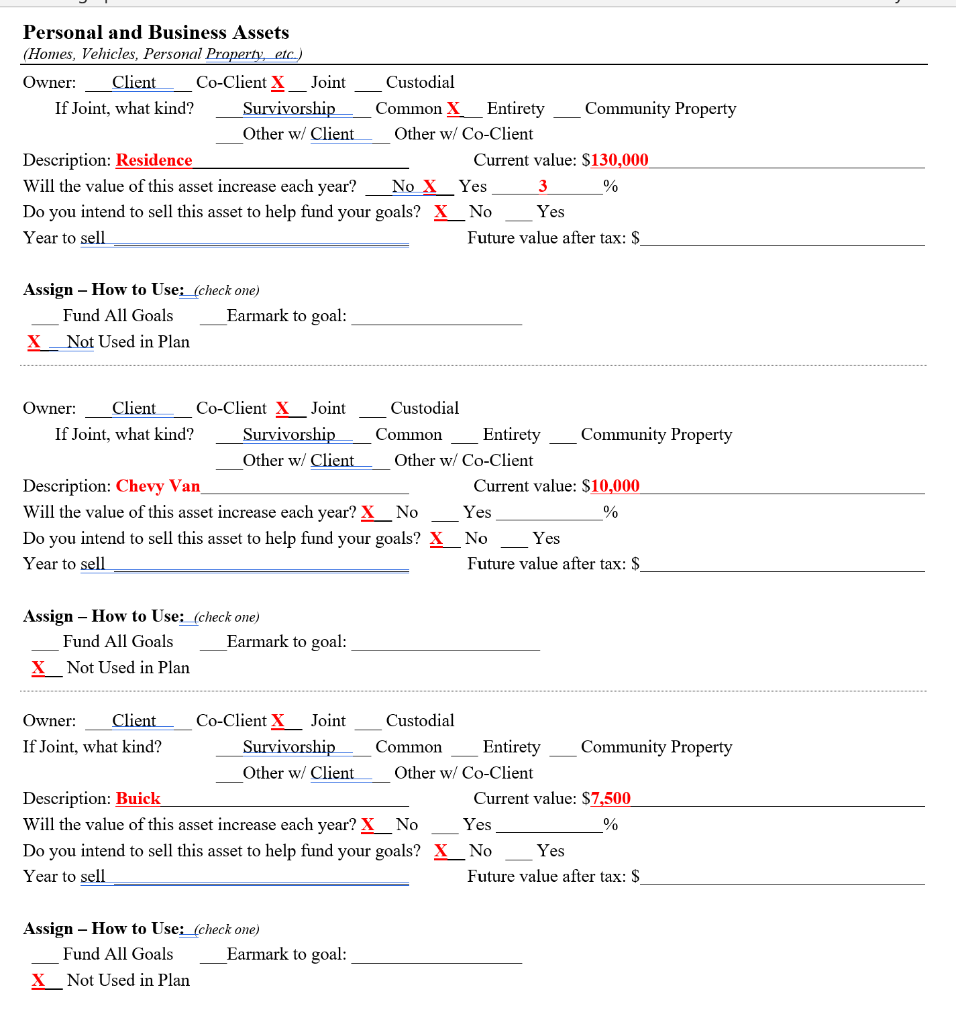

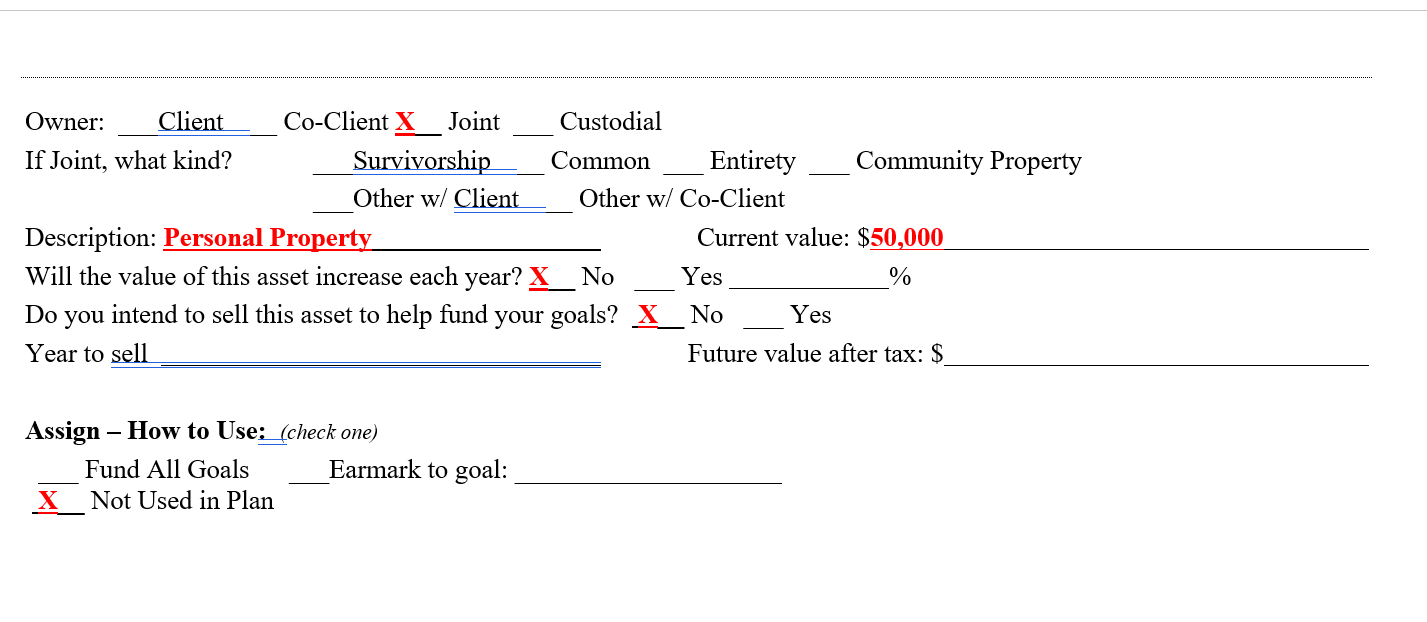

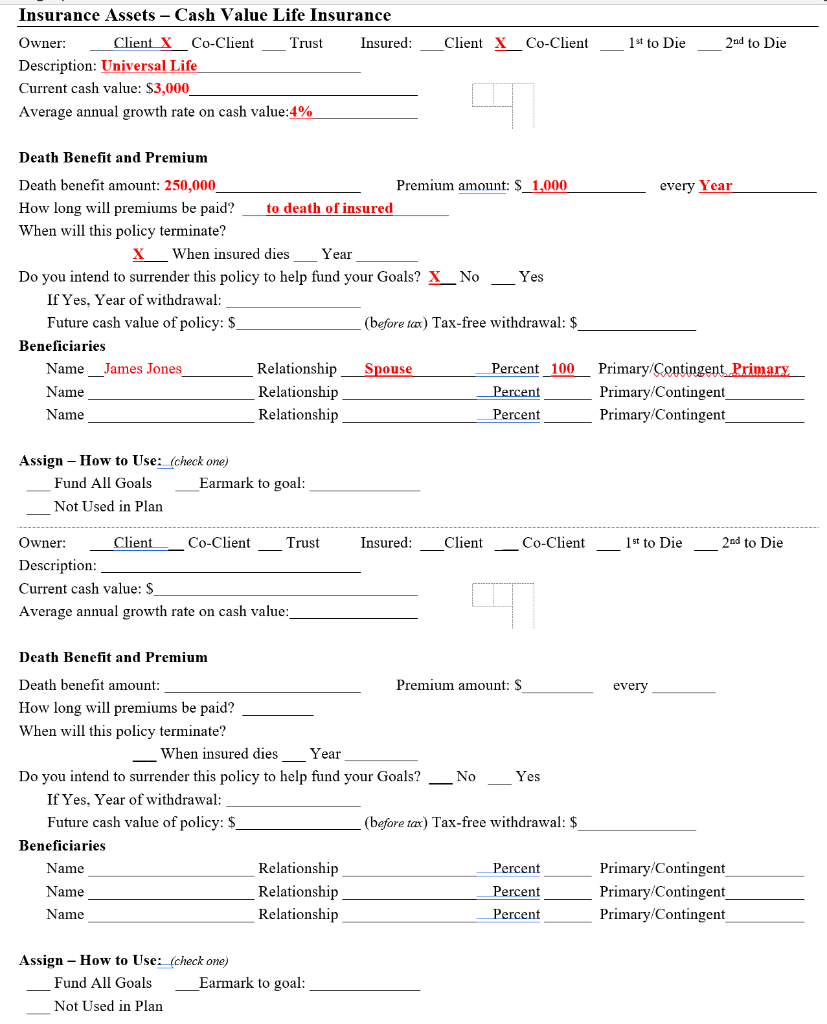

Use the below information to complete the financial position statement.

Information Given:

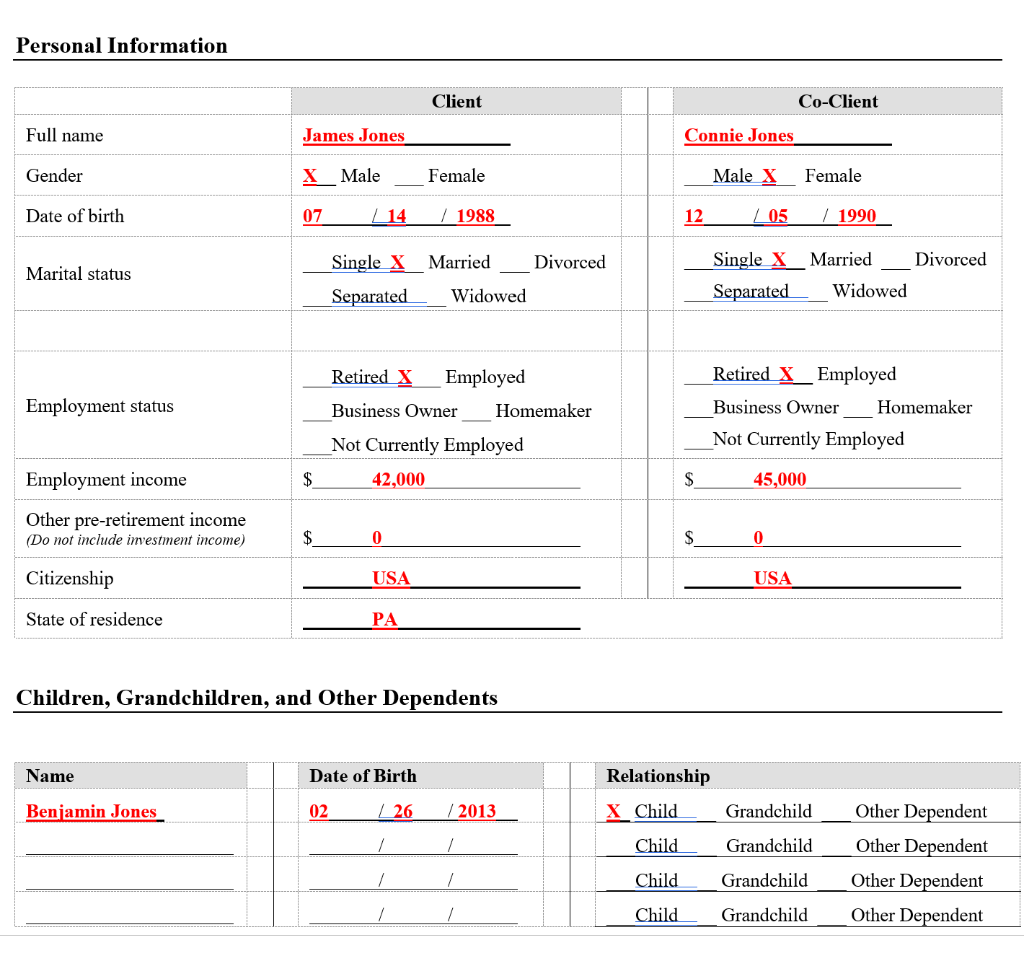

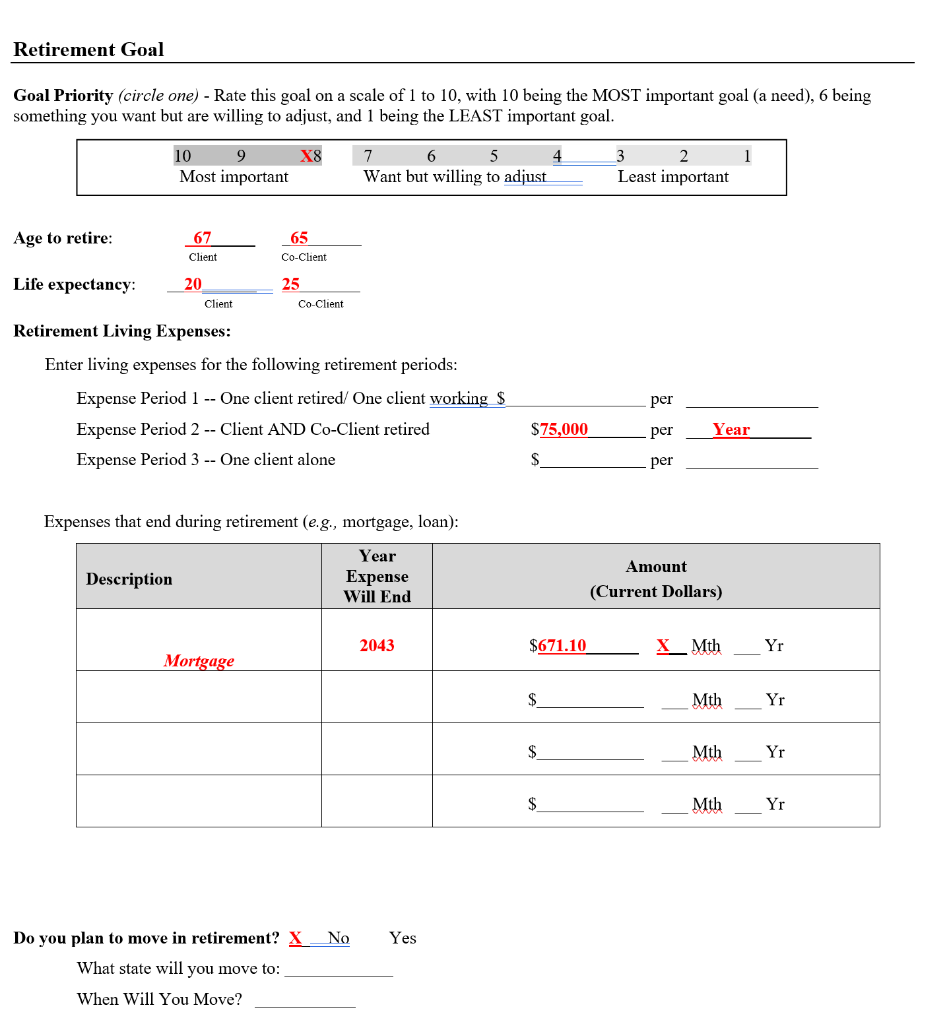

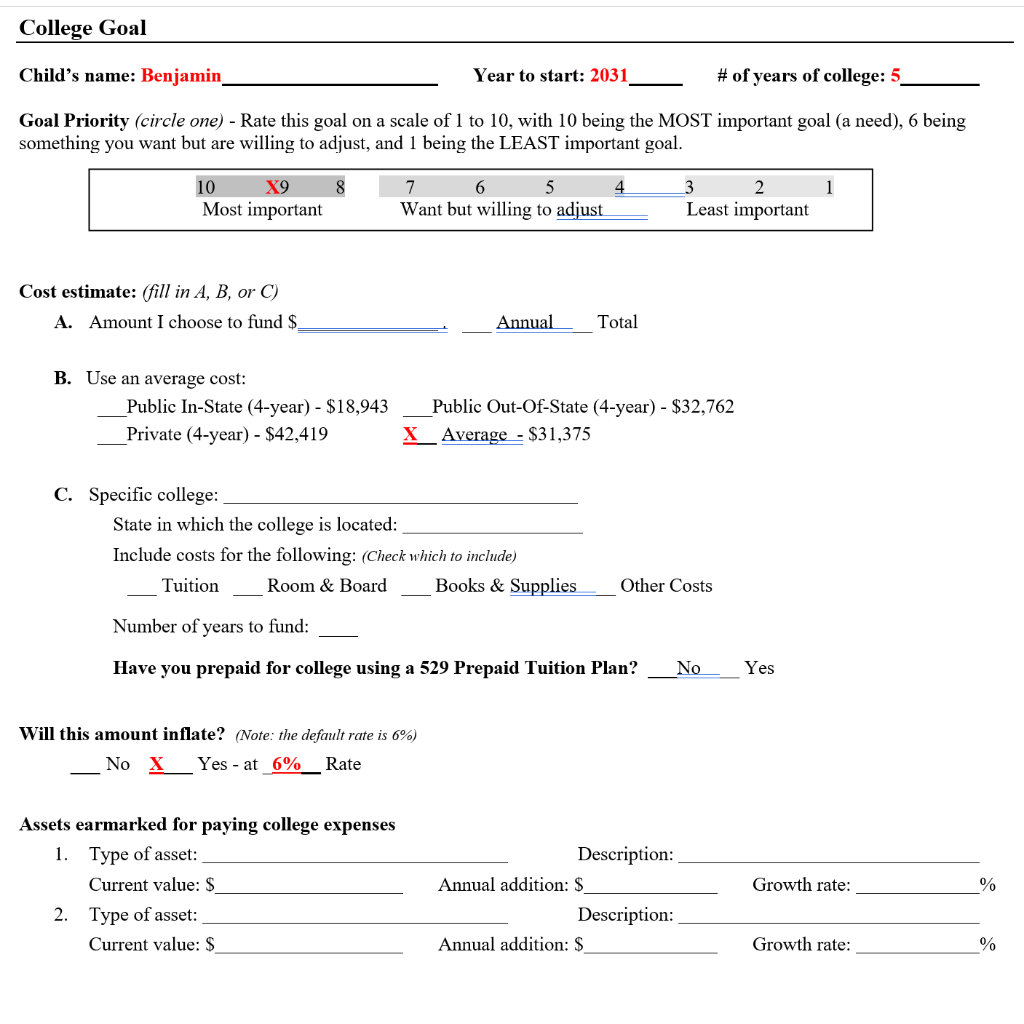

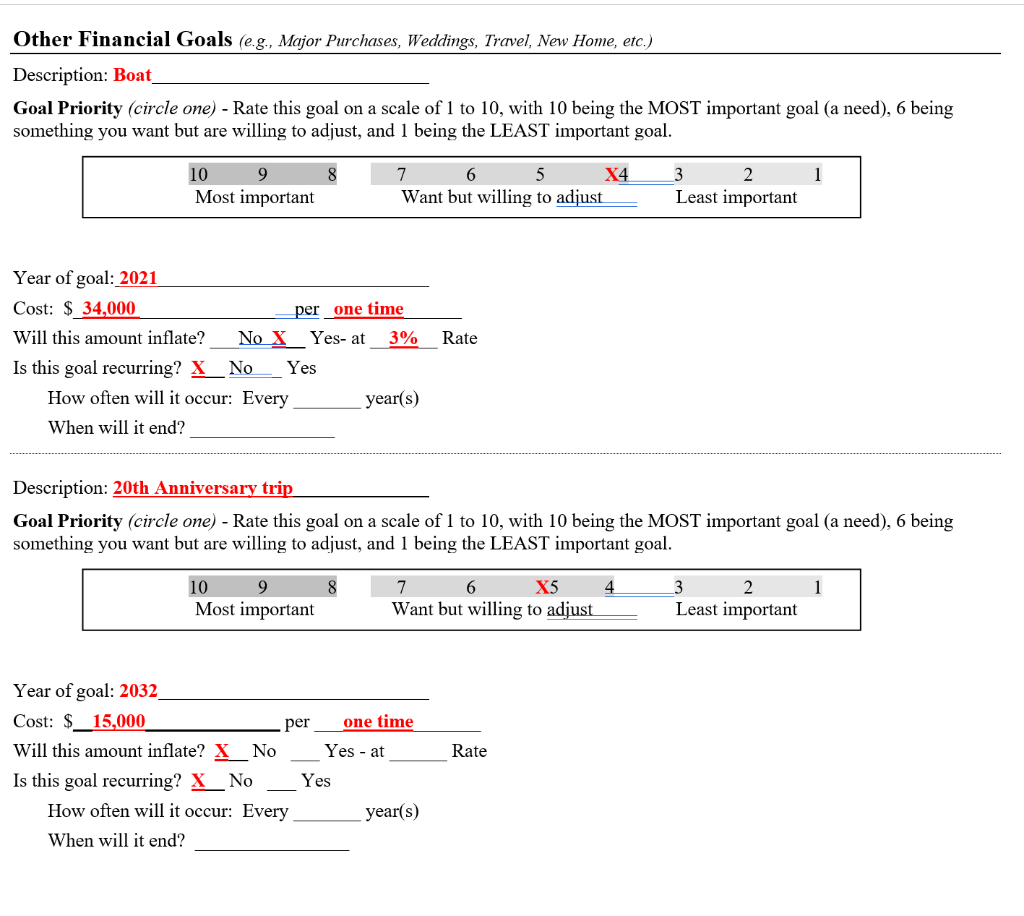

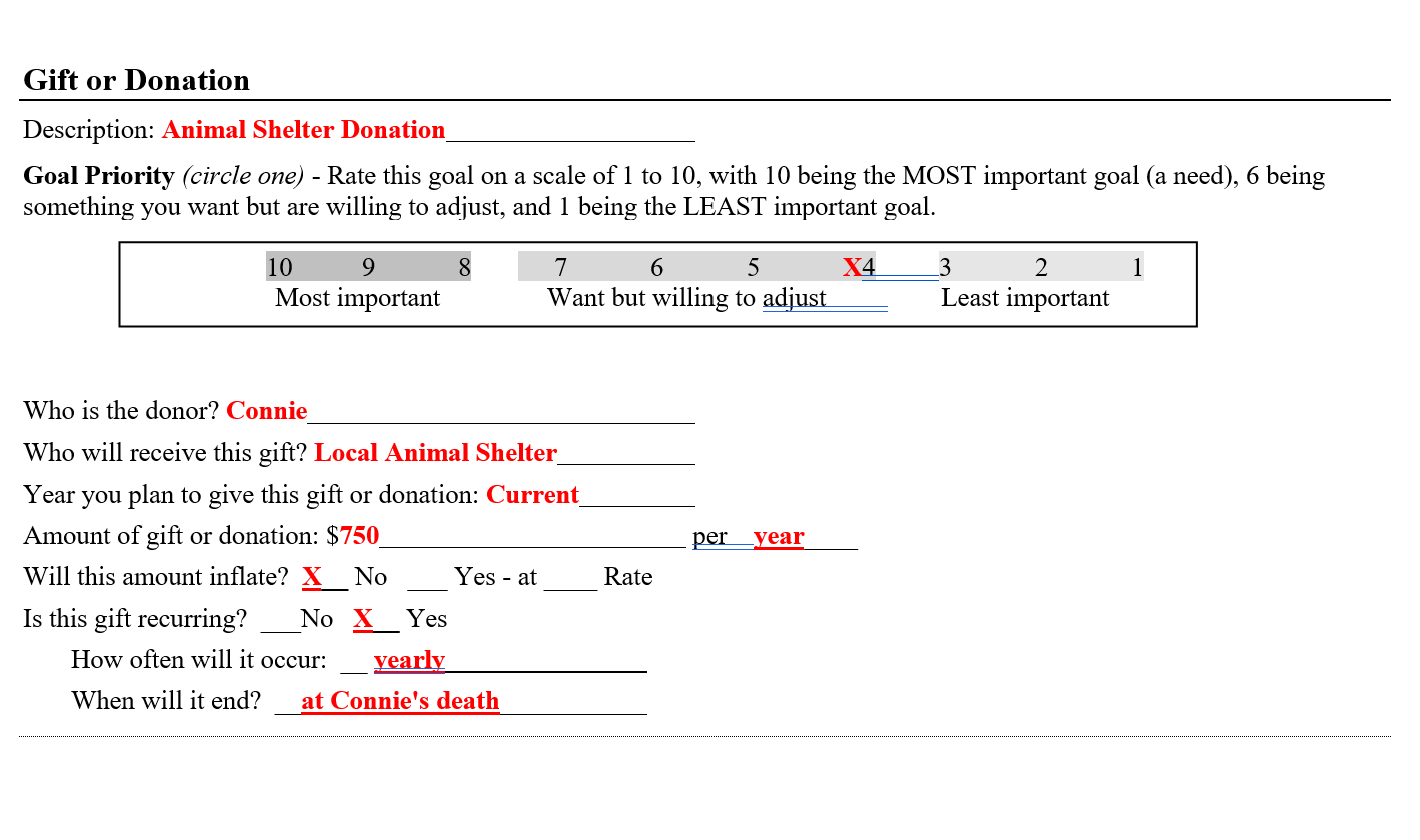

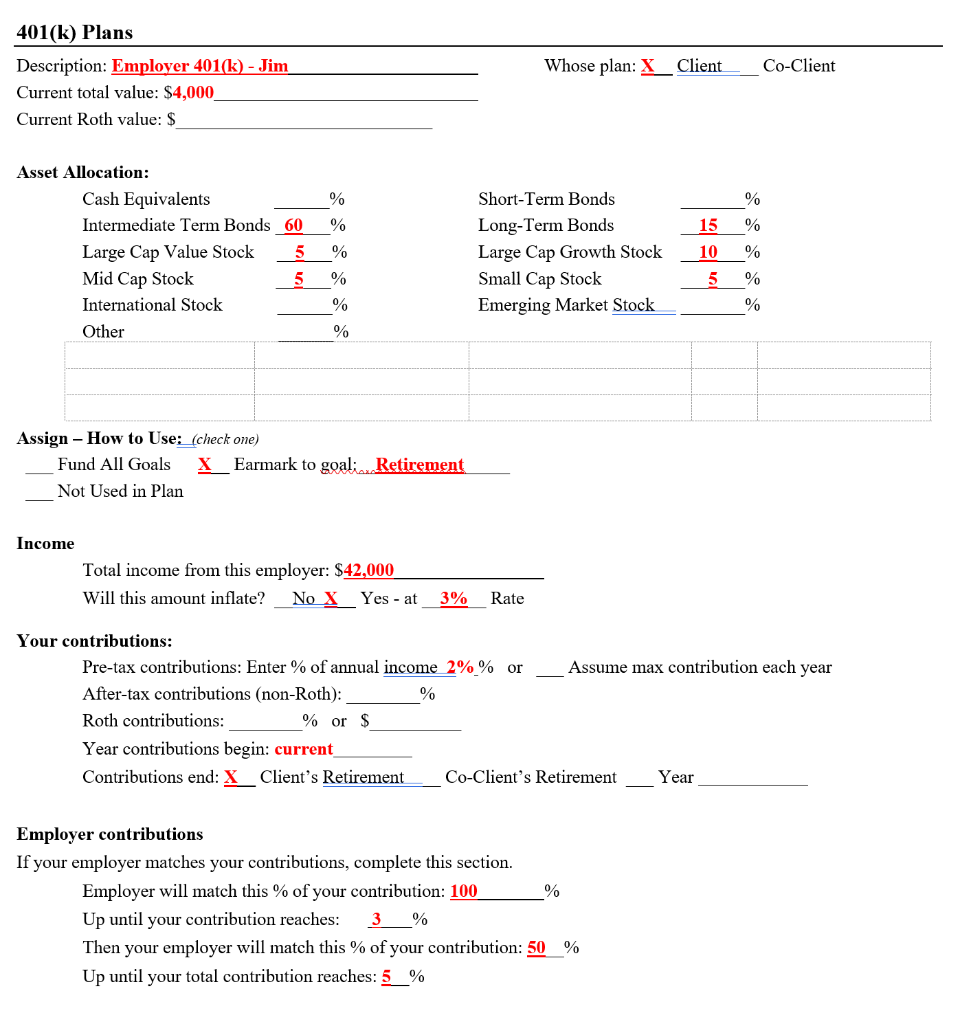

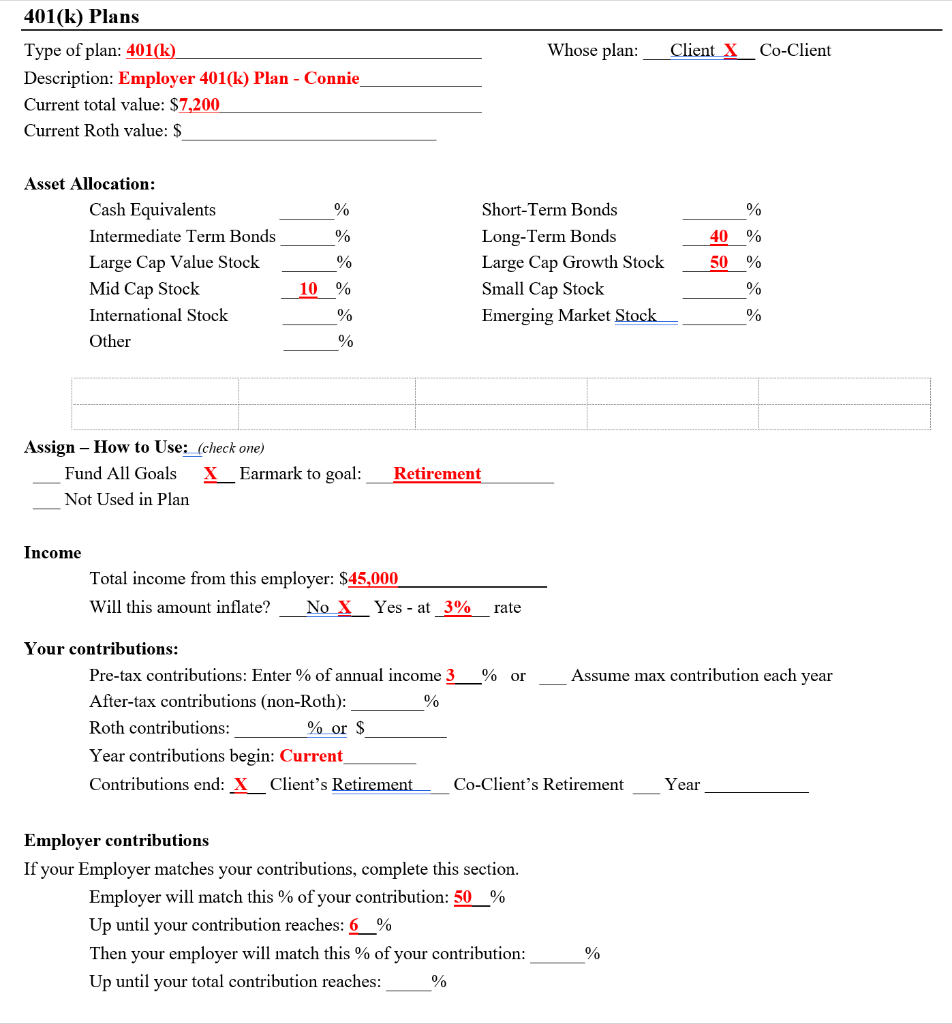

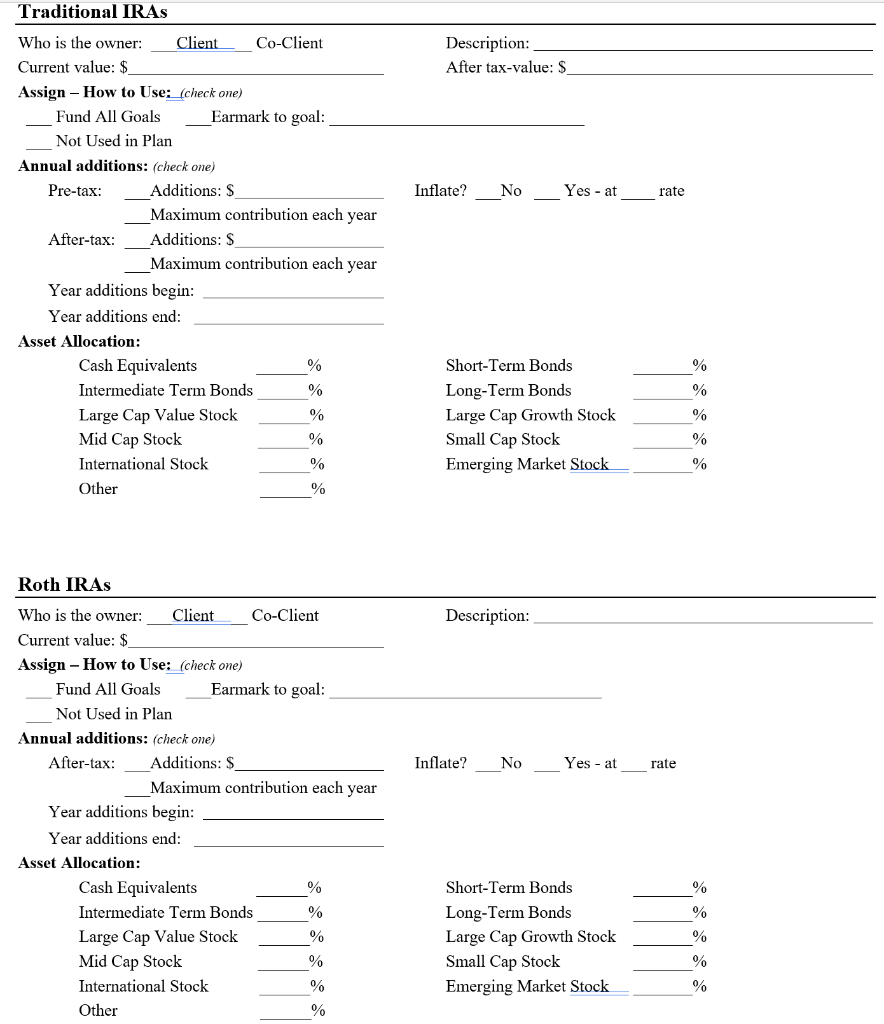

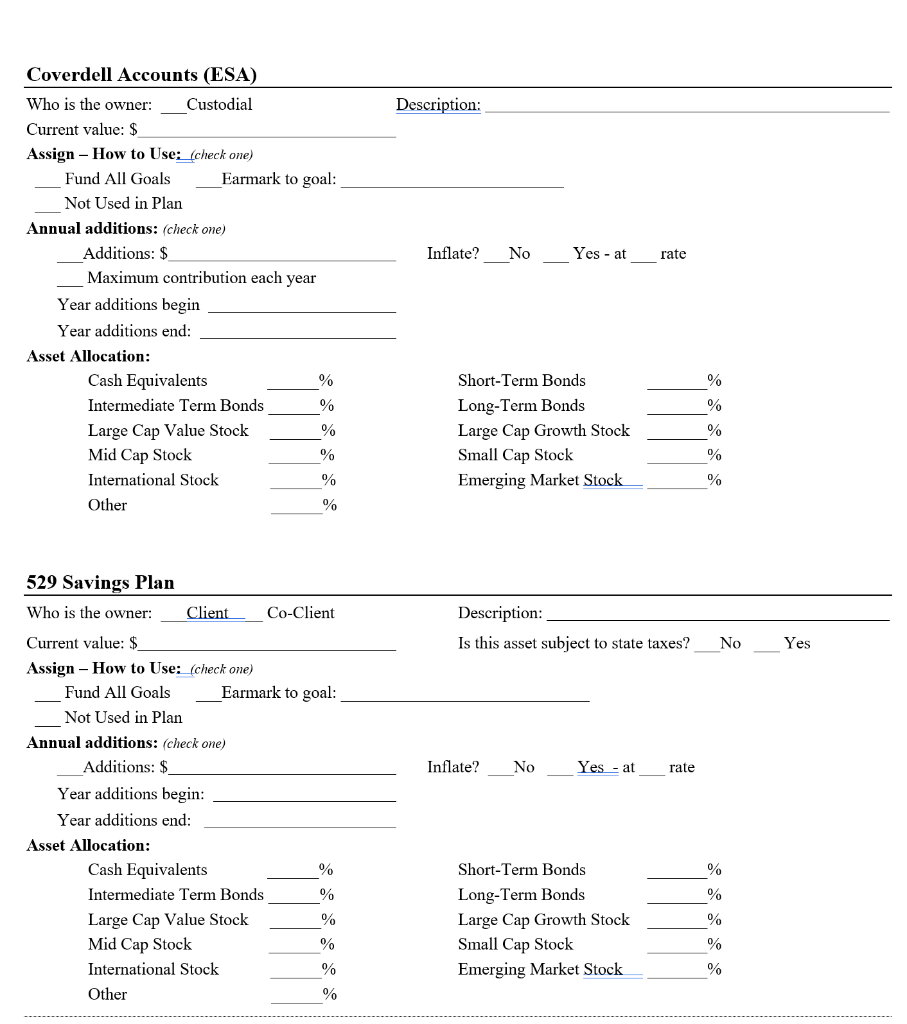

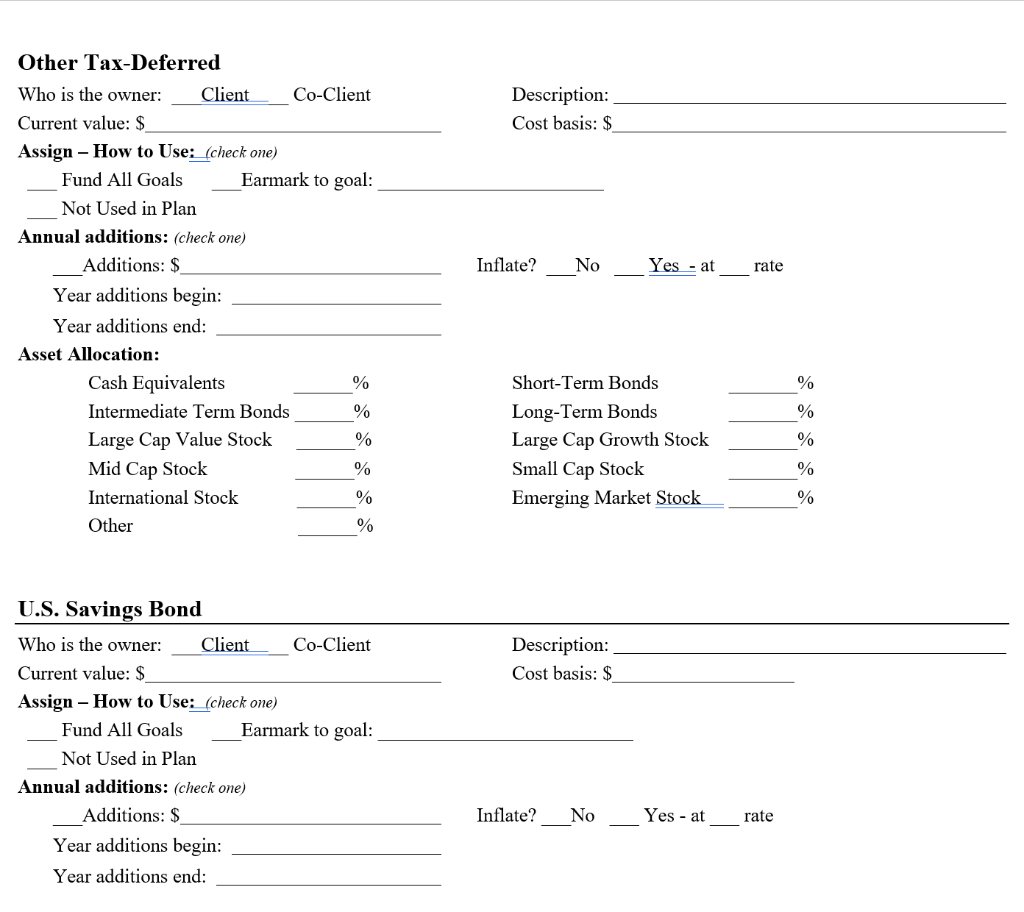

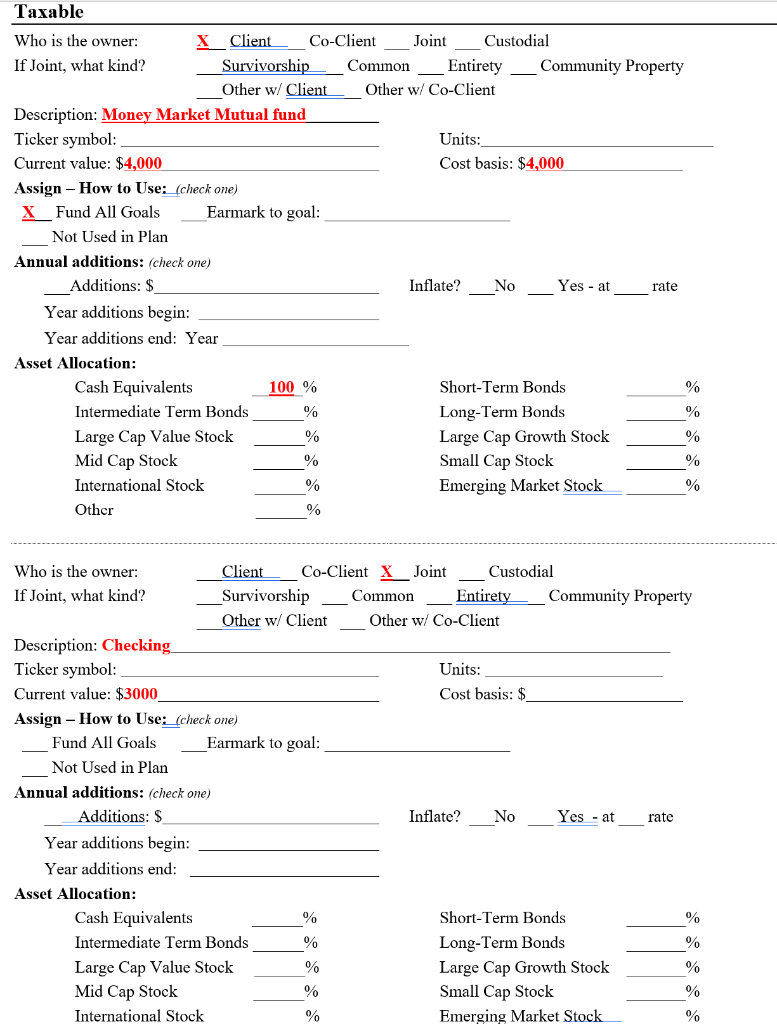

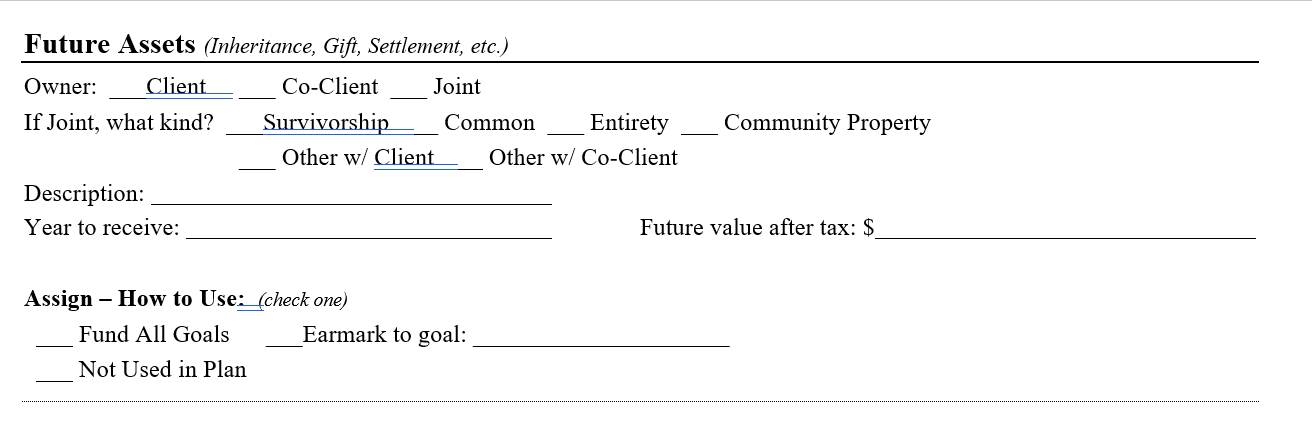

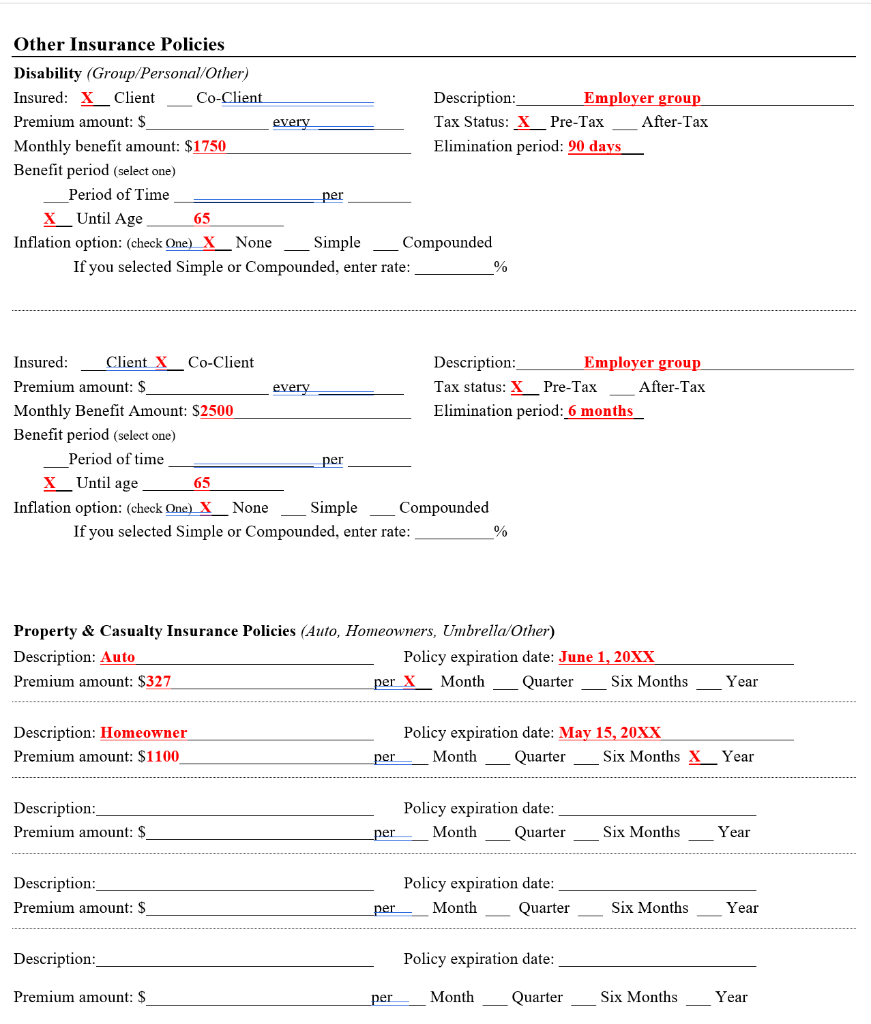

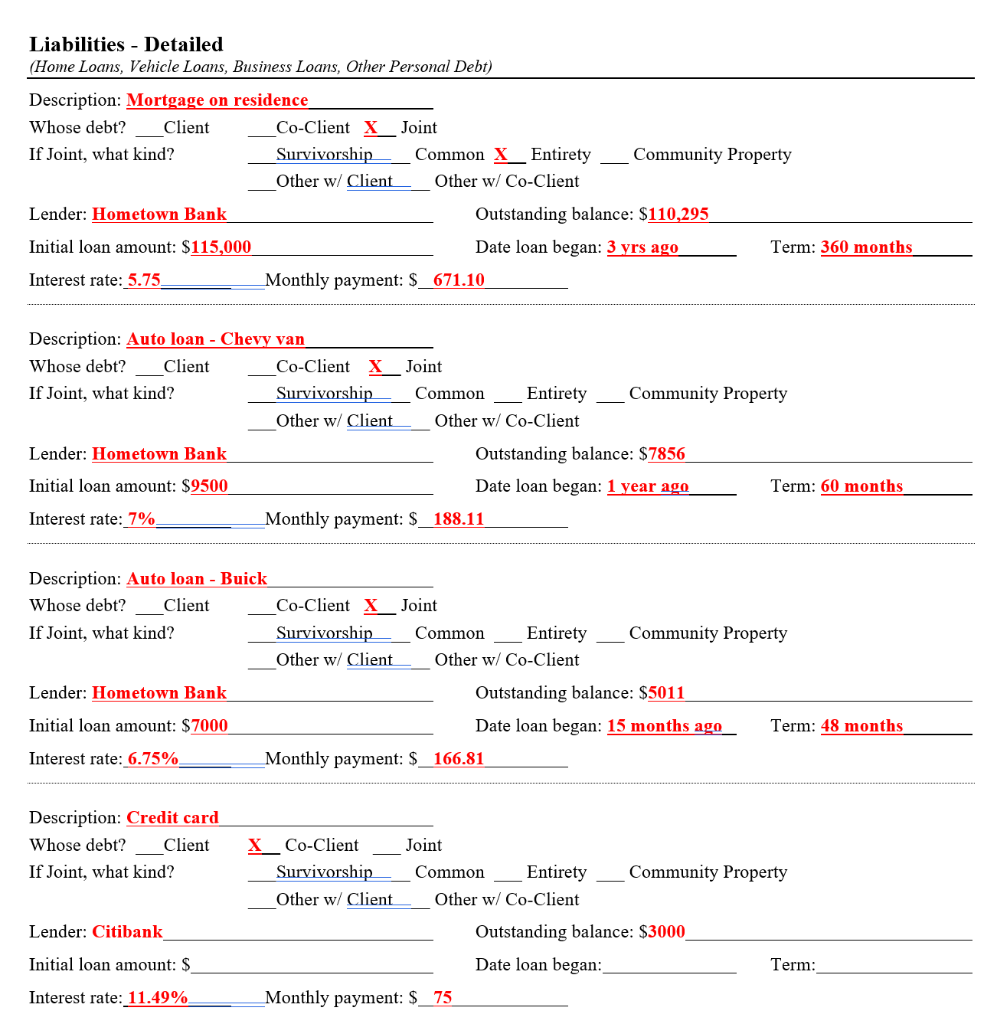

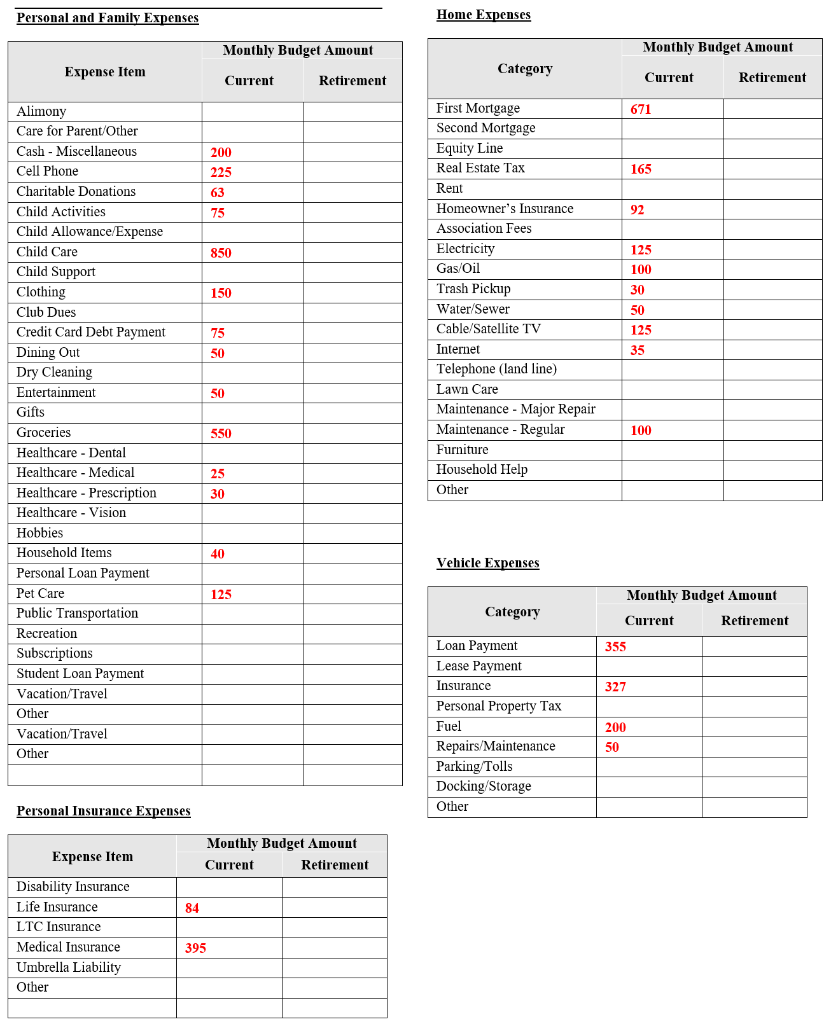

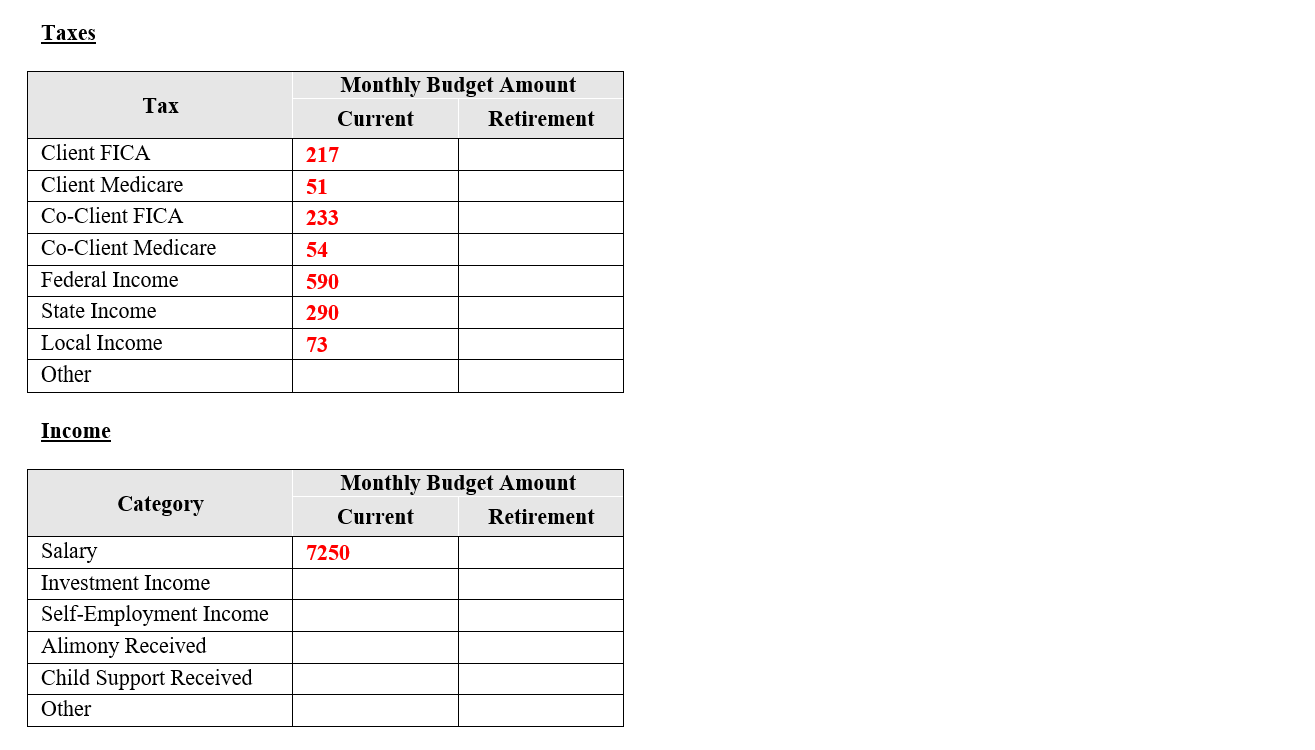

Name Statement of Financial Position As of December 31, 20XX Assets Liabilities Cash & Cash Equivalents Checking account - JT Money market fund - JT Life insurance cash value - H Short-term Liabilities Chase credit card - JT HSBC credit card - W Investment Assets AT&T Stock - H GM Bonds - JT Mutual funds - JT Long-term Liabilities SUV loan - W Sedan loan - H Student loan - W Mortgage on residence - JT Mortgage on vacation home - JT 0 Retirement Assets 401(k) - H 401(k) - W Roth IRA - W Total Liabilities $ 0 l. Di 1 Net Worth Use Assets Residence - JT Vacation home - JT SUV - W Sedan - H Jewelry - W Household items - JT Total Assets Total Liabilities and Net Worth H = owned by husband W = owned by wife JT = Joint Personal Information Client Co-Client Full name James Jones Connie Jones Gender X_Male Female Male X Female Date of birth 07 / 14 / 1988 12 /05 / 1990 Divorced Marital status Single X_Married Separated Widowed Single X_Married_ Divorced Separated Widowed Employment status Retired X Employed Business Owner Homemaker _Not Currently Employed 42,000 Retired X_Employed Business Owner_Homemaker Not Currently Employed 45,000 Employment income $ ---- -- .. ... Other pre-retirement income (Do not include investment income) $_ 0 Citizenship USA USA State of residence PA Children, Grandchildren, and Other Dependents Name Date of Birth Benjamin Jones / 26 /2013 Relationship X Child Grandchild Child Grandchild Child Grandchild Child Grandchild Other Dependent Other Dependent Other Dependent Other Dependent Retirement Goal Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 10 9 Most important X8 7 6 5 4 Want but willing to adjust 3 2 Least important 1 Age to retire: 67 Client chent - CoClient Co-Client Life expectancy: 20 25 Client Co-Client Retirement Living Expenses: Enter living expenses for the following retirement periods: Expense Period 1 -- One client retired/ One client working $ Expense Period 2 -- Client AND Co-Client retired Expense Period 3 -- One client alone $75,000 per Year Expenses that end during retirement (e.g., mortgage, loan): Description Year Expense Will End Amount (Current Dollars) 2043 $671.10 X_Mth __ Yr Mortgage Mth _ Yr s Mth __ Yr $__ Mth_Yr Yes Do you plan to move in retirement? X_No What state will you move to: When Will You Move? College Goal Child's name: Benjamin Year to start: 2031 # of years of college: 5 Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 10 X9 Most important 8 7 6 5 4 Want but willing to adjust 3 2 Least important 1 Cost estimate: (fill in A, B, or C) A. Amount I choose to fund $_ Annual Total B. Use an average cost: Public In-State (4-year) - $18,943 Private (4-year) - $42,419 Public Out-Of-State (4-year) - $32,762 X_Average - $31,375 C. Specific college: State in which the college is located: Include costs for the following: (Check which to include) Tuition Room & Board Books & Supplies Other Costs Number of years to fund: Have you prepaid for college using a 529 Prepaid Tuition Plan? No Yes Will this amount inflate? (Note: the default rate is 6%) __No X__Yes - at_6%_Rate Assets earmarked for paying college expenses 1. Type of asset: Current value: $_ 2. Type of asset: Current value: $ Growth rate: Description: Annual addition: $__ Description: Annual addition: $ Growth rate: Other Financial Goals (e.g., Major Purchases, Weddings, Travel, New Home, etc.) Description: Boat Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 1 10 9 Most important 7 6 5 X4 Want but willing to adjust 3 2 Least important Rate Year of goal: 2021 Cost: $_34,000 per one time Will this amount inflate? No X Yes- at 3% Is this goal recurring? X_NoYes How often will it occur: Every year(s) When will it end? Description: 20th Anniversary trip Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 4 10 9 Most important 7 6 X5 Want but willing to adjust 3 3 2 Least important Rate Year of goal: 2032 Cost: $_15,000 per one time Will this amount inflate? X_No Yes - at Is this goal recurring? X_No_Yes How often will it occur: Every year(s) When will it end? Gift or Donation Description: Animal Shelter Donation Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 10 9 Most important 4 u be willing to 7 6 5 Want but willing to adjust 3 2 Least important Let important per_year Who is the donor? Connie Who will receive this gift? Local Animal Shelter_ Year you plan to give this gift or donation: Current Amount of gift or donation: $750_ Will this amount inflate? X_No _Yes - at_ Is this gift recurring? No X_Yes How often will it occur: __yearly When will it end? at Connie's death Rate Whose plan: X_Client Co-Client 401(k) Plans Description: Employer 401(k) - Jim Current total value: $4,000 Current Roth value: $_ _15 % Asset Allocation: Cash Equivalents Intermediate Term Bonds_60 Large Cap Value Stock 5_ _% Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock 10 for Assign - How to Use: (check one) Fund All Goals X_Earmark to goal _Not Used in Plan Retirement Income Total income from this employer: $42,000 Will this amount inflate? No X_Yes - at_3%_Rate 1. % Your contributions: Pre-tax contributions: Enter % of annual income 2% % or Assume max contribution each year After-tax contributions (non-Roth): Roth contributions: % or $_ Year contributions begin: current Contributions end: X_Client's Retirement __Co-Client's Retirement Year % Employer contributions If your employer matches your contributions, complete this section. Employer will match this % of your contribution: 100 Up until your contribution reaches: 3_% Then your employer will match this % of your contribution: 50_% Up until your total contribution reaches: 5_% Whose plan: Client X_Co-Client 401(k) Plans Type of plan: 401(k) Description: Employer 401(k) Plan - Connie Current total value: $7,200 Current Roth value: $ Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock 10 % Assign - How to Use: (check one) Fund All Goals X_Earmark to goal: Not Used in Plan Retirement Income Total income from this employer: $45,000 Will this amount inflate? No X_Yes - at_3%_rate Your contributions: Pre-tax contributions: Enter % of annual income 3 % or Assume max contribution each year After-tax contributions (non-Roth): Roth contributions: % or $_ Year contributions begin: Current Contributions end: X_Client's Retirement Co-Client's Retirement Year Employer contributions If your Employer matches your contributions, complete this section. Employer will match this % of your contribution: 50_% Up until your contribution reaches: 6_% Then your employer will match this % of your contribution: Up until your total contribution reaches: _ % % Traditional IRAs Description: After tax-value: $ Inflate? _ No __Yes - at_ rate Who is the owner: Client Co-Client Current value: $ Assign - How to Use: (check one) __Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Pre-tax: Additions: S __Maximum contribution each year After-tax: Additions: $ __Maximum contribution each year Year additions begin: Year additions end: Asset Allocation: Cash Equivalents % Intermediate Term Bonds Large Cap Value Stock % Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Inflate? No _Yes-at_rate Roth IRAs Who is the owner: Client_Co-Client Current value: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) After-tax: Additions: $ __Maximum contribution each year Year additions begin: Year additions end: Asset Allocation: Cash Equivalents % Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Inflate?_No_Yes - at_ rate Coverdell Accounts (ESA) Who is the owner: Custodial Current value: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Maximum contribution each year Year additions begin Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Is this asset subject to state taxes? _No Yes Inflate? _ No Yes - at __rate 529 Savings Plan Who is the owner: Client_ Co-Client Current value: $ _ Assign - How to Use: (check one) Fund All Goals _ Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ _ Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Cost basis: $ Inflate? _ No_Yes - at ___rate Other Tax-Deferred Who is the owner: Client Co-Client Current value: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $_ Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock % Description: Cost basis: $ U.S. Savings Bond Who is the owner: Client_ Co-Client Current value: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) _Additions: $ Year additions begin: Year additions end: Inflate?_ No Yes - at_ rate Taxable Who is the owner: X_Client__Co-Client Joint Custodial If Joint, what kind? Survivorship_ Common_Entirety_ Community Property Other w/ Client Other w/ Co-Client Description: Money Market Mutual fund Ticker symbol: Units: Current value: $4,000 Cost basis: $4,000 Assign - How to Use: (check one) X_Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate?_ No_Yes - at_ rate Year additions begin: Year additions end: Year Asset Allocation: Cash Equivalents 100 % Short-Term Bonds Intermediate Term Bonds Long-Term Bonds Large Cap Value Stock Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock % Other Who is the owner: Client_Co-Client X_Joint Custodial If Joint, what kind? Survivorship Common Entirety __ _Community Property Other w/ Client Other w/ Co-Client Description: Checking Ticker symbol: Units: Current value: $3000 Cost basis: $_ Assign - How to Use:_(check one) _Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? No Yes - at rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Term Bonds_ Long-Term Bonds Large Cap Value Stock Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock Tax-Free Who is the owner: Client_Co-Client Joint Custodial If Joint, what kind? Survivorship_Common Entirety_ Community Property Other w/ Client Other w/ Co-Client Description: Ticker symbol: Units: Current value: $ Cost basis: $ Is this asset subject to state taxes? _No __Yes Assign - How to Use: (check one) __Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? _ No _Yes - at _ rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Term Bonds Long-Term Bonds Large Cap Value Stock % Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock Other Who is the owner: Client_Co-Client Joint Custodial If Joint, what kind? Survivorship__ Common__Entirety ___ Community Property Other w/ Client_ Other w/ Co-Client Description: Ticker symbol: _ - Units: Current value: $ Cost basis: $ Is this asset subject to state taxes? _No_Yes Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? No Yes - at rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Termn Bonds Long-Term Bonds Personal and Business Assets (Homes, Vehicles, Personal Property, etc.) Owner: Client__Co-Client X_Joint Custodial If Joint, what kind? Survivorship_ Common X_Entirety Community Property Other w/ Client Other w/ Co-Client Description: Residence - Current value: $130,000 Will the value of this asset increase each year? No X_Yes_ 3 _% Do you intend to sell this asset to help fund your goals? X_No Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) _Fund All Goals Earmark to goal: X__Not Used in Plan Sun Owner: Client__Co-Client X_Joint_Custodial If Joint, what kind? Survivorship_ Common Entirety_Community Property Other w/ Client_ Other w/ Co-Client Description: Chevy Van Current value: $10,000 Will the value of this asset increase each year? X_No Yes % Do you intend to sell this asset to help fund your goals? X_No_Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X_Not Used in Plan Owner: Client_ Co-Client X_ Joint Custodial If Joint, what kind? Survivorship_Common Entirety Community Property Other w/ Client Other w/ Co-Client Description: Buick Current value: $7,500 Will the value of this asset increase each year? X_No Yes Do you intend to sell this asset to help fund your goals? X_No Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X Not Used in Plan Owner: Client _ Co-Client X_ Joint Custodial If Joint, what kind? Survivorship_ Common_ Entirety_ Community Property __Other w/ Client _Other w/ Co-Client Description: Personal Property Current value: $50,000 Will the value of this asset increase each year? X_No Yes % Do you intend to sell this asset to help fund your goals? X_NO _Yes Year to sell Future value after tax: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X Not Used in Plan Client X_Co-Client _1st to Die 2nd to Die Insurance Assets - Cash Value Life Insurance Owner: Client X_Co-Client_Trust Insured: Description: Universal Life Current cash value: $3,000 Average annual growth rate on cash value:4% Death Benefit and Premium Death benefit amount: 250,000 Premium amount: $_1,000 every Year How long will premiums be paid to death of insured When will this policy terminate? x When insured dies Year Do you intend to surrender this policy to help fund your Goals? X No Yes If Yes, Year of withdrawal: Future cash value of policy: $ _ (before tar) Tax-free withdrawal: $_ Beneficiaries Name_James Jones Relationship Spouse Percent 100_Primary/Contingent Primary Name Relationship Percent Primary/Contingent Name Relationship Percent Primary/Contingent Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Insured: _Client _Co-Client_ 1st to Die _ 2nd to Die Owner: Client__Co-Client_Trust Description: Current cash value: $ Average annual growth rate on cash value: Death Benefit and Premium every Death benefit amount: Premium amount: $ How long will premiums be paid? When will this policy terminate? _When insured dies Year Do you intend to surrender this policy to help fund your Goals? No Yes If Yes, Year of withdrawal: Future cash value of policy: $_ _(before tar) Tax-free withdrawal: $ Beneficiaries Name Relationship Percent Name Relationship Percent Name Relationship Percent Primary/Contingent Primary/Contingent_ Primary/Contingent Assign - How to Use: (check one) _Fund All Goals Earmark to goal: Not Used in Plan Future Assets (Inheritance, Gift, Settlement, etc.) Owner: Client __Co-Client_Joint If Joint, what kind? Survivorship_Common Entirety Community Property Other w/ ClientOther w/ Co-Client Description: Year to receive: Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Other Insurance Policies Disability (Group/Personal/Other) Insured: X_Client Co-Client Description: Employer group Premium amount: $ every Tax Status: X_Pre-Tax After-Tax Monthly benefit amount: $1750 Elimination period: 90 days Benefit period (select one) Period of time per_ X_Until Age 65 Inflation option: (check One) X_None_Simple_Compounded If you selected Simple or Compounded, enter rate: Insured: Client X_Co-Client Description: Employer group Premium amount: $ every Tax status: X_Pre-Tax After-Tax Monthly Benefit Amount: $2500 Elimination period: 6 months Benefit period (select one) Period of time per X_Until age 65 Inflation option: (check One) X_None_Simple _Compounded If you selected Simple or Compounded, enter rate: Property & Casualty Insurance Policies (Auto, Homeowners, Umbrella/Other) Description: Auto - Policy expiration date: June 1, 20XX Premium amount: $327 per X_Month_Quarter_Six Months _Year Description: Homeowner Premium amount: $1100 Policy expiration date: May 15, 20XX _Month Quarter Six Months x per Year Description: Premium amount: $ Policy expiration date: _per_Month Quarter Six Months Year - Description: Premium amount: $ Policy expiration date: Month Quarter per Six Months Year Description: Policy expiration date: per__Month___ Quarter___ Six Months __ Year Premium amount: $ Liabilities - Detailed (Home Loans, Vehicle Loans, Business Loans, Other Personal Debt) Description: Mortgage on residence Whose debt? Client Co-Client X_Joint If Joint, what kind? Survivorship_Common X_Entirety_Community Property Other w/ Client__Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $110,295 Initial loan amount: $115,000 Date loan began: 3 yrs ago Term: 360 months Interest rate: 5.75. Monthly payment: $_671.10 ................... ...................... ............................ .............. ........ Description: Auto loan - Chevy van Whose debt? Client _Co-Client X_Joint If Joint, what kind? Survivorship _Common Entirety Community Property Other w/ Client_ Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $7856 Initial loan amount: $9500 Date loan began: 1 year ago Term: 60 months Interest rate: 7% Monthly payment: $_188.11 Description: Auto loan - Buick Whose debt? Client Co-Client X_Joint If Joint, what kind? Survivorship_ Common Entirety Community Property Other w/ Client_ Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $5011 Initial loan amount: $7000 Date loan began: 15 months ago_ Term: 48 months Interest rate: 6.75% Monthly payment: $_166.81 Description: Credit card Whose debt? Client If Joint, what kind? Lender: Citibank X_Co-Client Joint Survivorship _Common_Entirety_Community Property _Other w/ Client_ Other w/ Co-Client Outstanding balance: $3000 Date loan began: Term: Monthly payment: $_75 Initial loan amount: $ Interest rate: 11.49% Personal and Family Expenses Home Expenses Monthly Budget Amount Monthly Budget Amount Expense Item Category Current Retirement Current Retirement 671 First Mortgage Second Mortgage Equity Line Real Estate Tax 200 225 165 63 Rent 92 850 125 100 30 150 50 125 Alimony Care for Parent/Other Cash - Miscellaneous Cell Phone Charitable Donations Child Activities Child Allowance Expense Child Care Child Support Clothing Club Dues Credit Card Debt Payment Dining Out Dry Cleaning Entertainment Gifts Groceries Healthcare - Dental Healthcare - Medical Healthcare - Prescription Healthcare - Vision Hobbies Household Items Personal Loan Payment Pet Care Public Transportation Recreation Subscriptions Student Loan Payment Vacation Travel Other Vacation Travel Other Homeowner's Insurance Association Fees Electricity Gas/Oil Trash Pickup Water Sewer Cable Satellite TV Internet Telephone (land line) Lawn Care Maintenance - Major Repair Maintenance - Regular Furniture Household Help Other 550 100 Vehicle Expenses Category Monthly Budget Amount Current Retirement 355 327 Loan Payment Lease Payment Insurance Personal Property Tax Fuel Repairs/Maintenance Parking Tolls Docking Storage Other 200 50 Personal Insurance Expenses Expense Item Monthly Budget Amount Current Retirement Disability Insurance Life Insurance LTC Insurance Medical Insurance Umbrella Liability Other 395 Taxes Monthly Budget Amount Current Retirement 217 Client FICA Client Medicare Co-Client FICA Co-Client Medicare Federal Income State Income Local Income Other 51 233 | 54 590 290 73 Income Category Monthly Budget Amount Current Retirement 7250 Salary Investment Income Self-Employment Income Alimony Received Child Support Received Other Name Statement of Financial Position As of December 31, 20XX Assets Liabilities Cash & Cash Equivalents Checking account - JT Money market fund - JT Life insurance cash value - H Short-term Liabilities Chase credit card - JT HSBC credit card - W Investment Assets AT&T Stock - H GM Bonds - JT Mutual funds - JT Long-term Liabilities SUV loan - W Sedan loan - H Student loan - W Mortgage on residence - JT Mortgage on vacation home - JT 0 Retirement Assets 401(k) - H 401(k) - W Roth IRA - W Total Liabilities $ 0 l. Di 1 Net Worth Use Assets Residence - JT Vacation home - JT SUV - W Sedan - H Jewelry - W Household items - JT Total Assets Total Liabilities and Net Worth H = owned by husband W = owned by wife JT = Joint Personal Information Client Co-Client Full name James Jones Connie Jones Gender X_Male Female Male X Female Date of birth 07 / 14 / 1988 12 /05 / 1990 Divorced Marital status Single X_Married Separated Widowed Single X_Married_ Divorced Separated Widowed Employment status Retired X Employed Business Owner Homemaker _Not Currently Employed 42,000 Retired X_Employed Business Owner_Homemaker Not Currently Employed 45,000 Employment income $ ---- -- .. ... Other pre-retirement income (Do not include investment income) $_ 0 Citizenship USA USA State of residence PA Children, Grandchildren, and Other Dependents Name Date of Birth Benjamin Jones / 26 /2013 Relationship X Child Grandchild Child Grandchild Child Grandchild Child Grandchild Other Dependent Other Dependent Other Dependent Other Dependent Retirement Goal Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 10 9 Most important X8 7 6 5 4 Want but willing to adjust 3 2 Least important 1 Age to retire: 67 Client chent - CoClient Co-Client Life expectancy: 20 25 Client Co-Client Retirement Living Expenses: Enter living expenses for the following retirement periods: Expense Period 1 -- One client retired/ One client working $ Expense Period 2 -- Client AND Co-Client retired Expense Period 3 -- One client alone $75,000 per Year Expenses that end during retirement (e.g., mortgage, loan): Description Year Expense Will End Amount (Current Dollars) 2043 $671.10 X_Mth __ Yr Mortgage Mth _ Yr s Mth __ Yr $__ Mth_Yr Yes Do you plan to move in retirement? X_No What state will you move to: When Will You Move? College Goal Child's name: Benjamin Year to start: 2031 # of years of college: 5 Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 10 X9 Most important 8 7 6 5 4 Want but willing to adjust 3 2 Least important 1 Cost estimate: (fill in A, B, or C) A. Amount I choose to fund $_ Annual Total B. Use an average cost: Public In-State (4-year) - $18,943 Private (4-year) - $42,419 Public Out-Of-State (4-year) - $32,762 X_Average - $31,375 C. Specific college: State in which the college is located: Include costs for the following: (Check which to include) Tuition Room & Board Books & Supplies Other Costs Number of years to fund: Have you prepaid for college using a 529 Prepaid Tuition Plan? No Yes Will this amount inflate? (Note: the default rate is 6%) __No X__Yes - at_6%_Rate Assets earmarked for paying college expenses 1. Type of asset: Current value: $_ 2. Type of asset: Current value: $ Growth rate: Description: Annual addition: $__ Description: Annual addition: $ Growth rate: Other Financial Goals (e.g., Major Purchases, Weddings, Travel, New Home, etc.) Description: Boat Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 1 10 9 Most important 7 6 5 X4 Want but willing to adjust 3 2 Least important Rate Year of goal: 2021 Cost: $_34,000 per one time Will this amount inflate? No X Yes- at 3% Is this goal recurring? X_NoYes How often will it occur: Every year(s) When will it end? Description: 20th Anniversary trip Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 4 10 9 Most important 7 6 X5 Want but willing to adjust 3 3 2 Least important Rate Year of goal: 2032 Cost: $_15,000 per one time Will this amount inflate? X_No Yes - at Is this goal recurring? X_No_Yes How often will it occur: Every year(s) When will it end? Gift or Donation Description: Animal Shelter Donation Goal Priority (circle one) - Rate this goal on a scale of 1 to 10, with 10 being the MOST important goal (a need), 6 being something you want but are willing to adjust, and 1 being the LEAST important goal. 8 10 9 Most important 4 u be willing to 7 6 5 Want but willing to adjust 3 2 Least important Let important per_year Who is the donor? Connie Who will receive this gift? Local Animal Shelter_ Year you plan to give this gift or donation: Current Amount of gift or donation: $750_ Will this amount inflate? X_No _Yes - at_ Is this gift recurring? No X_Yes How often will it occur: __yearly When will it end? at Connie's death Rate Whose plan: X_Client Co-Client 401(k) Plans Description: Employer 401(k) - Jim Current total value: $4,000 Current Roth value: $_ _15 % Asset Allocation: Cash Equivalents Intermediate Term Bonds_60 Large Cap Value Stock 5_ _% Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock 10 for Assign - How to Use: (check one) Fund All Goals X_Earmark to goal _Not Used in Plan Retirement Income Total income from this employer: $42,000 Will this amount inflate? No X_Yes - at_3%_Rate 1. % Your contributions: Pre-tax contributions: Enter % of annual income 2% % or Assume max contribution each year After-tax contributions (non-Roth): Roth contributions: % or $_ Year contributions begin: current Contributions end: X_Client's Retirement __Co-Client's Retirement Year % Employer contributions If your employer matches your contributions, complete this section. Employer will match this % of your contribution: 100 Up until your contribution reaches: 3_% Then your employer will match this % of your contribution: 50_% Up until your total contribution reaches: 5_% Whose plan: Client X_Co-Client 401(k) Plans Type of plan: 401(k) Description: Employer 401(k) Plan - Connie Current total value: $7,200 Current Roth value: $ Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock 10 % Assign - How to Use: (check one) Fund All Goals X_Earmark to goal: Not Used in Plan Retirement Income Total income from this employer: $45,000 Will this amount inflate? No X_Yes - at_3%_rate Your contributions: Pre-tax contributions: Enter % of annual income 3 % or Assume max contribution each year After-tax contributions (non-Roth): Roth contributions: % or $_ Year contributions begin: Current Contributions end: X_Client's Retirement Co-Client's Retirement Year Employer contributions If your Employer matches your contributions, complete this section. Employer will match this % of your contribution: 50_% Up until your contribution reaches: 6_% Then your employer will match this % of your contribution: Up until your total contribution reaches: _ % % Traditional IRAs Description: After tax-value: $ Inflate? _ No __Yes - at_ rate Who is the owner: Client Co-Client Current value: $ Assign - How to Use: (check one) __Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Pre-tax: Additions: S __Maximum contribution each year After-tax: Additions: $ __Maximum contribution each year Year additions begin: Year additions end: Asset Allocation: Cash Equivalents % Intermediate Term Bonds Large Cap Value Stock % Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Inflate? No _Yes-at_rate Roth IRAs Who is the owner: Client_Co-Client Current value: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) After-tax: Additions: $ __Maximum contribution each year Year additions begin: Year additions end: Asset Allocation: Cash Equivalents % Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Inflate?_No_Yes - at_ rate Coverdell Accounts (ESA) Who is the owner: Custodial Current value: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Maximum contribution each year Year additions begin Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Is this asset subject to state taxes? _No Yes Inflate? _ No Yes - at __rate 529 Savings Plan Who is the owner: Client_ Co-Client Current value: $ _ Assign - How to Use: (check one) Fund All Goals _ Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ _ Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock Description: Cost basis: $ Inflate? _ No_Yes - at ___rate Other Tax-Deferred Who is the owner: Client Co-Client Current value: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $_ Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Intermediate Term Bonds Large Cap Value Stock Mid Cap Stock International Stock Other Short-Term Bonds Long-Term Bonds Large Cap Growth Stock Small Cap Stock Emerging Market Stock % Description: Cost basis: $ U.S. Savings Bond Who is the owner: Client_ Co-Client Current value: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) _Additions: $ Year additions begin: Year additions end: Inflate?_ No Yes - at_ rate Taxable Who is the owner: X_Client__Co-Client Joint Custodial If Joint, what kind? Survivorship_ Common_Entirety_ Community Property Other w/ Client Other w/ Co-Client Description: Money Market Mutual fund Ticker symbol: Units: Current value: $4,000 Cost basis: $4,000 Assign - How to Use: (check one) X_Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate?_ No_Yes - at_ rate Year additions begin: Year additions end: Year Asset Allocation: Cash Equivalents 100 % Short-Term Bonds Intermediate Term Bonds Long-Term Bonds Large Cap Value Stock Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock % Other Who is the owner: Client_Co-Client X_Joint Custodial If Joint, what kind? Survivorship Common Entirety __ _Community Property Other w/ Client Other w/ Co-Client Description: Checking Ticker symbol: Units: Current value: $3000 Cost basis: $_ Assign - How to Use:_(check one) _Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? No Yes - at rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Term Bonds_ Long-Term Bonds Large Cap Value Stock Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock Tax-Free Who is the owner: Client_Co-Client Joint Custodial If Joint, what kind? Survivorship_Common Entirety_ Community Property Other w/ Client Other w/ Co-Client Description: Ticker symbol: Units: Current value: $ Cost basis: $ Is this asset subject to state taxes? _No __Yes Assign - How to Use: (check one) __Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? _ No _Yes - at _ rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Term Bonds Long-Term Bonds Large Cap Value Stock % Large Cap Growth Stock Mid Cap Stock Small Cap Stock International Stock Emerging Market Stock Other Who is the owner: Client_Co-Client Joint Custodial If Joint, what kind? Survivorship__ Common__Entirety ___ Community Property Other w/ Client_ Other w/ Co-Client Description: Ticker symbol: _ - Units: Current value: $ Cost basis: $ Is this asset subject to state taxes? _No_Yes Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Annual additions: (check one) Additions: $ Inflate? No Yes - at rate Year additions begin: Year additions end: Asset Allocation: Cash Equivalents Short-Term Bonds Intermediate Termn Bonds Long-Term Bonds Personal and Business Assets (Homes, Vehicles, Personal Property, etc.) Owner: Client__Co-Client X_Joint Custodial If Joint, what kind? Survivorship_ Common X_Entirety Community Property Other w/ Client Other w/ Co-Client Description: Residence - Current value: $130,000 Will the value of this asset increase each year? No X_Yes_ 3 _% Do you intend to sell this asset to help fund your goals? X_No Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) _Fund All Goals Earmark to goal: X__Not Used in Plan Sun Owner: Client__Co-Client X_Joint_Custodial If Joint, what kind? Survivorship_ Common Entirety_Community Property Other w/ Client_ Other w/ Co-Client Description: Chevy Van Current value: $10,000 Will the value of this asset increase each year? X_No Yes % Do you intend to sell this asset to help fund your goals? X_No_Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X_Not Used in Plan Owner: Client_ Co-Client X_ Joint Custodial If Joint, what kind? Survivorship_Common Entirety Community Property Other w/ Client Other w/ Co-Client Description: Buick Current value: $7,500 Will the value of this asset increase each year? X_No Yes Do you intend to sell this asset to help fund your goals? X_No Yes Year to sell Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X Not Used in Plan Owner: Client _ Co-Client X_ Joint Custodial If Joint, what kind? Survivorship_ Common_ Entirety_ Community Property __Other w/ Client _Other w/ Co-Client Description: Personal Property Current value: $50,000 Will the value of this asset increase each year? X_No Yes % Do you intend to sell this asset to help fund your goals? X_NO _Yes Year to sell Future value after tax: $_ Assign - How to Use: (check one) Fund All Goals Earmark to goal: X Not Used in Plan Client X_Co-Client _1st to Die 2nd to Die Insurance Assets - Cash Value Life Insurance Owner: Client X_Co-Client_Trust Insured: Description: Universal Life Current cash value: $3,000 Average annual growth rate on cash value:4% Death Benefit and Premium Death benefit amount: 250,000 Premium amount: $_1,000 every Year How long will premiums be paid to death of insured When will this policy terminate? x When insured dies Year Do you intend to surrender this policy to help fund your Goals? X No Yes If Yes, Year of withdrawal: Future cash value of policy: $ _ (before tar) Tax-free withdrawal: $_ Beneficiaries Name_James Jones Relationship Spouse Percent 100_Primary/Contingent Primary Name Relationship Percent Primary/Contingent Name Relationship Percent Primary/Contingent Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Insured: _Client _Co-Client_ 1st to Die _ 2nd to Die Owner: Client__Co-Client_Trust Description: Current cash value: $ Average annual growth rate on cash value: Death Benefit and Premium every Death benefit amount: Premium amount: $ How long will premiums be paid? When will this policy terminate? _When insured dies Year Do you intend to surrender this policy to help fund your Goals? No Yes If Yes, Year of withdrawal: Future cash value of policy: $_ _(before tar) Tax-free withdrawal: $ Beneficiaries Name Relationship Percent Name Relationship Percent Name Relationship Percent Primary/Contingent Primary/Contingent_ Primary/Contingent Assign - How to Use: (check one) _Fund All Goals Earmark to goal: Not Used in Plan Future Assets (Inheritance, Gift, Settlement, etc.) Owner: Client __Co-Client_Joint If Joint, what kind? Survivorship_Common Entirety Community Property Other w/ ClientOther w/ Co-Client Description: Year to receive: Future value after tax: $ Assign - How to Use: (check one) Fund All Goals Earmark to goal: Not Used in Plan Other Insurance Policies Disability (Group/Personal/Other) Insured: X_Client Co-Client Description: Employer group Premium amount: $ every Tax Status: X_Pre-Tax After-Tax Monthly benefit amount: $1750 Elimination period: 90 days Benefit period (select one) Period of time per_ X_Until Age 65 Inflation option: (check One) X_None_Simple_Compounded If you selected Simple or Compounded, enter rate: Insured: Client X_Co-Client Description: Employer group Premium amount: $ every Tax status: X_Pre-Tax After-Tax Monthly Benefit Amount: $2500 Elimination period: 6 months Benefit period (select one) Period of time per X_Until age 65 Inflation option: (check One) X_None_Simple _Compounded If you selected Simple or Compounded, enter rate: Property & Casualty Insurance Policies (Auto, Homeowners, Umbrella/Other) Description: Auto - Policy expiration date: June 1, 20XX Premium amount: $327 per X_Month_Quarter_Six Months _Year Description: Homeowner Premium amount: $1100 Policy expiration date: May 15, 20XX _Month Quarter Six Months x per Year Description: Premium amount: $ Policy expiration date: _per_Month Quarter Six Months Year - Description: Premium amount: $ Policy expiration date: Month Quarter per Six Months Year Description: Policy expiration date: per__Month___ Quarter___ Six Months __ Year Premium amount: $ Liabilities - Detailed (Home Loans, Vehicle Loans, Business Loans, Other Personal Debt) Description: Mortgage on residence Whose debt? Client Co-Client X_Joint If Joint, what kind? Survivorship_Common X_Entirety_Community Property Other w/ Client__Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $110,295 Initial loan amount: $115,000 Date loan began: 3 yrs ago Term: 360 months Interest rate: 5.75. Monthly payment: $_671.10 ................... ...................... ............................ .............. ........ Description: Auto loan - Chevy van Whose debt? Client _Co-Client X_Joint If Joint, what kind? Survivorship _Common Entirety Community Property Other w/ Client_ Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $7856 Initial loan amount: $9500 Date loan began: 1 year ago Term: 60 months Interest rate: 7% Monthly payment: $_188.11 Description: Auto loan - Buick Whose debt? Client Co-Client X_Joint If Joint, what kind? Survivorship_ Common Entirety Community Property Other w/ Client_ Other w/ Co-Client Lender: Hometown Bank Outstanding balance: $5011 Initial loan amount: $7000 Date loan began: 15 months ago_ Term: 48 months Interest rate: 6.75% Monthly payment: $_166.81 Description: Credit card Whose debt? Client If Joint, what kind? Lender: Citibank X_Co-Client Joint Survivorship _Common_Entirety_Community Property _Other w/ Client_ Other w/ Co-Client Outstanding balance: $3000 Date loan began: Term: Monthly payment: $_75 Initial loan amount: $ Interest rate: 11.49% Personal and Family Expenses Home Expenses Monthly Budget Amount Monthly Budget Amount Expense Item Category Current Retirement Current Retirement 671 First Mortgage Second Mortgage Equity Line Real Estate Tax 200 225 165 63 Rent 92 850 125 100 30 150 50 125 Alimony Care for Parent/Other Cash - Miscellaneous Cell Phone Charitable Donations Child Activities Child Allowance Expense Child Care Child Support Clothing Club Dues Credit Card Debt Payment Dining Out Dry Cleaning Entertainment Gifts Groceries Healthcare - Dental Healthcare - Medical Healthcare - Prescription Healthcare - Vision Hobbies Household Items Personal Loan Payment Pet Care Public Transportation Recreation Subscriptions Student Loan Payment Vacation Travel Other Vacation Travel Other Homeowner's Insurance Association Fees Electricity Gas/Oil Trash Pickup Water Sewer Cable Satellite TV Internet Telephone (land line) Lawn Care Maintenance - Major Repair Maintenance - Regular Furniture Household Help Other 550 100 Vehicle Expenses Category Monthly Budget Amount Current Retirement 355 327 Loan Payment Lease Payment Insurance Personal Property Tax Fuel Repairs/Maintenance Parking Tolls Docking Storage Other 200 50 Personal Insurance Expenses Expense Item Monthly Budget Amount Current Retirement Disability Insurance Life Insurance LTC Insurance Medical Insurance Umbrella Liability Other 395 Taxes Monthly Budget Amount Current Retirement 217 Client FICA Client Medicare Co-Client FICA Co-Client Medicare Federal Income State Income Local Income Other 51 233 | 54 590 290 73 Income Category Monthly Budget Amount Current Retirement 7250 Salary Investment Income Self-Employment Income Alimony Received Child Support Received Other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts